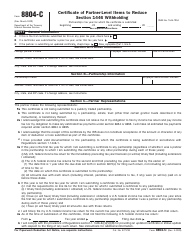

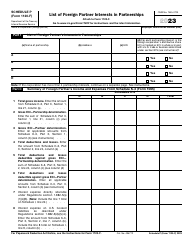

This version of the form is not currently in use and is provided for reference only. Download this version of

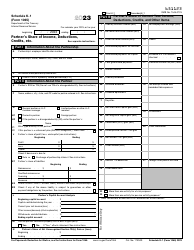

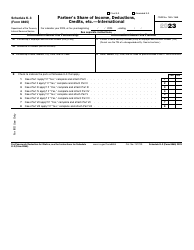

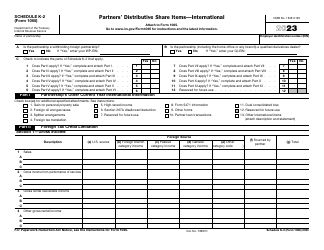

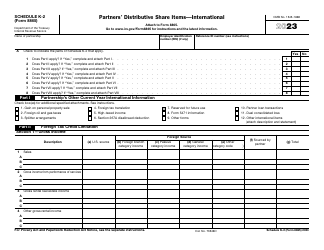

IRS Form 8865 Schedule K-1

for the current year.

