This version of the form is not currently in use and is provided for reference only. Download this version of

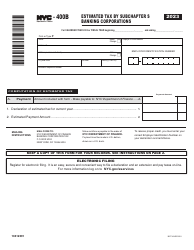

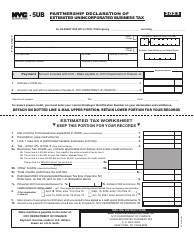

Form NYC-400

for the current year.

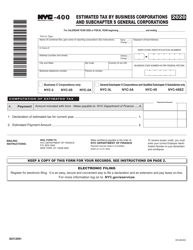

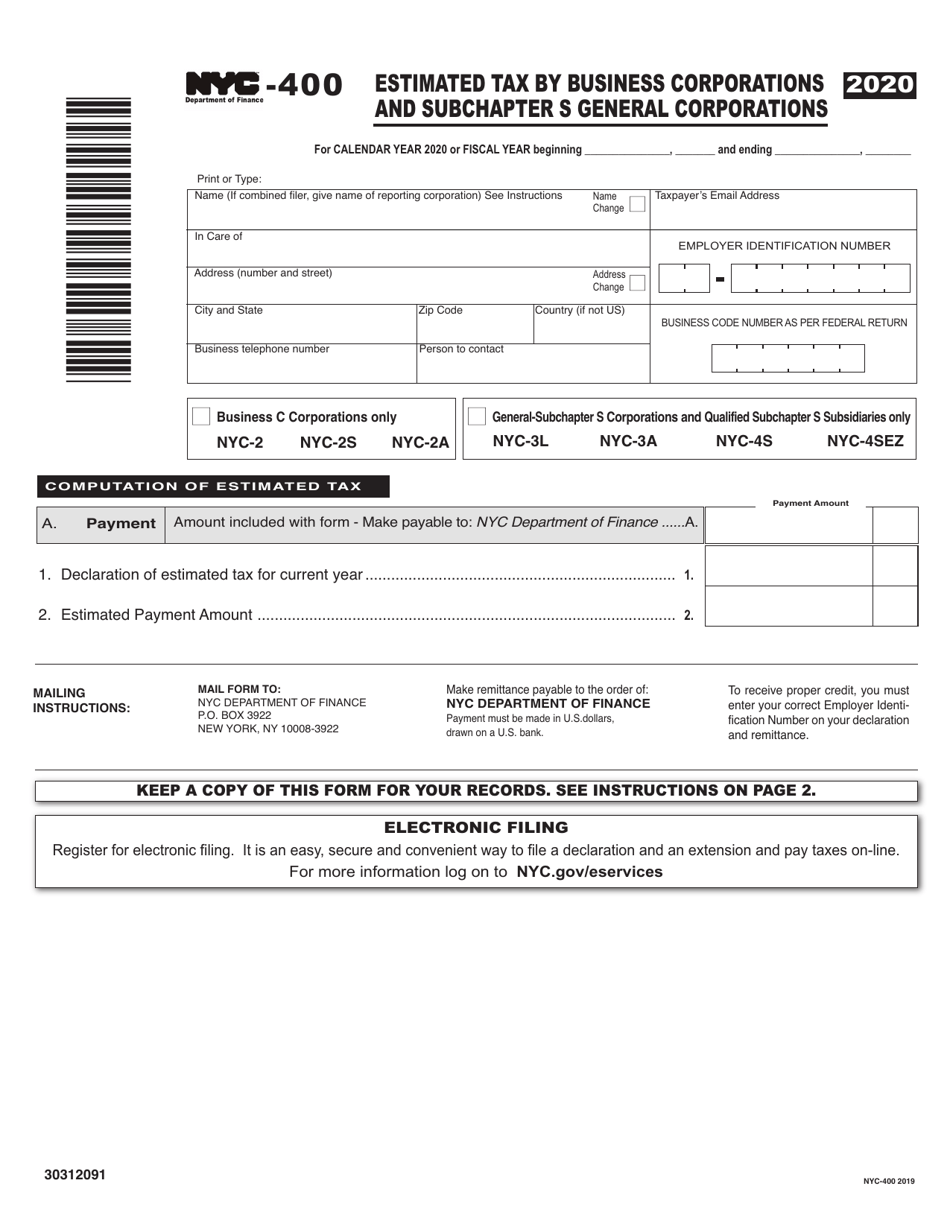

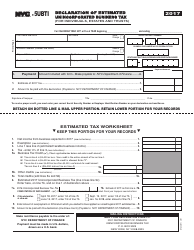

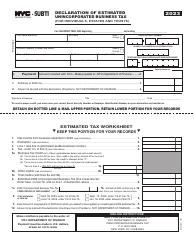

Form NYC-400 Estimated Tax by Business Corporations and Subchapter S General Corporations - New York City

What Is Form NYC-400?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

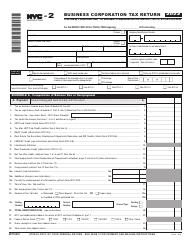

Q: What is NYC-400?

