This version of the form is not currently in use and is provided for reference only. Download this version of

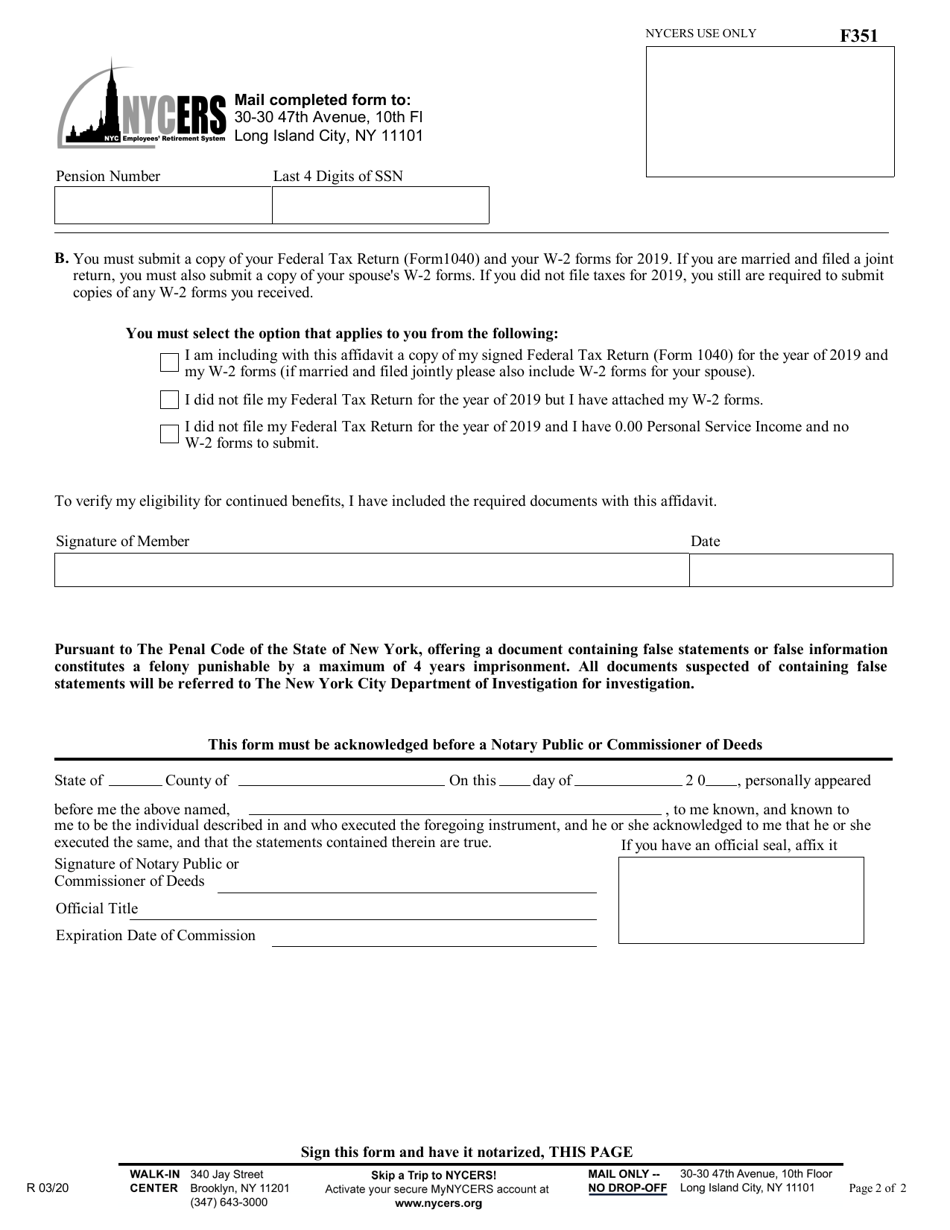

Form F351

for the current year.