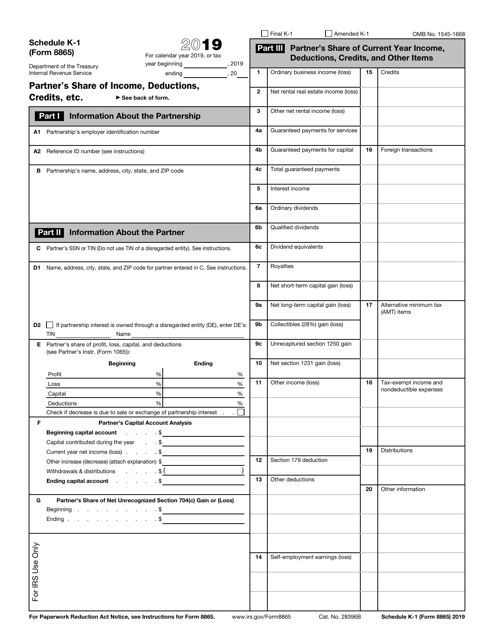

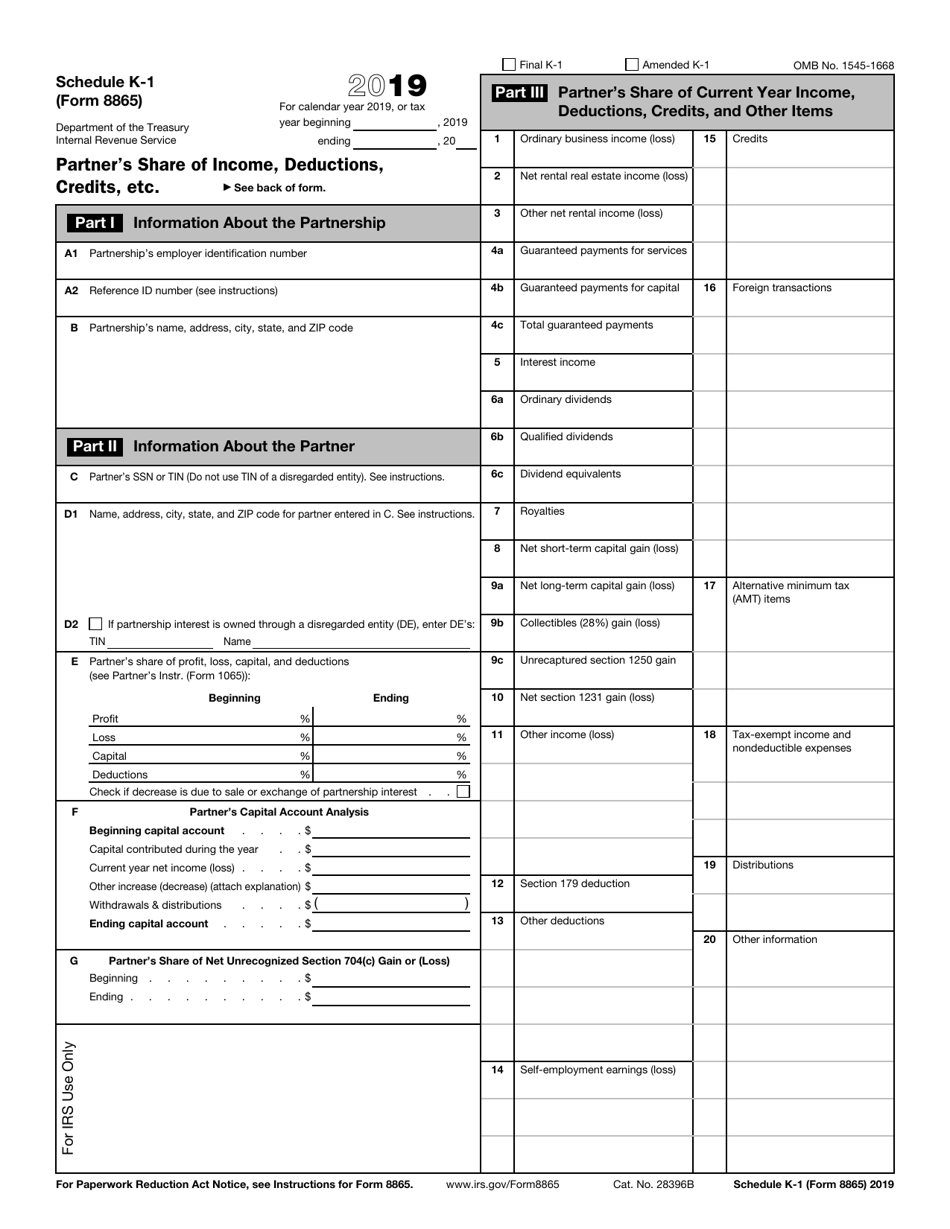

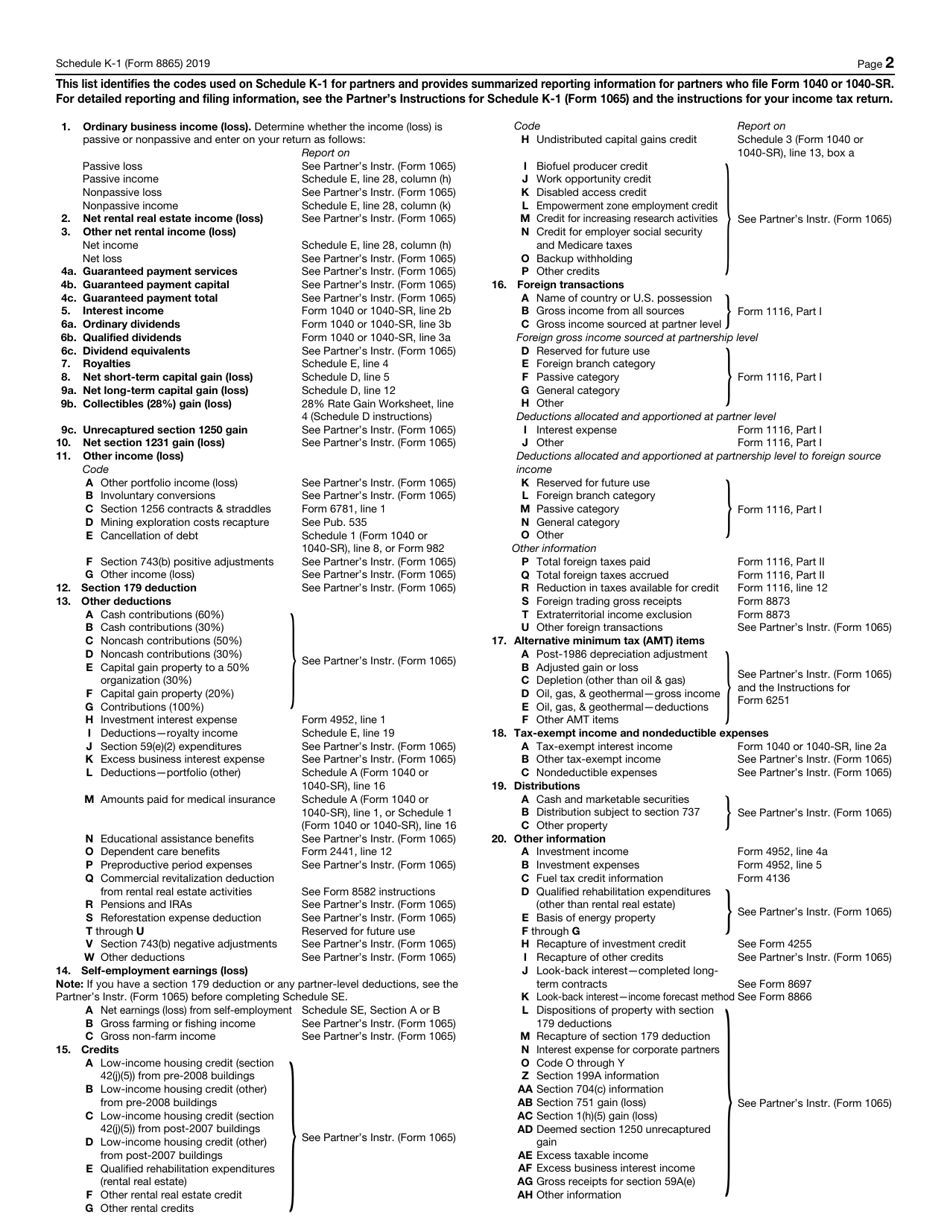

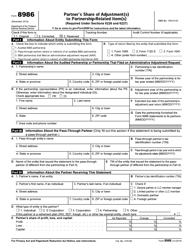

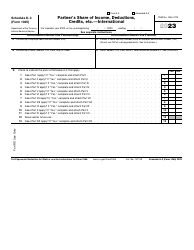

IRS Form 8865 Schedule K-1 Partner's Share of Income, Deductions, Credits, Etc.

What Is IRS Form 8865 Schedule K-1?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8865 Schedule K-1?

A: IRS Form 8865 Schedule K-1 is a form used to report a partner's share of income, deductions, credits, etc. from a partnership that is engaged in a US trade or business.

Q: Who needs to file IRS Form 8865 Schedule K-1?

A: Partners of a partnership that is engaged in a US trade or business need to file IRS Form 8865 Schedule K-1.

Q: What information is provided in IRS Form 8865 Schedule K-1?

A: IRS Form 8865 Schedule K-1 provides information about the partner's share of income, deductions, credits, etc. from the partnership.

Q: How is IRS Form 8865 Schedule K-1 filed?

A: IRS Form 8865 Schedule K-1 is filed along with the partner's personal tax return, typically using Form 1040.

Q: What happens if IRS Form 8865 Schedule K-1 is not filed?

A: Failing to file IRS Form 8865 Schedule K-1 can result in penalties and other consequences from the IRS.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8865 Schedule K-1 through the link below or browse more documents in our library of IRS Forms.