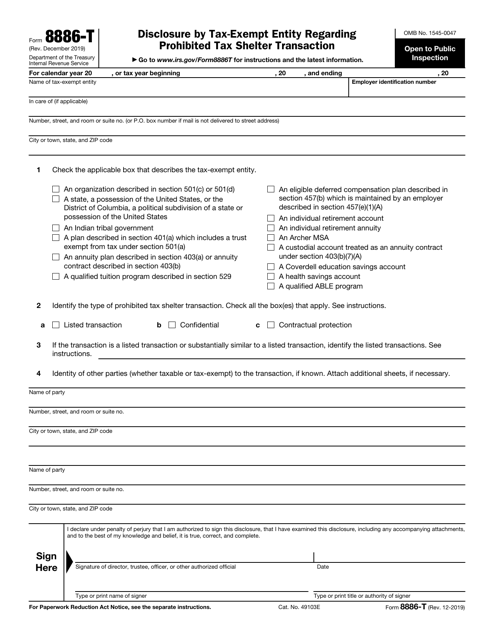

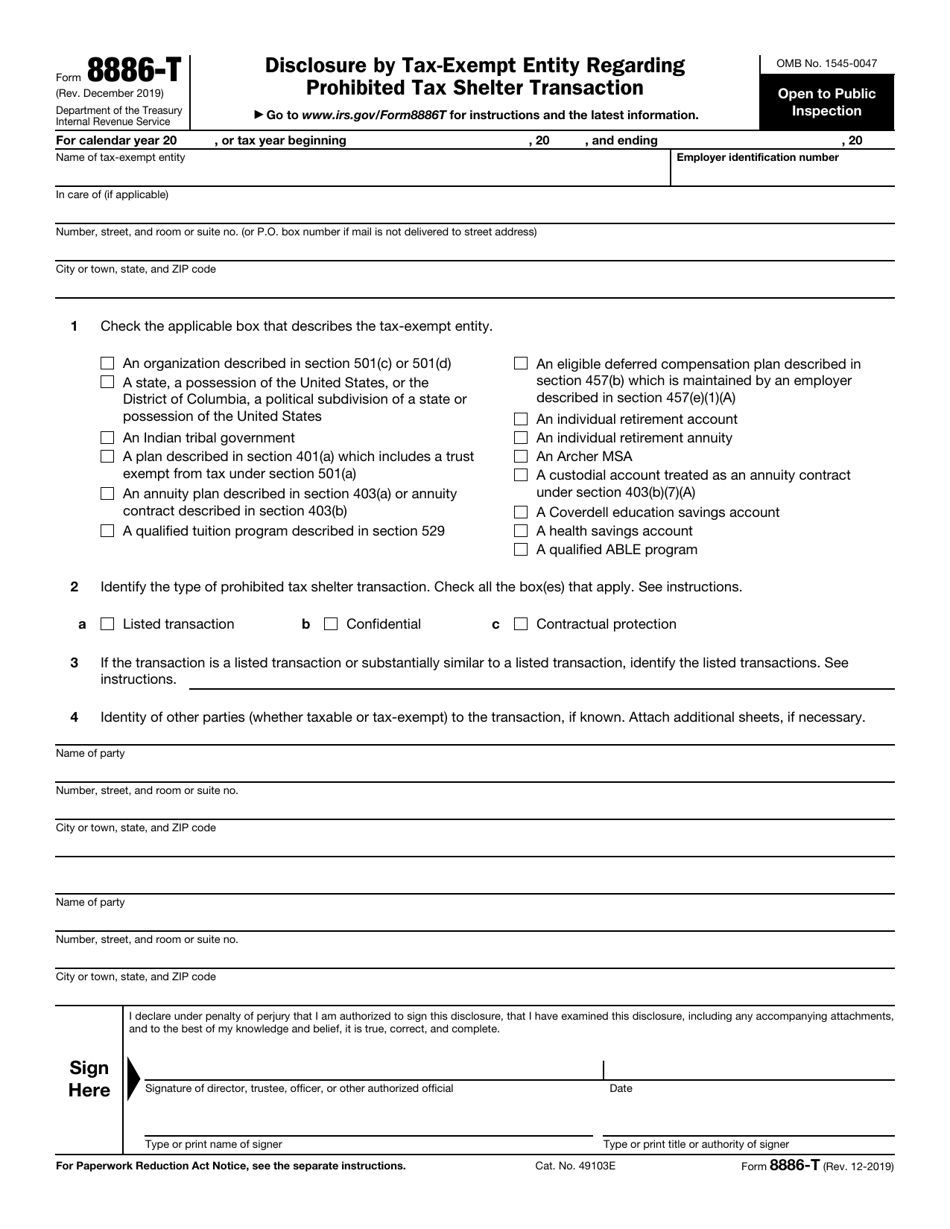

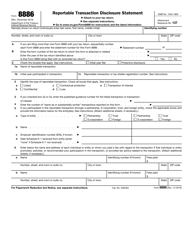

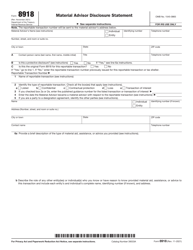

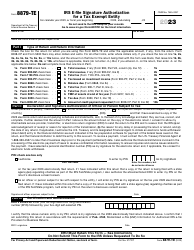

IRS Form 8886-T Disclosure by Tax Exempt Entity Regarding Prohibited Tax Shelter Transaction

What Is IRS Form 8886-T?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2019. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8886-T?

A: IRS Form 8886-T is a form used by tax-exempt entities to disclose information about prohibited tax shelter transactions.

Q: Who is required to file IRS Form 8886-T?

A: Tax-exempt entities that have engaged in prohibited tax shelter transactions are required to file IRS Form 8886-T.

Q: What is a prohibited tax shelter transaction?

A: A prohibited tax shelter transaction is a transaction that the IRS has determined to be an abusive tax avoidance transaction.

Q: What information needs to be disclosed on IRS Form 8886-T?

A: IRS Form 8886-T requires tax-exempt entities to disclose specific details about the prohibited tax shelter transaction, including the parties involved and the tax benefits received.

Q: When is IRS Form 8886-T due?

A: IRS Form 8886-T is generally due on the date the tax return for the tax year in which the transaction occurred is due.

Q: What are the consequences of not filing IRS Form 8886-T?

A: Failure to file IRS Form 8886-T can result in penalties and additional tax liabilities for the tax-exempt entity.

Q: Is IRS Form 8886-T required for all tax-exempt entities?

A: No, IRS Form 8886-T is only required for tax-exempt entities that have engaged in prohibited tax shelter transactions.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8886-T through the link below or browse more documents in our library of IRS Forms.