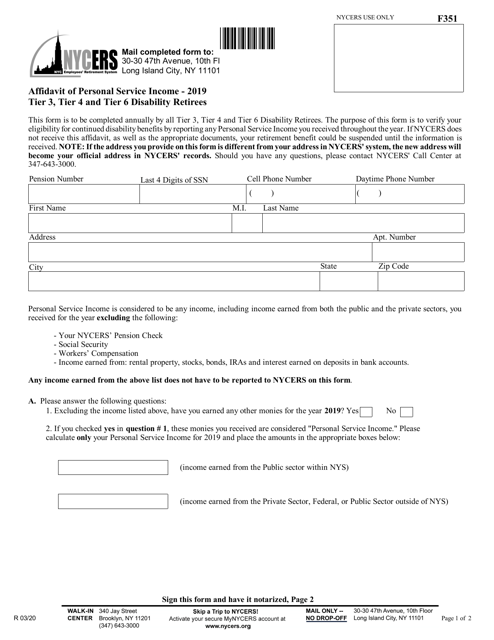

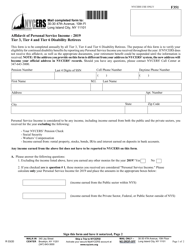

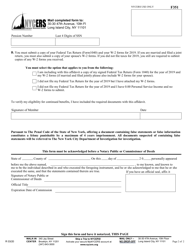

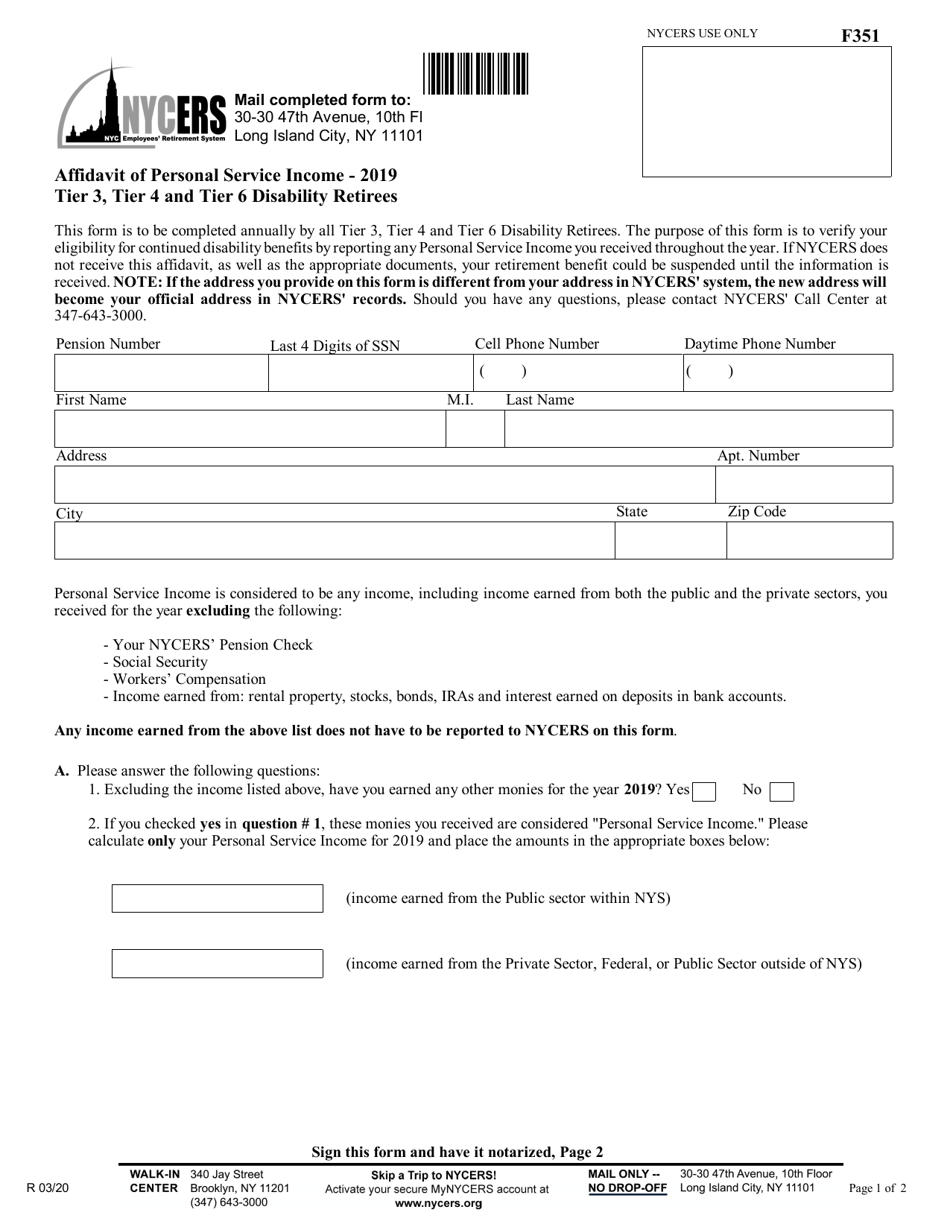

Form F351 Affidavit of Personal Service Income - Tier 3, Tier 4 and Tier 6 Disability Retirees - New York City

What Is Form F351?

This is a legal form that was released by the New York City Employees' Retirement System - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F351?

A: Form F351 is the Affidavit of Personal Service Income for Tier 3, Tier 4, and Tier 6 Disability Retirees in New York City.

Q: Who needs to fill out Form F351?

A: Tier 3, Tier 4, and Tier 6 Disability Retirees in New York City need to fill out Form F351.

Q: What is the purpose of Form F351?

A: Form F351 is used to report personal service income for Tier 3, Tier 4, and Tier 6 Disability Retirees in New York City.

Q: What types of income should be reported on Form F351?

A: Any personal service income earned by Tier 3, Tier 4, and Tier 6 Disability Retirees in New York City should be reported on Form F351.

Q: When is the deadline to submit Form F351?

A: The deadline to submit Form F351 is typically in April of each year. You should refer to the instructions accompanying the form for the specific deadline.

Q: What happens if I don't submit Form F351?

A: Failure to submit Form F351 or reporting inaccurate information may result in penalties or other consequences, as determined by NYCERS.

Q: I am not a Disability Retiree. Do I still need to fill out Form F351?

A: No, Form F351 is specifically for Tier 3, Tier 4, and Tier 6 Disability Retirees in New York City. If you are not in one of these tiers, you do not need to fill out this form.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the New York City Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F351 by clicking the link below or browse more documents and templates provided by the New York City Employees' Retirement System.