A: NYC-400 is a form used to estimate the tax owed by business corporations and Subchapter S general corporations in New York City.

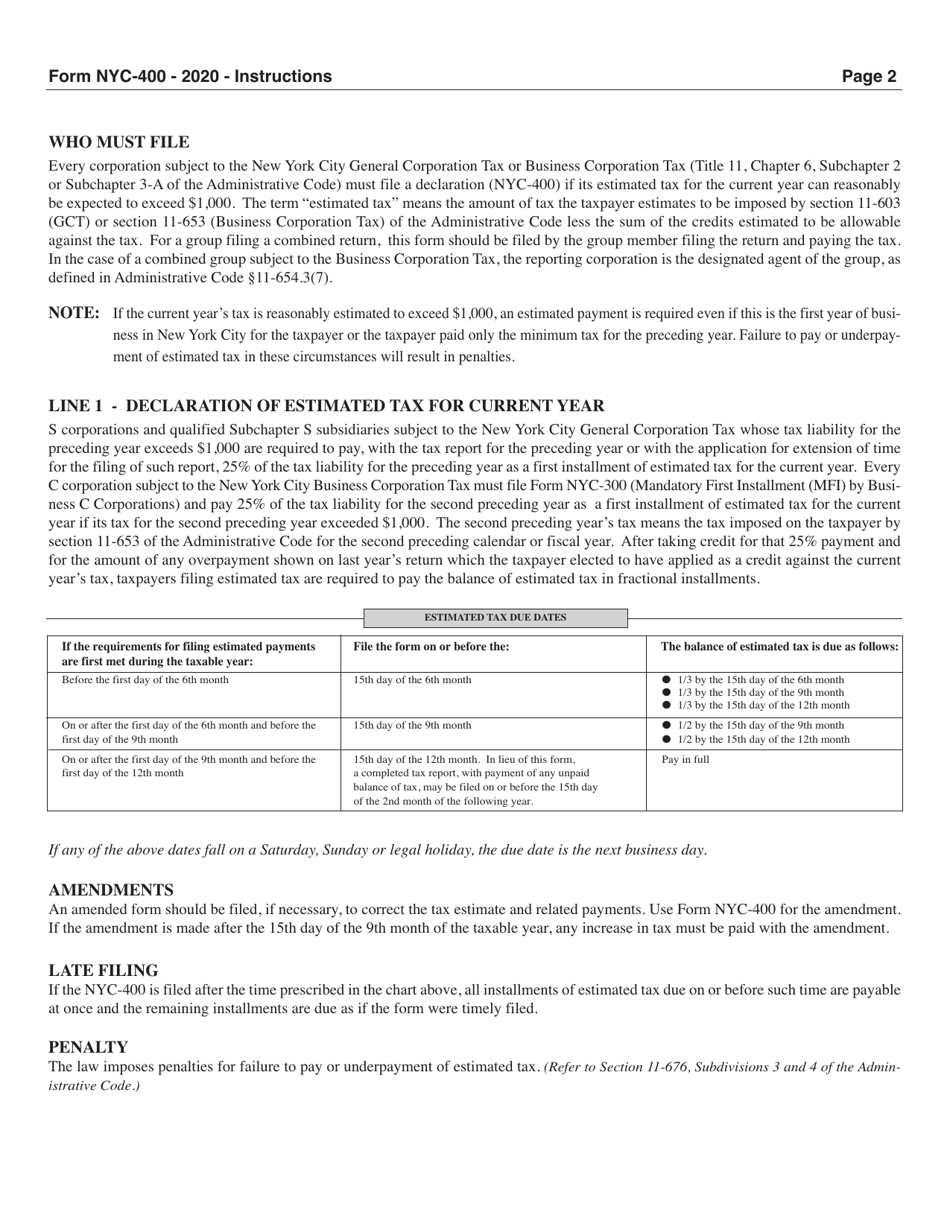

Q: Who needs to file NYC-400?

A: Business corporations and Subchapter S general corporations operating in New York City need to file NYC-400.

Q: What is the purpose of filing NYC-400?

A: The purpose of filing NYC-400 is to estimate and pay the tax owed by corporations to the city of New York.

Q: How often is NYC-400 filed?

A: NYC-400 is typically filed annually, along with the corporation's tax return.

Q: What information is required to complete NYC-400?

A: NYC-400 requires information such as the corporation's income, deductions, credits, and other relevant financial details.

Q: What are the due dates for filing NYC-400?

A: The due date for filing NYC-400 is typically March 15th for calendar year filers, or the 15th day of the third month following the close of the corporation's fiscal year.

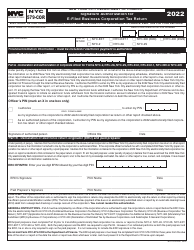

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-400 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.