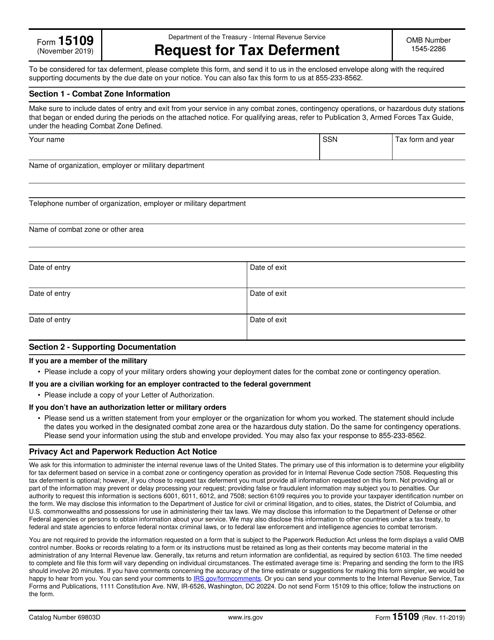

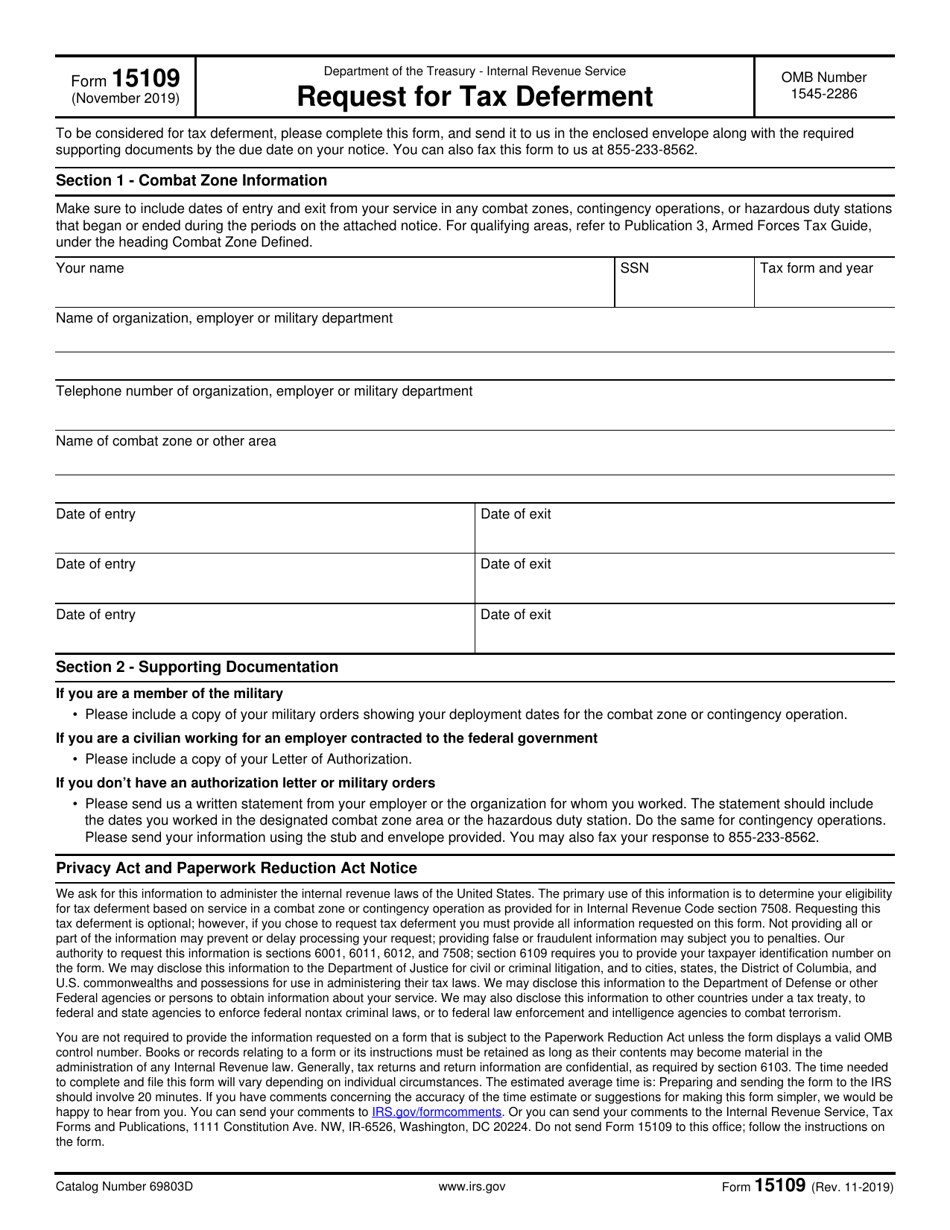

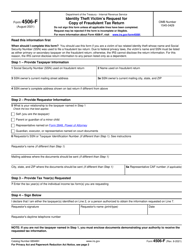

IRS Form 15109 Request for Tax Deferment

What Is IRS Form 15109?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2019. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 15109?

A: IRS Form 15109 is a request for tax deferment.

Q: What is tax deferment?

A: Tax deferment is a temporary postponement of paying taxes.

Q: Who can use IRS Form 15109?

A: Individuals, businesses, and organizations can use IRS Form 15109 to request tax deferment.

Q: What information is required in IRS Form 15109?

A: IRS Form 15109 requires information such as your name, contact information, tax liability, and reason for requesting deferment.

Q: Is there a deadline to submit IRS Form 15109?

A: There may be specific deadlines for submitting IRS Form 15109 depending on the type of tax deferment requested. Check the instructions or consult with the IRS for more information.

Q: What happens after submitting IRS Form 15109?

A: After submitting IRS Form 15109, the IRS will review your request and determine if you qualify for tax deferment.

Q: Can I request tax deferment for all types of taxes?

A: Tax deferment may be available for certain types of taxes, such as income tax or property tax. Check the instructions or consult with the IRS to see if your tax liability qualifies for deferment.

Q: Is tax deferment the same as tax forgiveness?

A: No, tax deferment only postpones the payment of taxes, while tax forgiveness eliminates the obligation to pay certain taxes.

Q: Are there any penalties or interest for tax deferment?

A: Penalties or interest may apply if you do not meet the requirements for tax deferment or if you fail to pay the deferred taxes by the specified deadline. Check the instructions or consult with the IRS for more information.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 15109 through the link below or browse more documents in our library of IRS Forms.