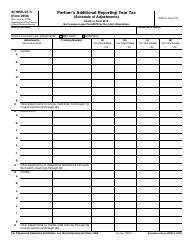

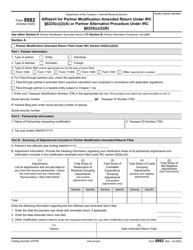

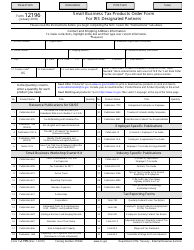

This version of the form is not currently in use and is provided for reference only. Download this version of

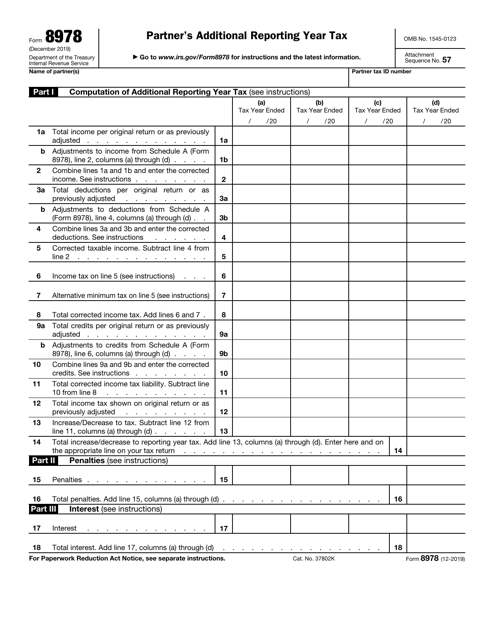

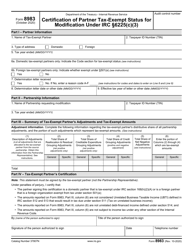

IRS Form 8978

for the current year.

IRS Form 8978 Partner's Additional Reporting Year Tax

What Is IRS Form 8978?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2019. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8978?

A: IRS Form 8978 is a form used for Partner's Additional Reporting Year Tax.

Q: Who needs to file IRS Form 8978?

A: Partners of partnerships that have elected to report income, deductions, and credit for a tax year different from the partnership's tax year must file IRS Form 8978.

Q: What is the purpose of IRS Form 8978?

A: The purpose of IRS Form 8978 is to report and pay any additional tax due as a result of a partnership changing its tax year.

Q: When is IRS Form 8978 due?

A: IRS Form 8978 is typically due on or before the 15th day of the 9th month after the close of the partnership's tax year.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8978 through the link below or browse more documents in our library of IRS Forms.