This version of the form is not currently in use and is provided for reference only. Download this version of

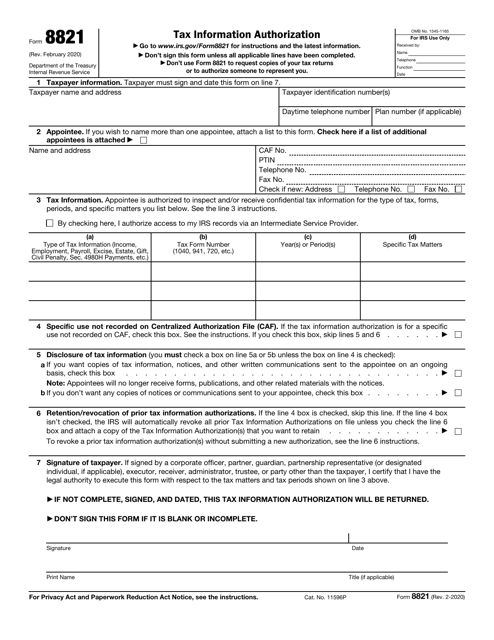

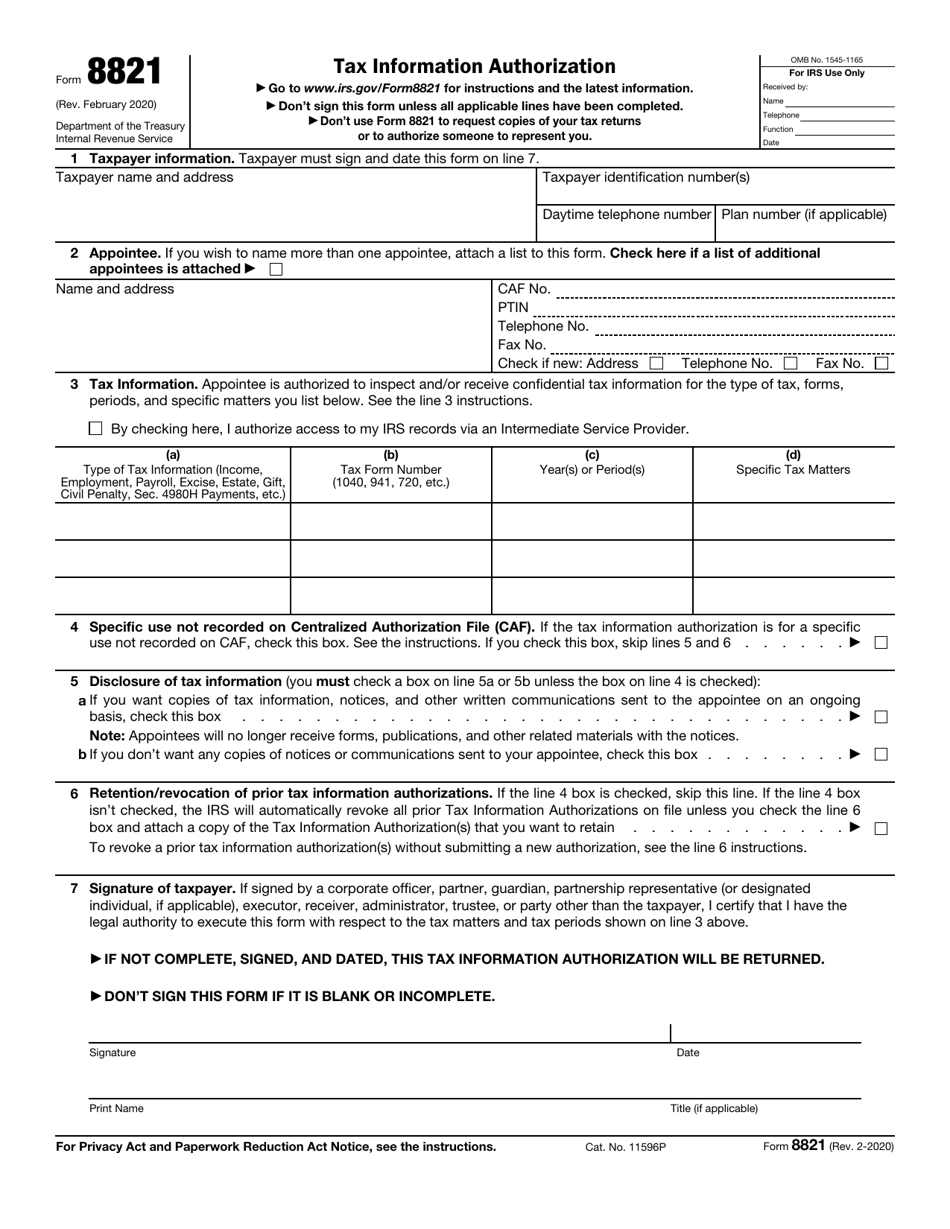

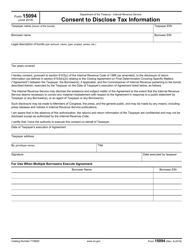

IRS Form 8821

for the current year.

IRS Form 8821 Tax Information Authorization

What Is IRS Form 8821?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2020. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8821?

A: IRS Form 8821 is a tax form used to authorize someone to receive your tax information.

Q: Who should use IRS Form 8821?

A: Anyone who wants to authorize another person or organization to receive their tax information should use IRS Form 8821.

Q: Why would I need to use IRS Form 8821?

A: You might need to use IRS Form 8821 if you want someone else to access your tax information, such as a tax professional or a trusted family member.

Q: How do I fill out IRS Form 8821?

A: You need to provide your personal information, the information of the authorized individual or organization, and specify the tax years or periods for which the authorization is granted.

Q: Is there a fee to file IRS Form 8821?

A: No, there is no fee to file IRS Form 8821.

Form Details:

- A 1-page form available for download in PDF;

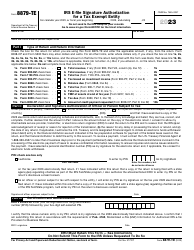

- Actual and valid for filing 2023 taxes;

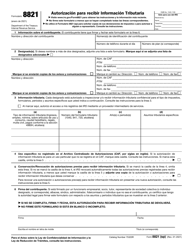

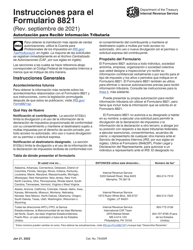

- A Spanish version of IRS Form 8821 is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8821 through the link below or browse more documents in our library of IRS Forms.