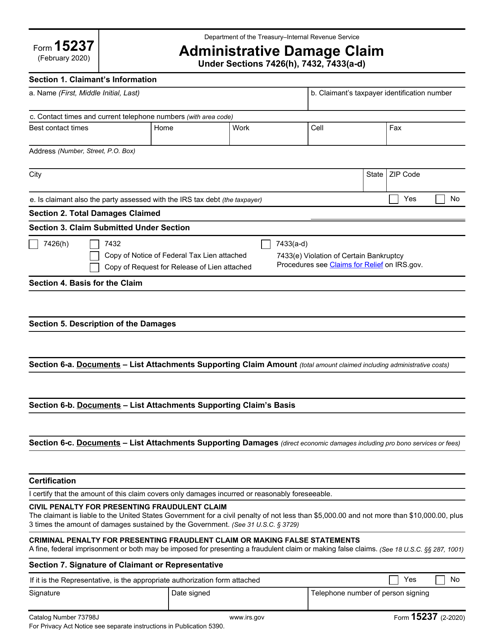

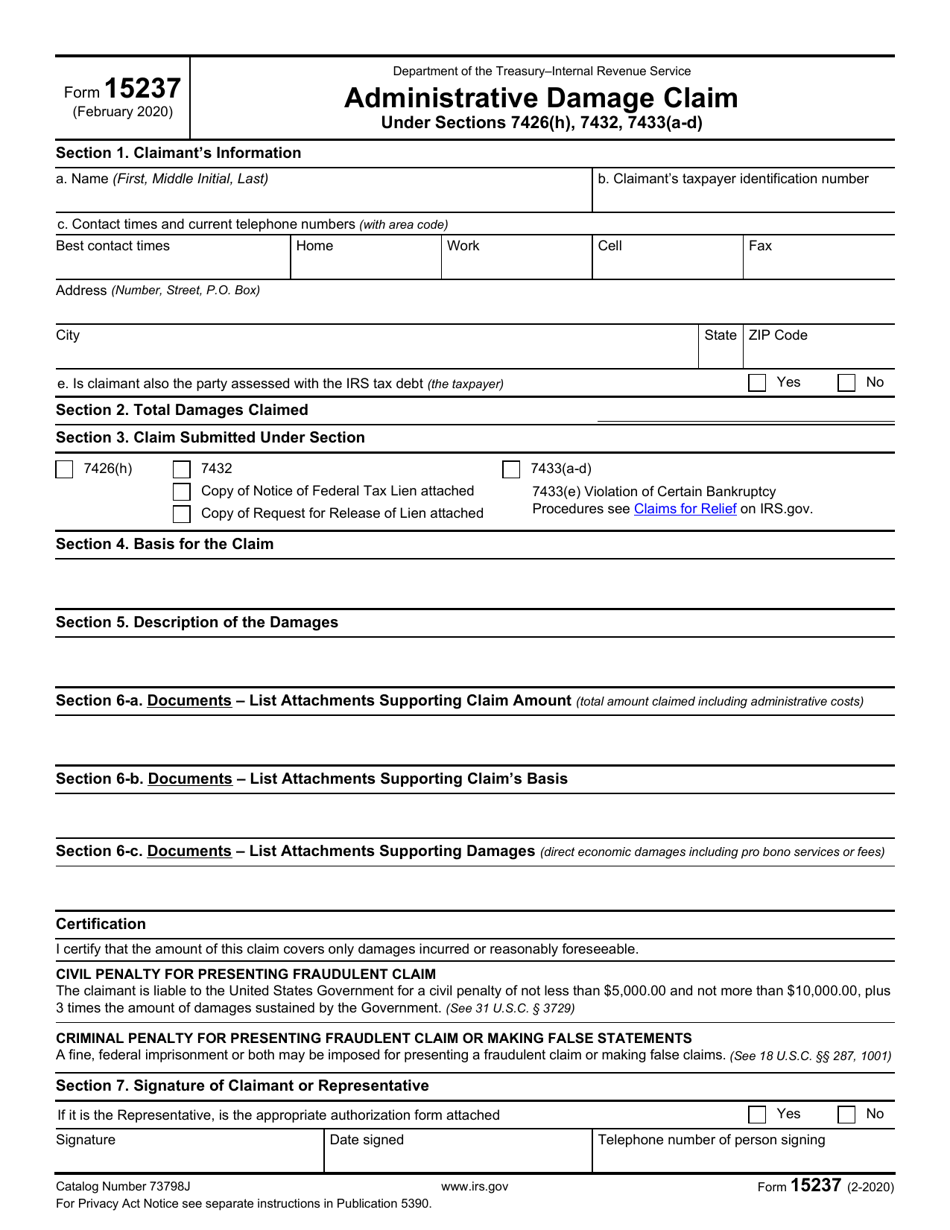

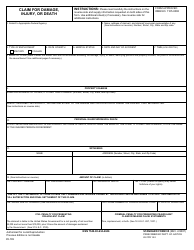

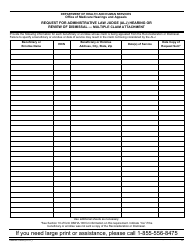

IRS Form 15237 Administrative Damage Claim Under Sections 7426(H), 7432, 7433(A-D)

What Is IRS Form 15237?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2020. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 15237?

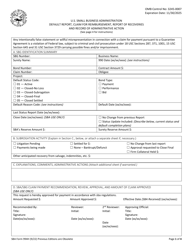

A: IRS Form 15237 is a form used for filing an Administrative Damage Claim under Sections 7426(h), 7432, and 7433(a-d).

Q: What are Sections 7426(h), 7432, and 7433(a-d) of the IRS code?

A: Sections 7426(h), 7432, and 7433(a-d) are sections of the IRS code that deal with administrative damage claims against the IRS.

Q: Who can file an Administrative Damage Claim using Form 15237?

A: Any individual or entity that believes they have suffered damages due to actions or errors by the IRS can file an Administrative Damage Claim using Form 15237.

Q: What types of damages can be claimed using Form 15237?

A: Form 15237 allows for claims related to unauthorized collection actions, unauthorized inspections or disclosures, and unauthorized levies or seizures initiated by the IRS.

Q: Are there any deadlines for filing an Administrative Damage Claim?

A: Yes, there are specific deadlines for filing an Administrative Damage Claim. It is important to review the instructions on Form 15237 or consult with a tax professional for the applicable deadlines.

Q: What should I do if my claim is denied or I disagree with the IRS's decision?

A: If your claim is denied or you disagree with the IRS's decision, you may have the option to pursue further legal action. Consulting with a tax professional or attorney is recommended in these situations.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 15237 through the link below or browse more documents in our library of IRS Forms.