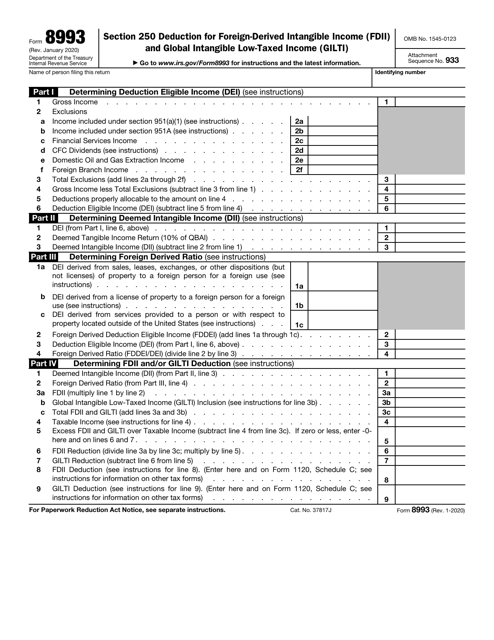

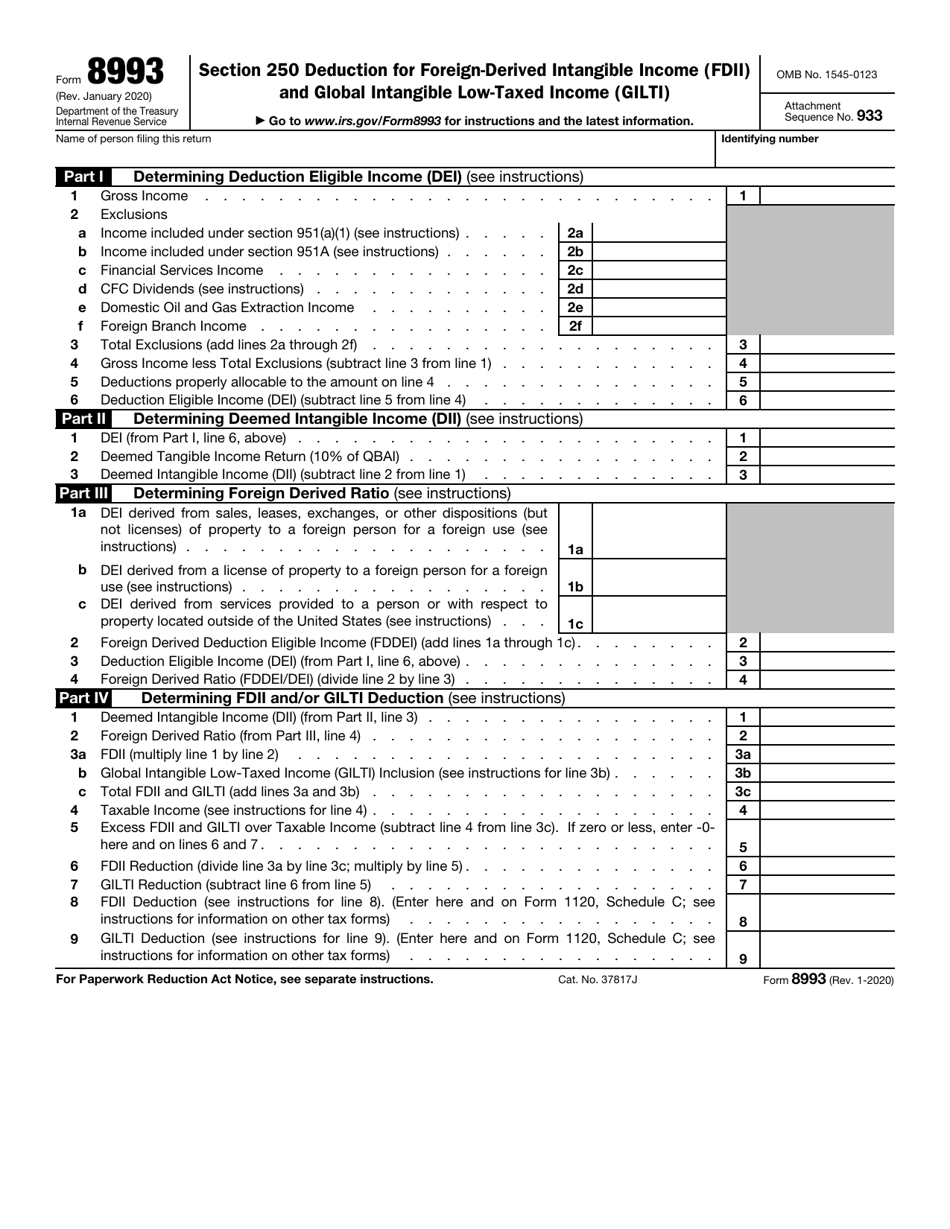

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8993

for the current year.

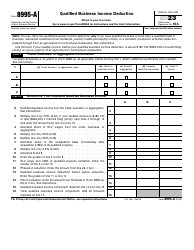

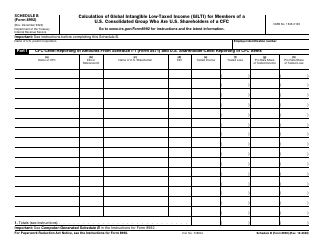

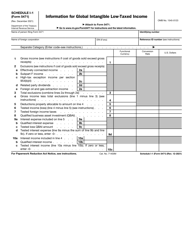

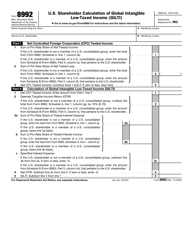

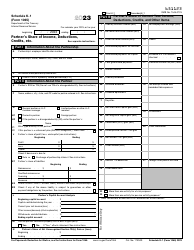

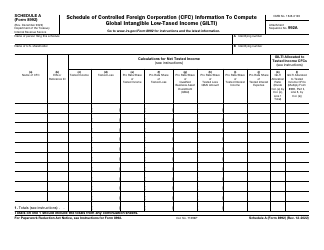

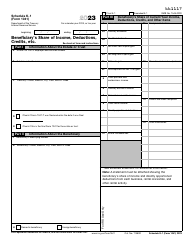

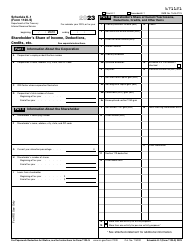

IRS Form 8993 Section 250 Deduction for Foreign Derived Intangible Income (Fdii) and Global Intangible Low-Taxed Income (Gilti)

What Is IRS Form 8993?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2020. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is Form 8993?

A: Form 8993 is a tax form used to claim the deduction for Foreign Derived Intangible Income (FDII) and Global Intangible Low-Taxed Income (GILTI).

Q: What is the Section 250 deduction?

A: The Section 250 deduction allows U.S. taxpayers to reduce their taxable income by a portion of their FDII and GILTI.

Q: What is FDII?

A: Foreign Derived Intangible Income (FDII) is the income derived from serving foreign markets with intellectual property.

Q: What is GILTI?

A: Global Intangible Low-Taxed Income (GILTI) is the income earned by U.S. shareholders of certain foreign corporations.

Q: Who is eligible for the Section 250 deduction?

A: U.S. taxpayers who have eligible FDII and GILTI income can claim the Section 250 deduction.

Q: How do I file Form 8993?

A: Form 8993 should be filed with your annual tax return, such as Form 1040.

Q: Are there any limitations or restrictions on the Section 250 deduction?

A: Yes, there are various limitations and restrictions on the Section 250 deduction. It is recommended to consult a tax professional or refer to the IRS instructions for Form 8993 for more details.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8993 through the link below or browse more documents in our library of IRS Forms.