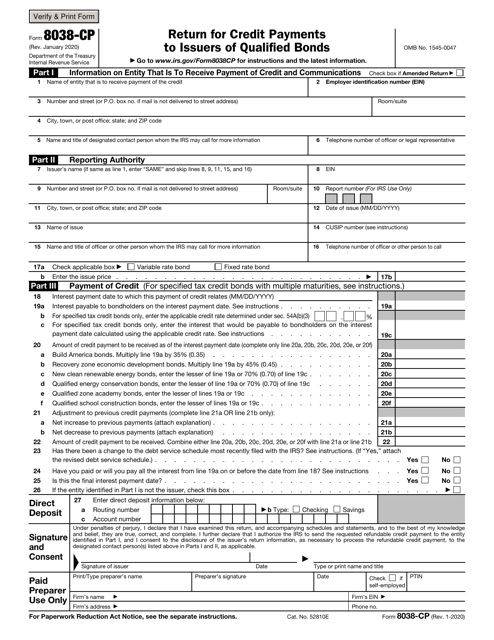

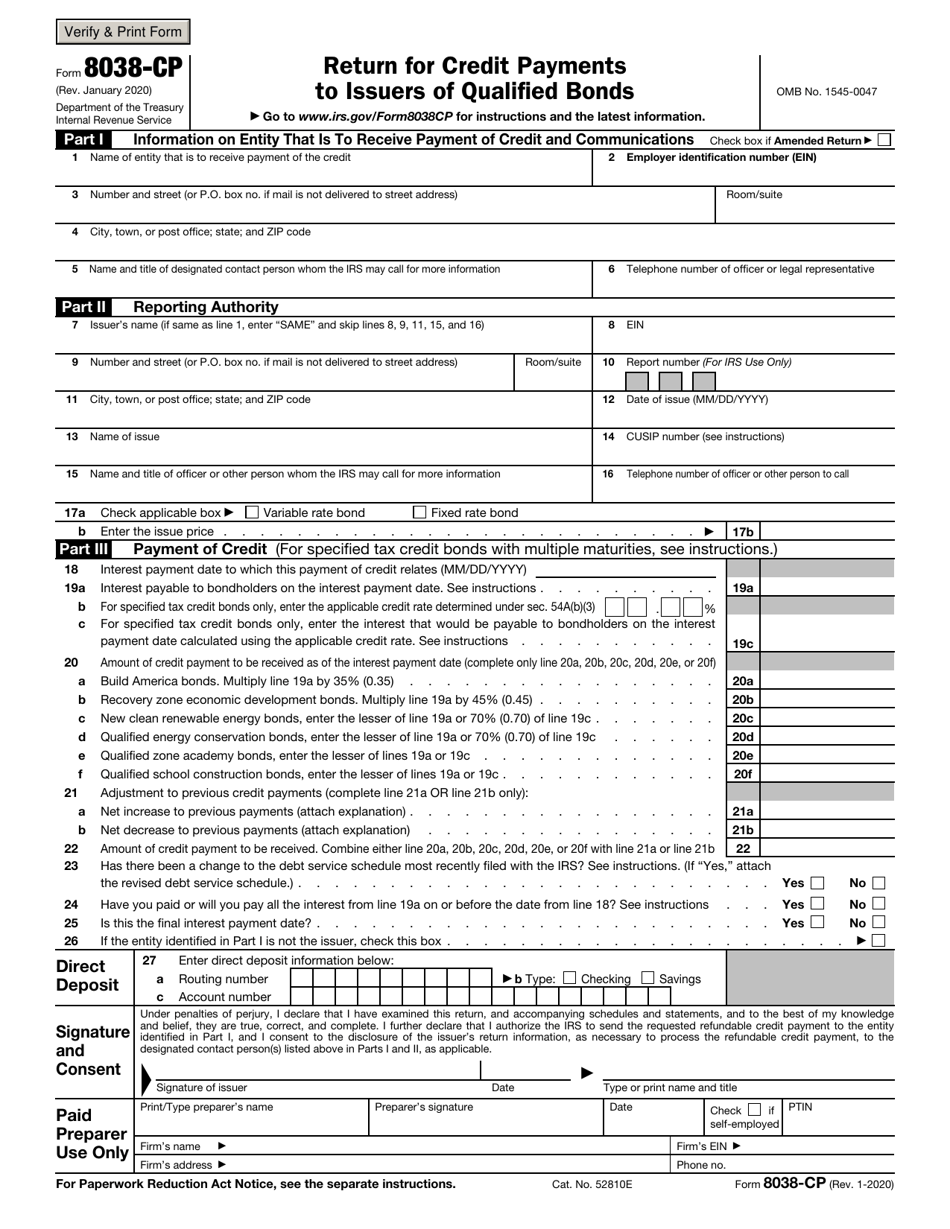

This version of the form is not currently in use and is provided for reference only. Download this version of

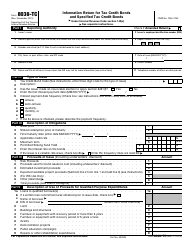

IRS Form 8038-CP

for the current year.

IRS Form 8038-CP Return for Credit Payments to Issuers of Qualified Bonds

What Is IRS Form 8038-CP?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2020. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8038-CP?

A: IRS Form 8038-CP is a form used to report credit payments made to issuers of qualified bonds.

Q: Who needs to file IRS Form 8038-CP?

A: The issuers of qualified bonds who made credit payments need to file IRS Form 8038-CP.

Q: What are credit payments?

A: Credit payments are payments made by the issuers of qualified bonds as reimbursement for any credit claimed by bondholders.

Q: What are qualified bonds?

A: Qualified bonds are tax-exempt bonds issued by state and local governments to fund certain projects.

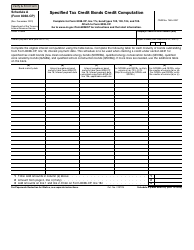

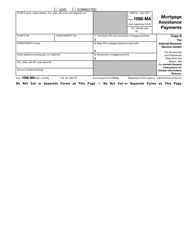

Q: What information is required on IRS Form 8038-CP?

A: IRS Form 8038-CP requires information about the issuer, bond series, credit payments made, and bondholder information.

Q: When is IRS Form 8038-CP due?

A: IRS Form 8038-CP is due on or before the 15th day of the 2nd calendar month following the calendar quarter in which the credit payment was made.

Q: Do I need to attach any supporting documents with IRS Form 8038-CP?

A: Yes, you may need to attach supporting documents such as a copy of the bond indenture or loan agreement.

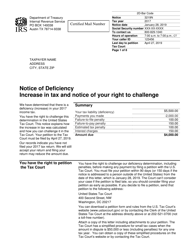

Q: Are there any penalties for not filing IRS Form 8038-CP?

A: Yes, there are penalties for not filing or late filing of IRS Form 8038-CP. It is important to comply with the filing deadline to avoid penalties.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8038-CP through the link below or browse more documents in our library of IRS Forms.