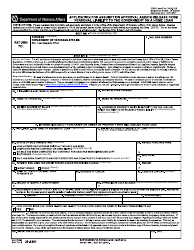

This version of the form is not currently in use and is provided for reference only. Download this version of

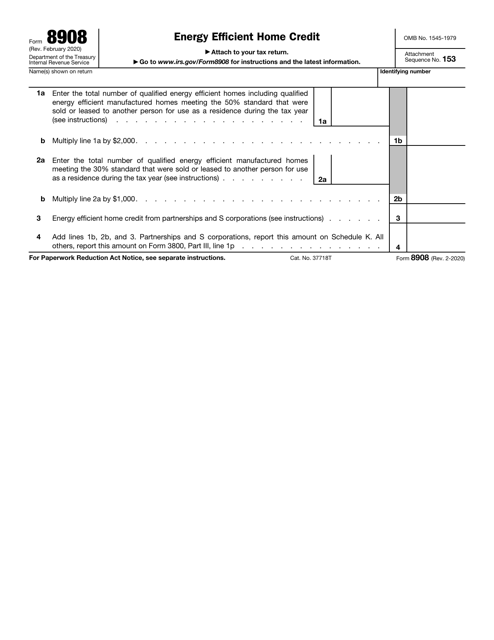

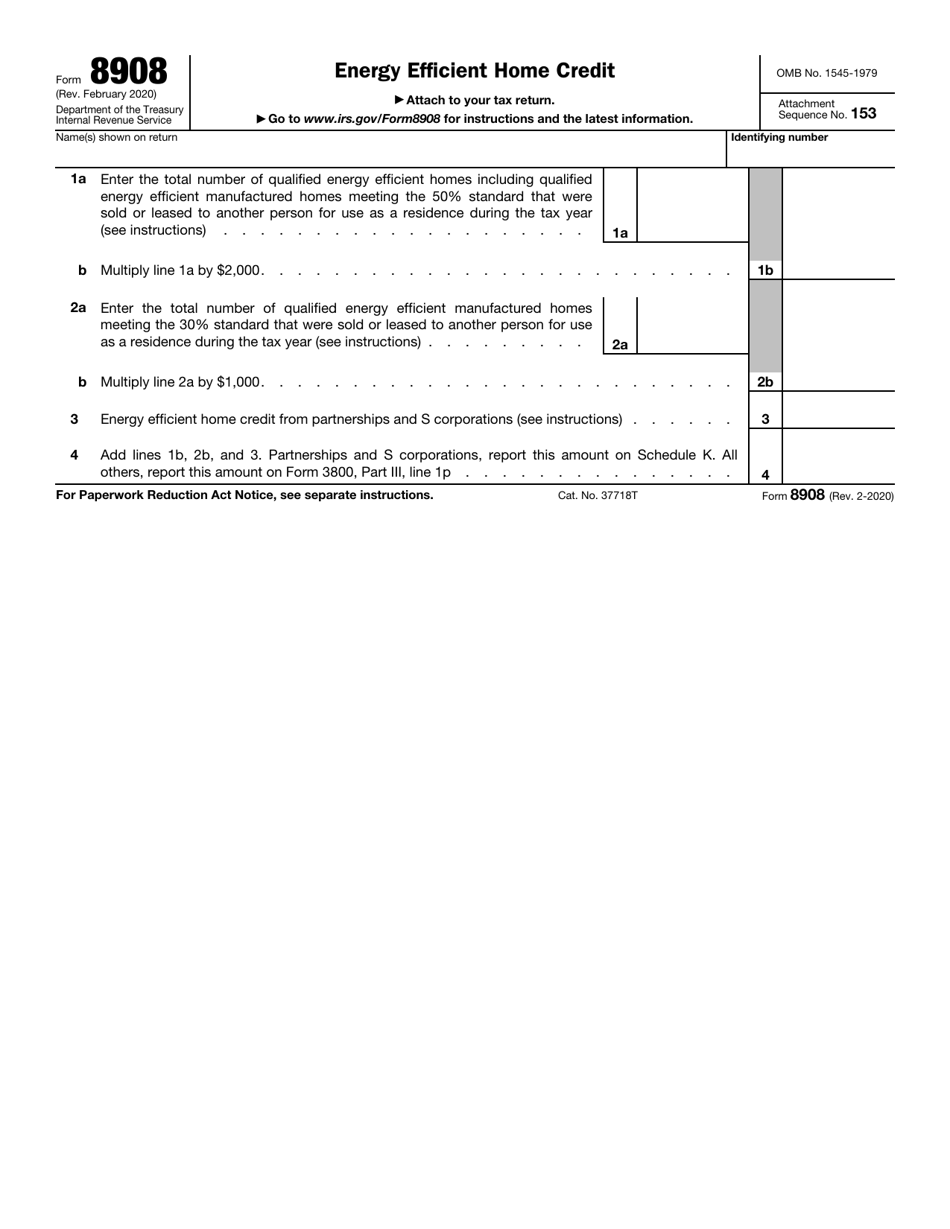

IRS Form 8908

for the current year.

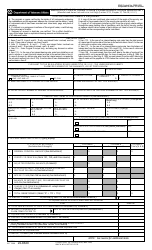

IRS Form 8908 Energy Efficient Home Credit

What Is IRS Form 8908?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2020. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

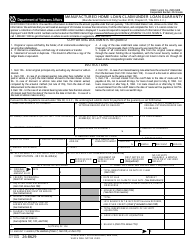

Q: What is IRS Form 8908?

A: IRS Form 8908 is a form used by taxpayers claiming the Energy Efficient Home Credit.

Q: What is the Energy Efficient Home Credit?

A: The Energy Efficient Home Credit is a tax credit available to individuals and businesses who make energy-efficient improvements to their homes or buildings.

Q: Who is eligible for the Energy Efficient Home Credit?

A: Both individuals and businesses may be eligible for the Energy Efficient Home Credit, depending on the specific improvements made.

Q: What type of improvements qualify for the Energy Efficient Home Credit?

A: Qualifying improvements can include energy-efficient windows, doors, insulation, roofs, and heating and cooling systems.

Q: How do I claim the Energy Efficient Home Credit?

A: To claim the credit, taxpayers must complete and submit IRS Form 8908 along with their tax return.

Q: What documentation do I need to support my claim for the Energy Efficient Home Credit?

A: Taxpayers should keep records of the improvements made, including receipts, manufacturer certifications, and any other relevant documentation.

Q: What is the amount of the Energy Efficient Home Credit?

A: The credit amount varies depending on the type of improvement, with a maximum credit of $500 for most improvements.

Q: Is there a deadline for claiming the Energy Efficient Home Credit?

A: Yes, the credit must be claimed in the same tax year that the improvements were made.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8908 through the link below or browse more documents in our library of IRS Forms.