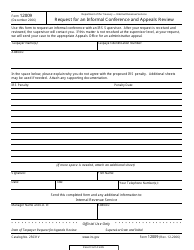

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 12203

for the current year.

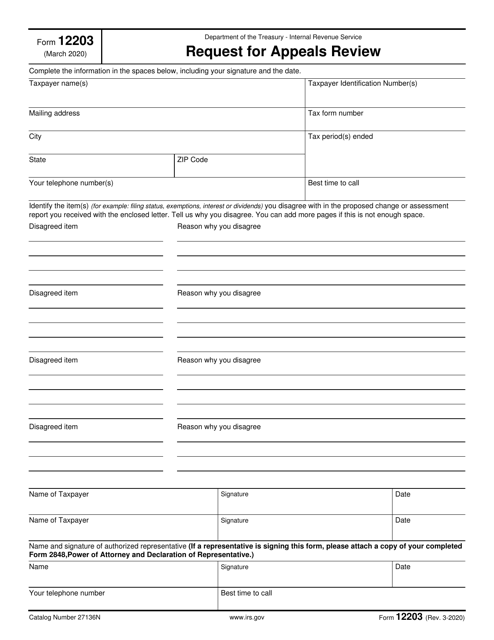

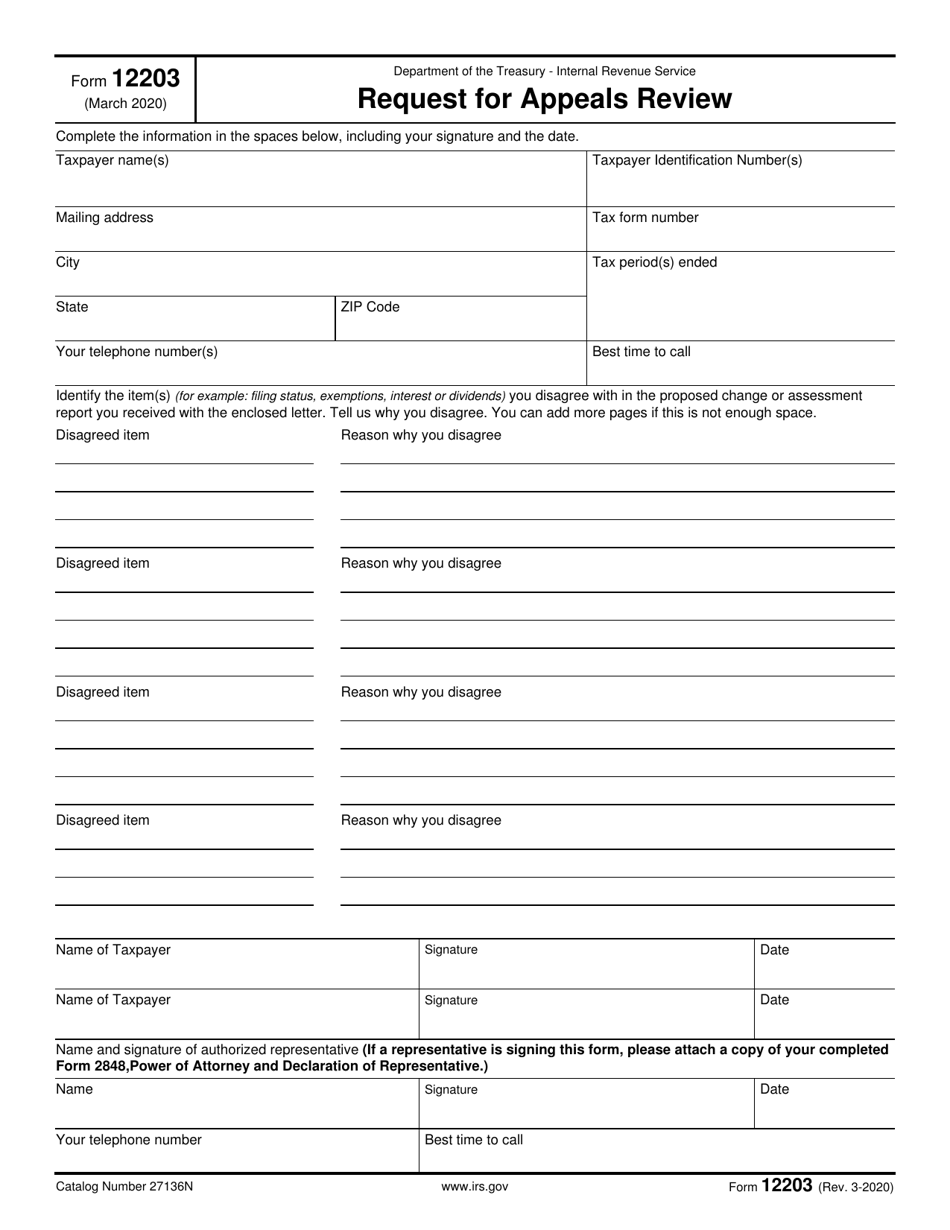

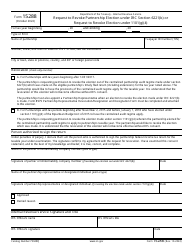

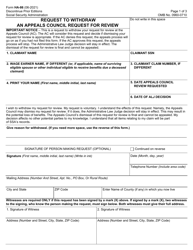

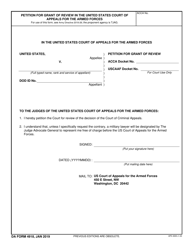

IRS Form 12203 Request for Appeals Review

What Is IRS Form 12203?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on March 1, 2020. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

