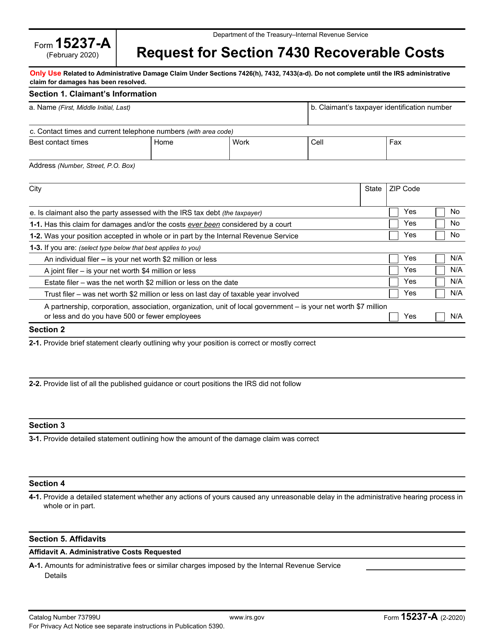

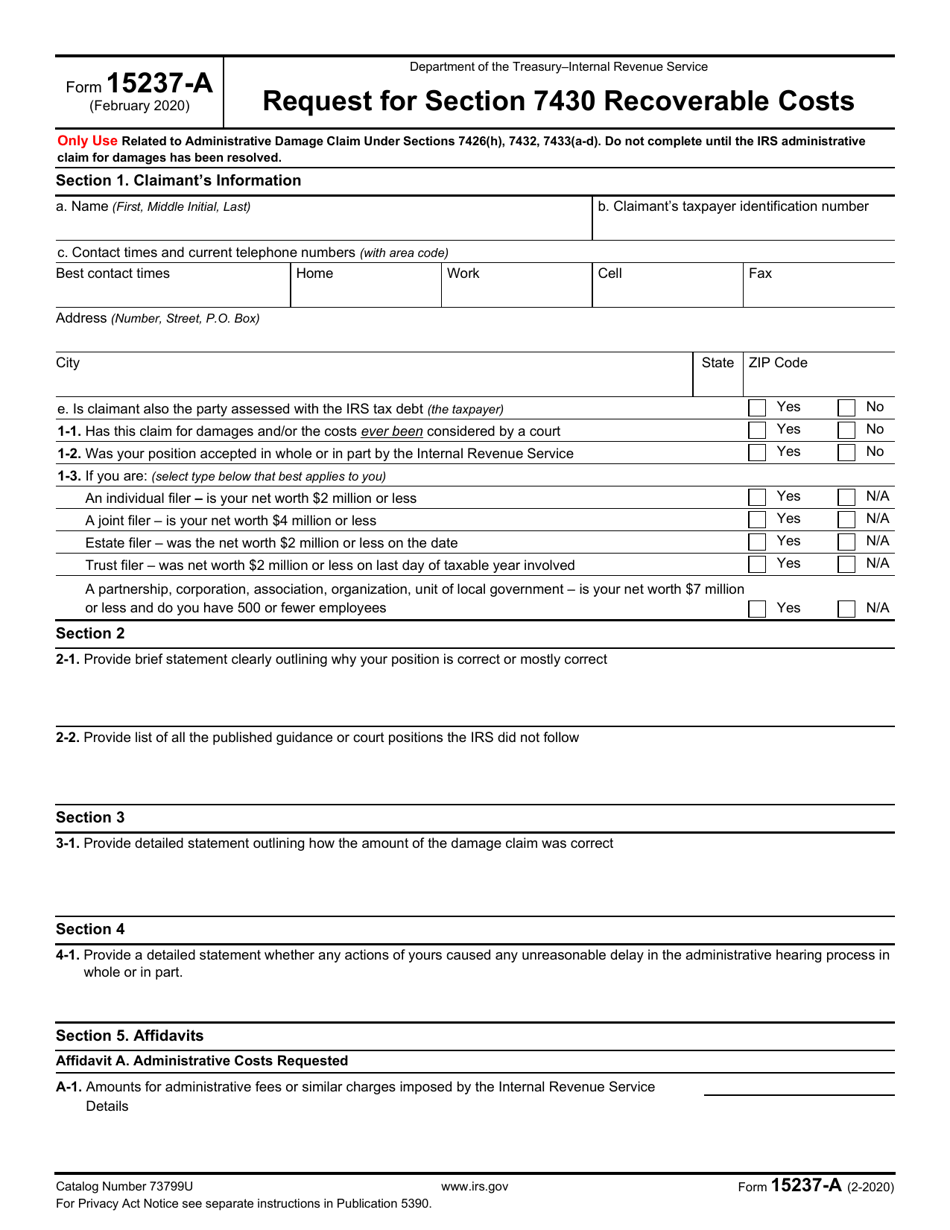

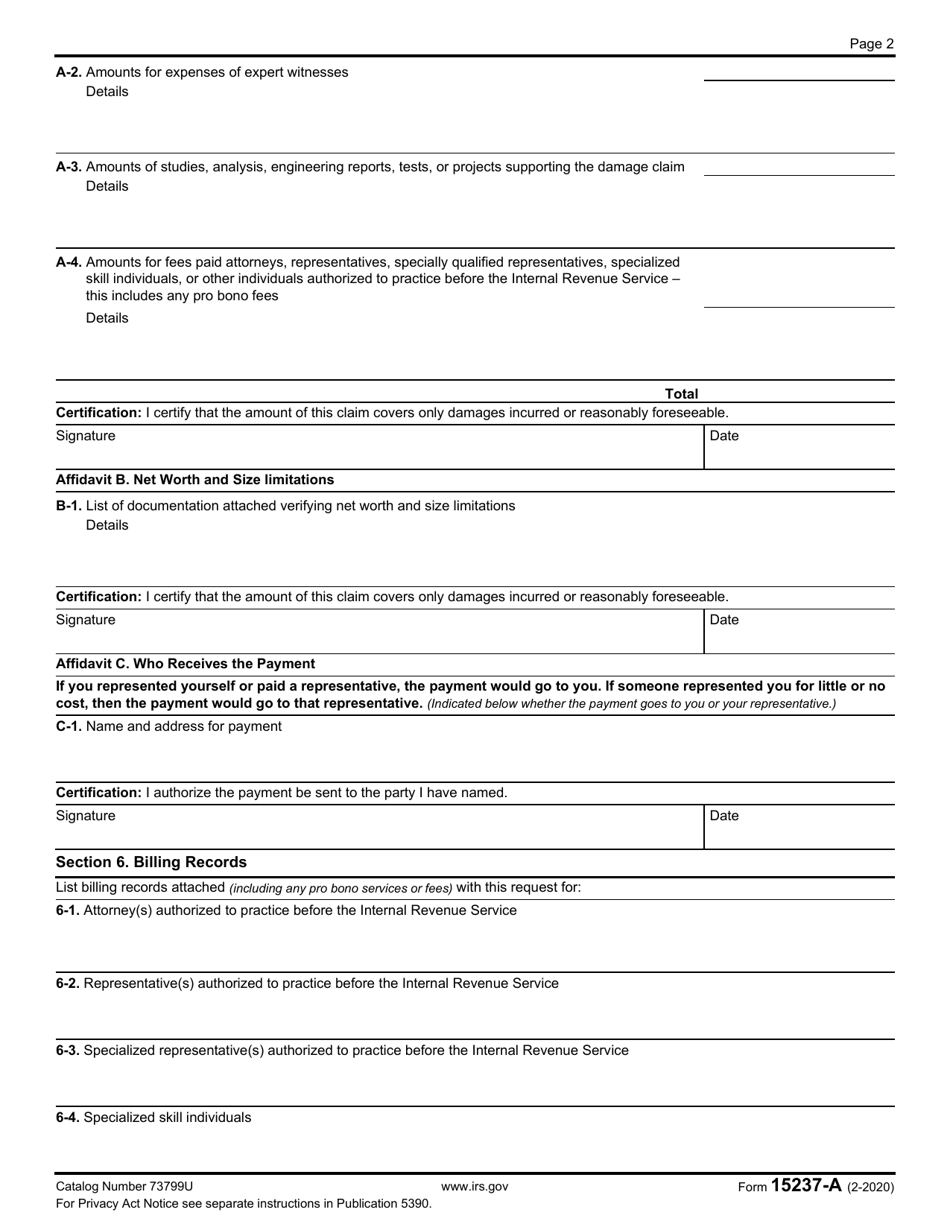

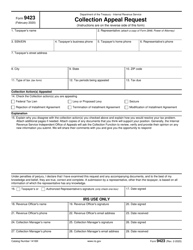

IRS Form 15237-A Request for Section 7430 Recoverable Costs

What Is IRS Form 15237-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2020. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 15237-A?

A: IRS Form 15237-A is a form used to request Section 7430 recoverable costs.

Q: What is Section 7430?

A: Section 7430 is a provision of the Internal Revenue Code that allows taxpayers to recover their costs if they prevail in certain administrative or court proceedings against the IRS.

Q: Who can file Form 15237-A?

A: Taxpayers who have prevailed in administrative or court proceedings against the IRS and are seeking to recover their costs can file Form 15237-A.

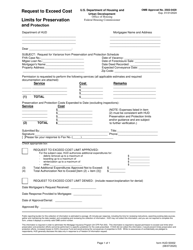

Q: What costs can be recovered?

A: The costs that can be recovered include reasonable attorney's fees, expert witness fees, and other costs directly related to the proceedings.

Q: How should Form 15237-A be filed?

A: Form 15237-A should be submitted to the IRS office that was involved in the proceedings.

Q: Is there a deadline for filing Form 15237-A?

A: Yes, Form 15237-A must be filed within 30 days of the final disposition of the proceedings.

Q: Are there any restrictions on filing Form 15237-A?

A: Yes, there are certain eligibility requirements and limitations on the amount of costs that can be recovered. It is recommended to consult the instructions for Form 15237-A or seek professional advice for specific details.

Form Details:

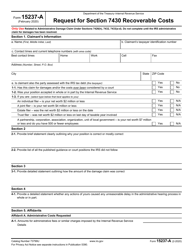

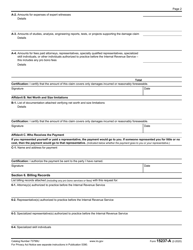

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 15237-A through the link below or browse more documents in our library of IRS Forms.