This version of the form is not currently in use and is provided for reference only. Download this version of

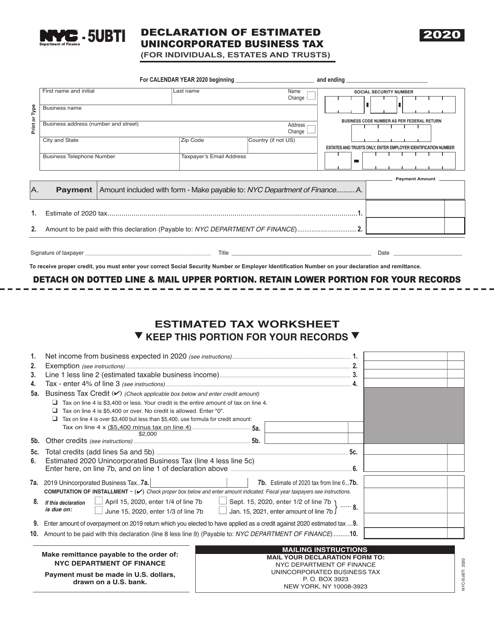

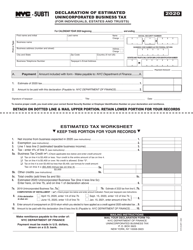

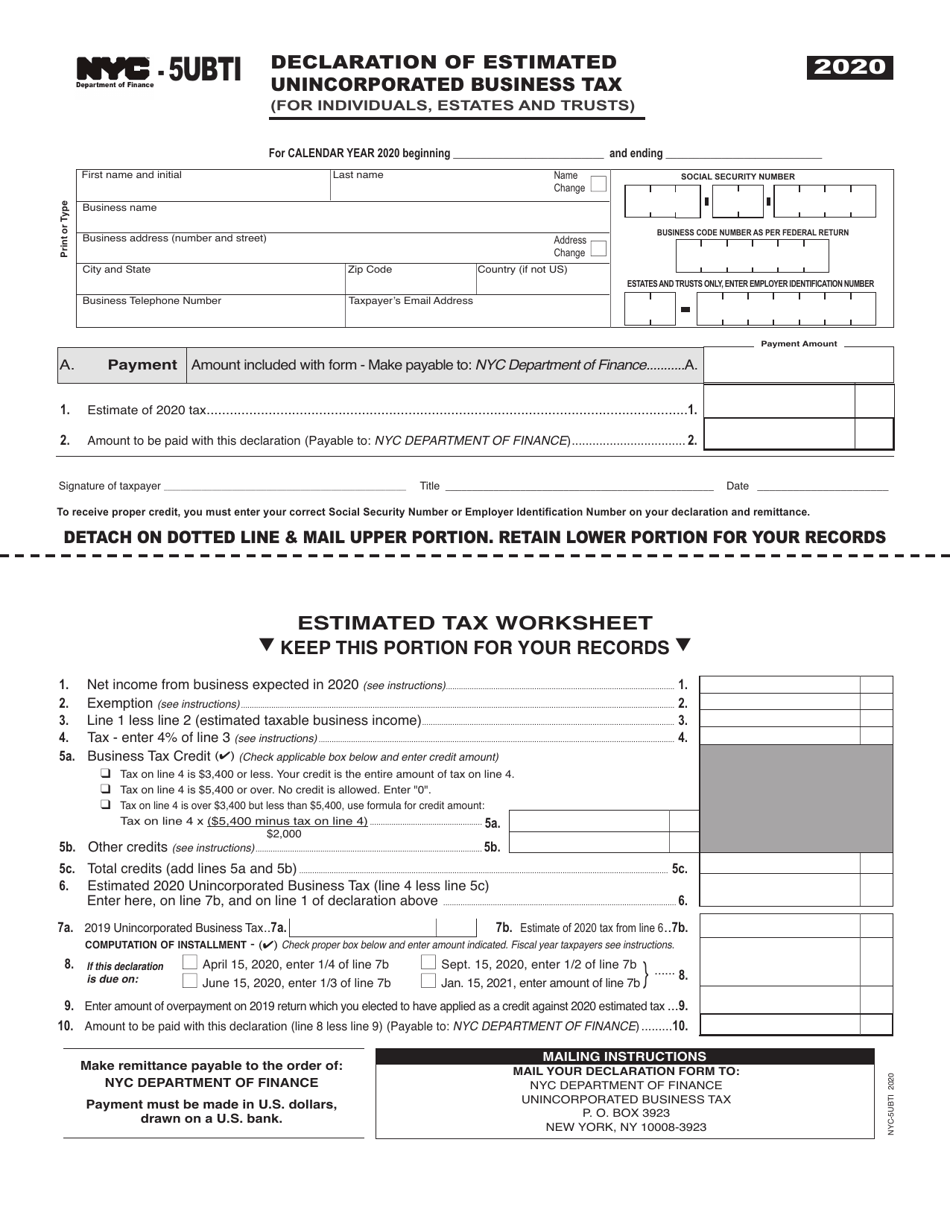

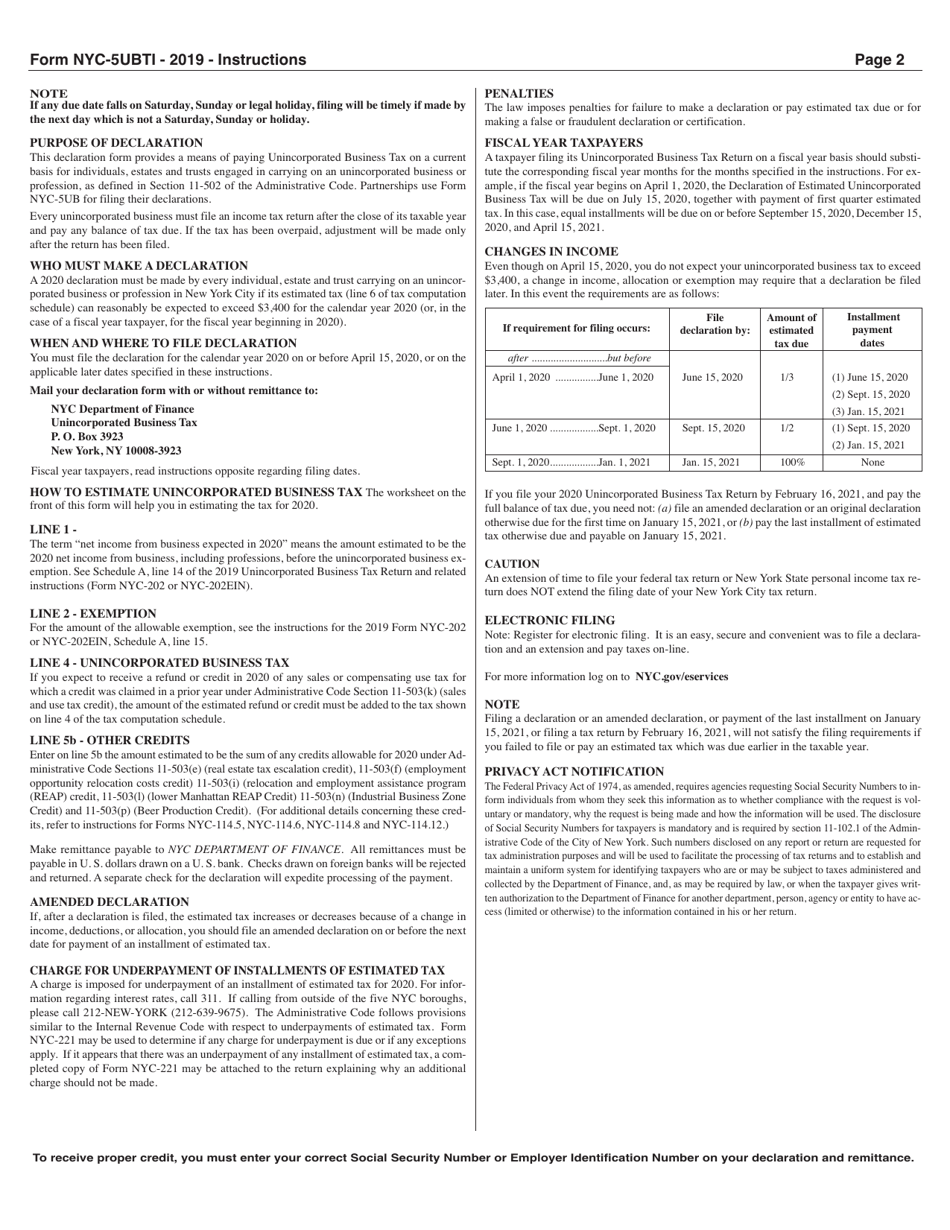

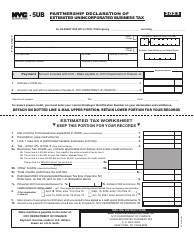

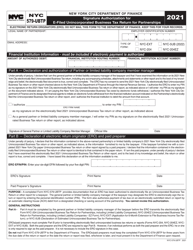

Form NYC-5UBTI

for the current year.

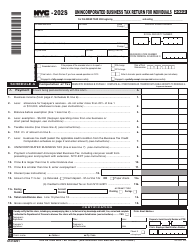

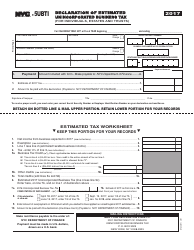

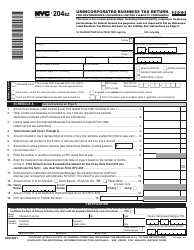

Form NYC-5UBTI Declaration of Estimated Unincorporated Business Tax (For Individuals, Estates and Trusts) - New York City

What Is Form NYC-5UBTI?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a NYC-5UBTI Declaration?