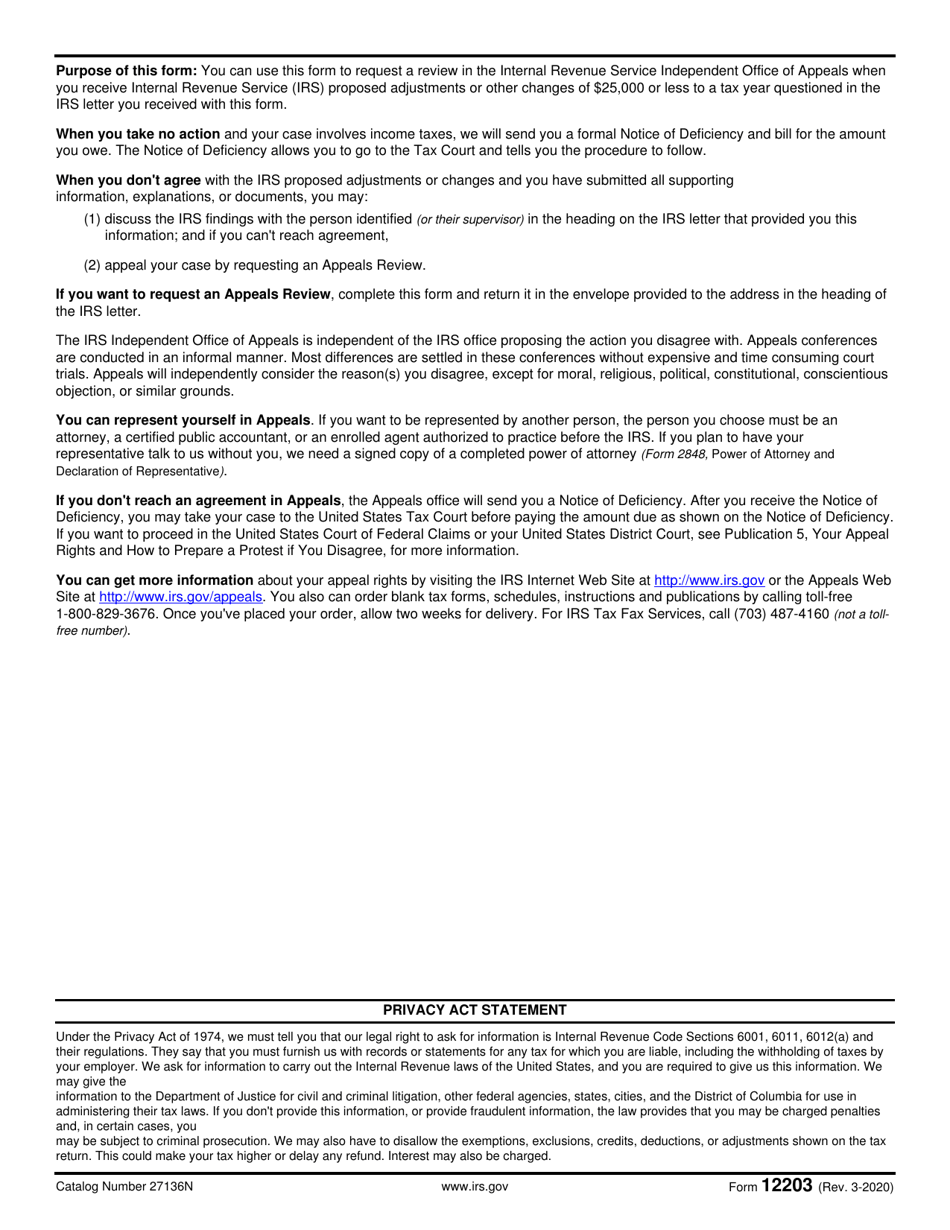

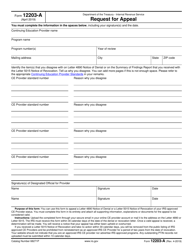

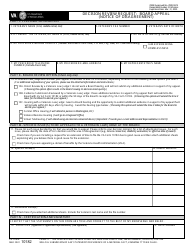

Q: What is IRS Form 12203?

A: IRS Form 12203 is a form used to request an appeals review of a decision made by the Internal Revenue Service.

Q: When should I use IRS Form 12203?

A: You should use IRS Form 12203 when you disagree with a decision made by the IRS and want to request a review.

Q: How do I fill out IRS Form 12203?

A: You need to provide your contact information, describe the decision you are appealing, explain why you disagree with it, and include any supporting documents.

Q: Is there a deadline for submitting IRS Form 12203?

A: Yes, there is a deadline for submitting IRS Form 12203. It is generally within 30 days from the date of the IRS decision you are appealing.

Q: What happens after I submit IRS Form 12203?

A: After you submit IRS Form 12203, the IRS will review your request and make a decision on whether to grant the appeal or not.

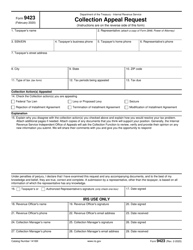

Q: Can I appeal the decision again if my request is denied?

A: Yes, if your request for appeal is denied, you may have the option to further appeal the decision to the Office of Appeals within the IRS.

Q: Are there any fees associated with filing IRS Form 12203?

A: No, there are no specific fees associated with filing IRS Form 12203.

Q: Can I get assistance with filling out IRS Form 12203?

A: Yes, you can seek assistance from a tax professional or a qualified tax attorney to help you fill out IRS Form 12203.

Q: Is IRS Form 12203 applicable for both individuals and businesses?

A: Yes, IRS Form 12203 is applicable for both individuals and businesses who want to request an appeals review of a decision made by the IRS.

Form Details:

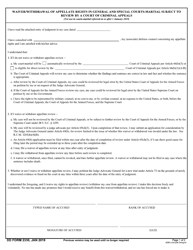

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 12203 through the link below or browse more documents in our library of IRS Forms.