This version of the form is not currently in use and is provided for reference only. Download this version of

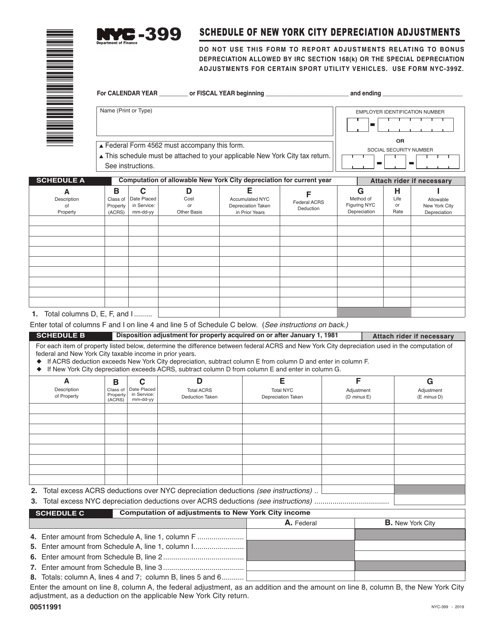

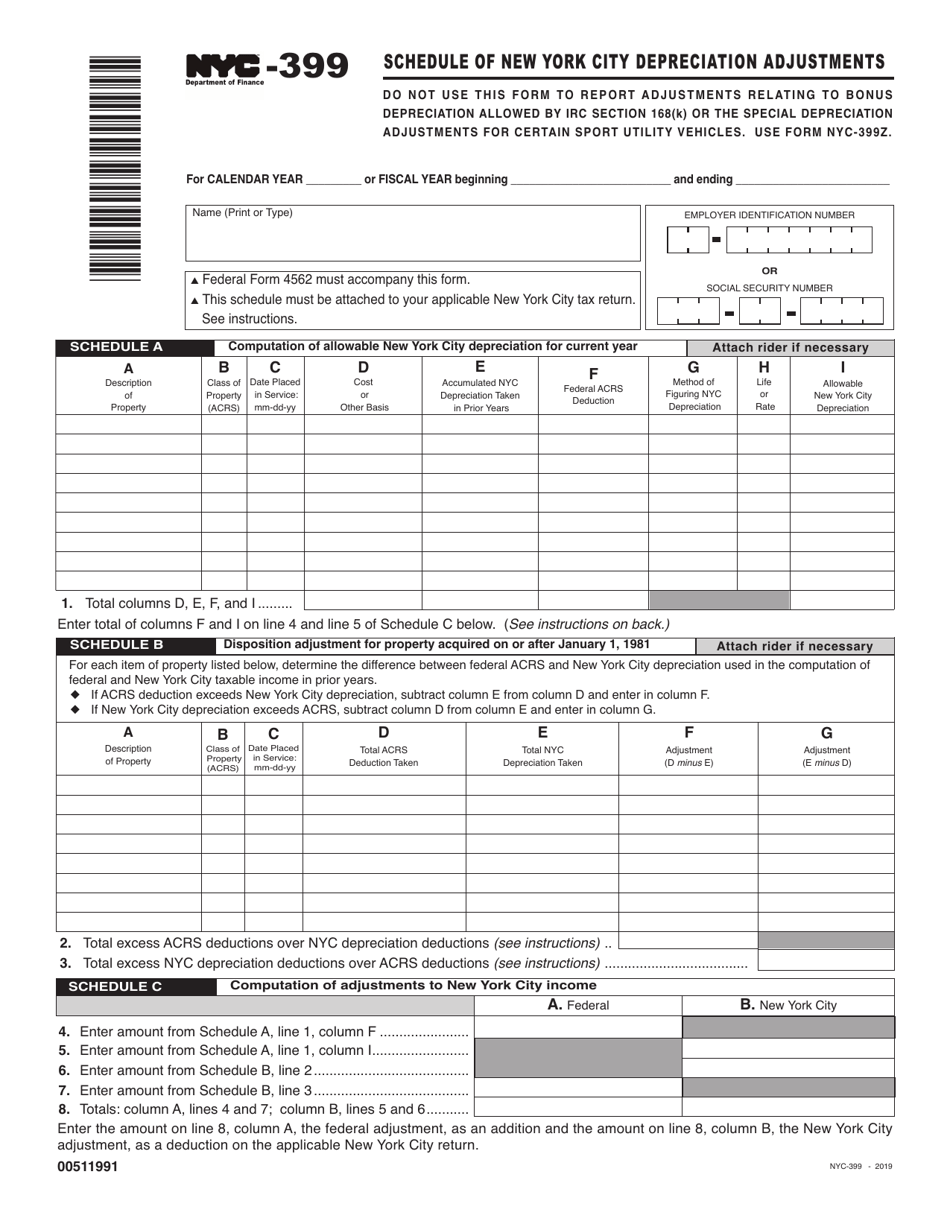

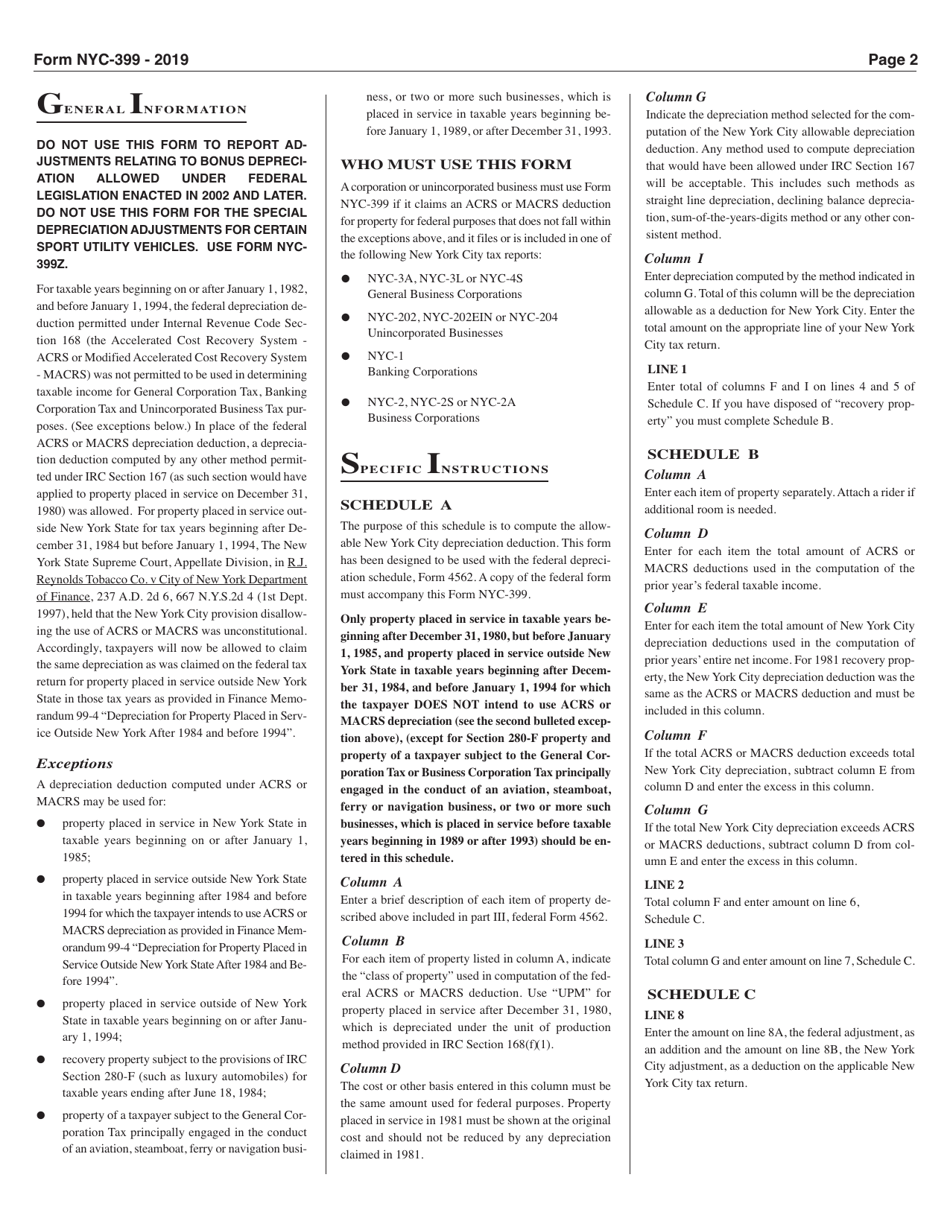

Form NYC-399

for the current year.

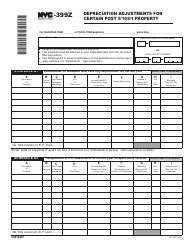

Form NYC-399 Schedule of New York City Depreciation Adjustments - New York City

What Is Form NYC-399?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-399 Schedule?

A: NYC-399 Schedule is a form used to report New York City Depreciation Adjustments.

Q: What are New York City Depreciation Adjustments?

A: New York City Depreciation Adjustments are changes made to the depreciation of assets for tax purposes in New York City.

Q: Who needs to file NYC-399 Schedule?

A: Individuals and businesses who have assets in New York City and need to report depreciation adjustments for tax purposes need to file NYC-399 Schedule.

Q: How do I file NYC-399 Schedule?

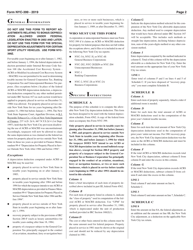

A: NYC-399 Schedule can be filed electronically or by mail. The specific instructions for filing can be found on the form itself.

Q: Are there any deadlines for filing NYC-399 Schedule?

A: The deadlines for filing NYC-399 Schedule vary depending on the tax year. It is important to check the instructions on the form for the specific deadline.

Q: What happens if I don't file NYC-399 Schedule?

A: If you are required to file NYC-399 Schedule and fail to do so, you may be subject to penalties and interest on any unpaid taxes.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-399 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.