A: The NYC-5UBTI Declaration is a form used to report estimated unincorporated business tax for individuals, estates, and trusts in New York City.

Q: Who needs to file the NYC-5UBTI Declaration?

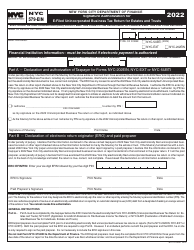

A: Individuals, estates, and trusts engaged in unincorporated business activity in New York City need to file the NYC-5UBTI Declaration.

Q: What is the purpose of the NYC-5UBTI Declaration?

A: The purpose of the NYC-5UBTI Declaration is to report estimated unincorporated business tax liability and make estimated tax payments.

Q: When is the deadline to file the NYC-5UBTI Declaration?

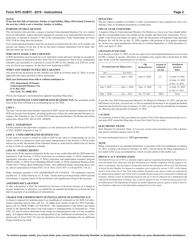

A: The NYC-5UBTI Declaration must be filed by April 15th of each year, or the next business day if April 15th falls on a weekend or holiday.

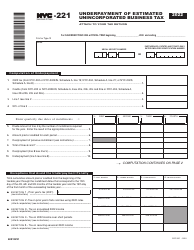

Q: Are there any penalties for not filing the NYC-5UBTI Declaration?

A: Yes, failure to file the NYC-5UBTI Declaration or pay the estimated tax can result in penalties and interest.

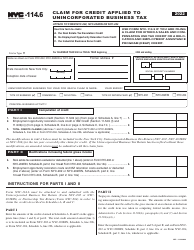

Q: Are there any exemptions or deductions available for the unincorporated business tax?

A: Yes, there are certain exemptions and deductions available for the unincorporated business tax. It is recommended to consult a tax professional or refer to the official instructions for more information.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-5UBTI by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.