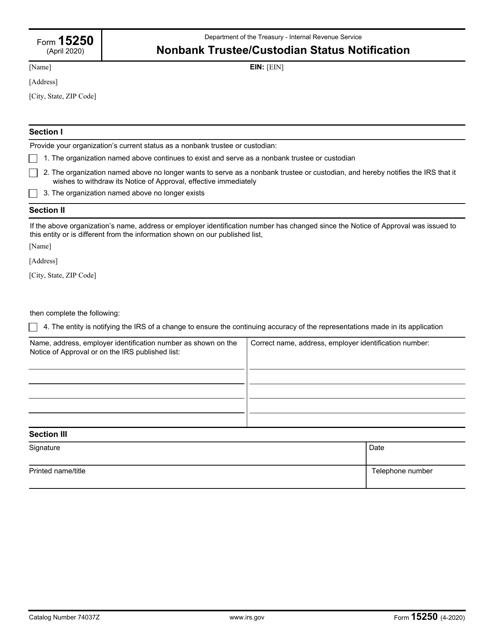

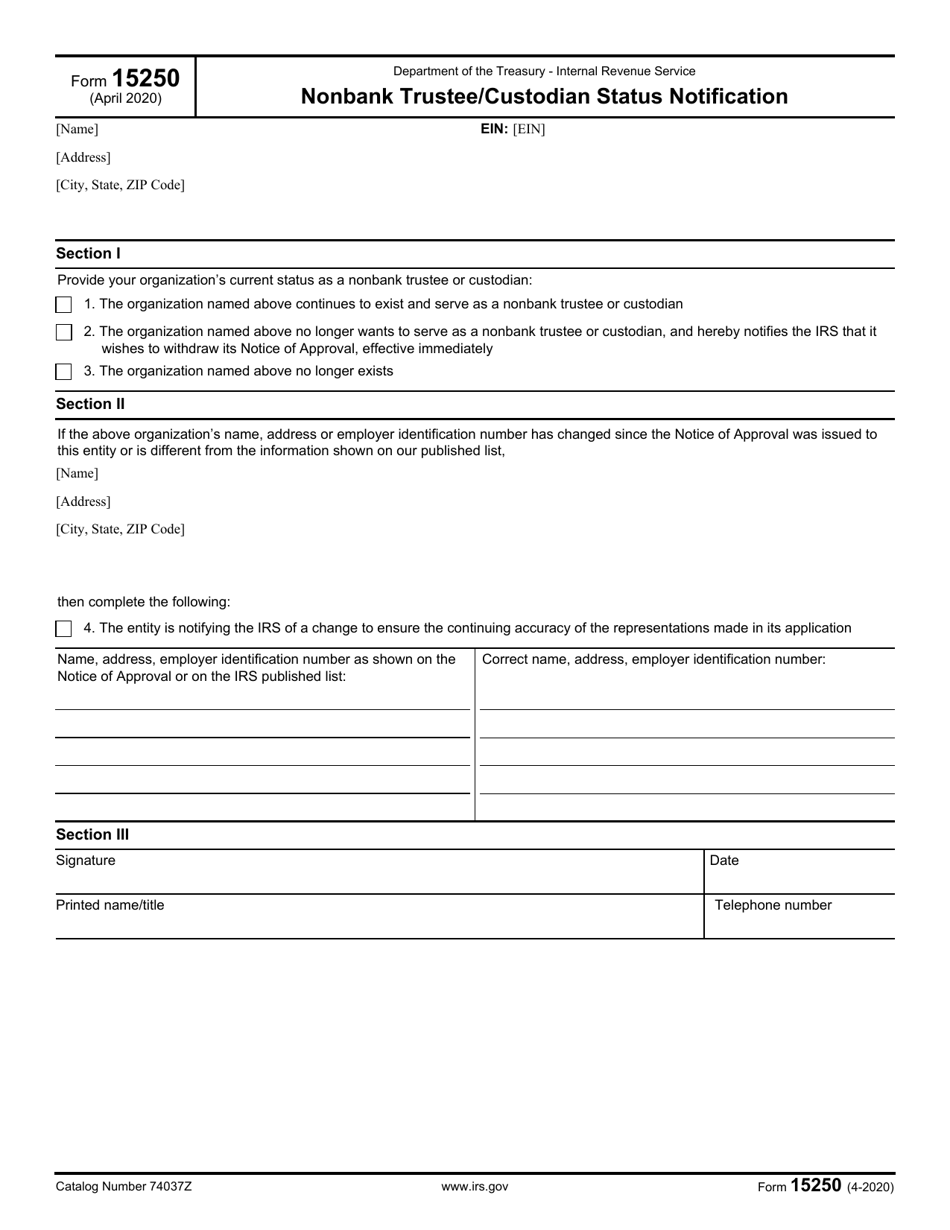

IRS Form 15250 Nonbank Trustee / Custodian Status Notification

What Is IRS Form 15250?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on April 1, 2020. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 15250?

A: IRS Form 15250 is a form used for Nonbank Trustee/Custodian Status Notification.

Q: Who uses IRS Form 15250?

A: Nonbank trustees or custodians use IRS Form 15250.

Q: What is the purpose of IRS Form 15250?

A: The purpose of IRS Form 15250 is to notify the IRS of the status of a nonbank trustee or custodian.

Q: Is IRS Form 15250 mandatory?

A: Yes, nonbank trustees or custodians are required to file IRS Form 15250 to notify the IRS of their status.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 15250 through the link below or browse more documents in our library of IRS Forms.