This version of the form is not currently in use and is provided for reference only. Download this version of

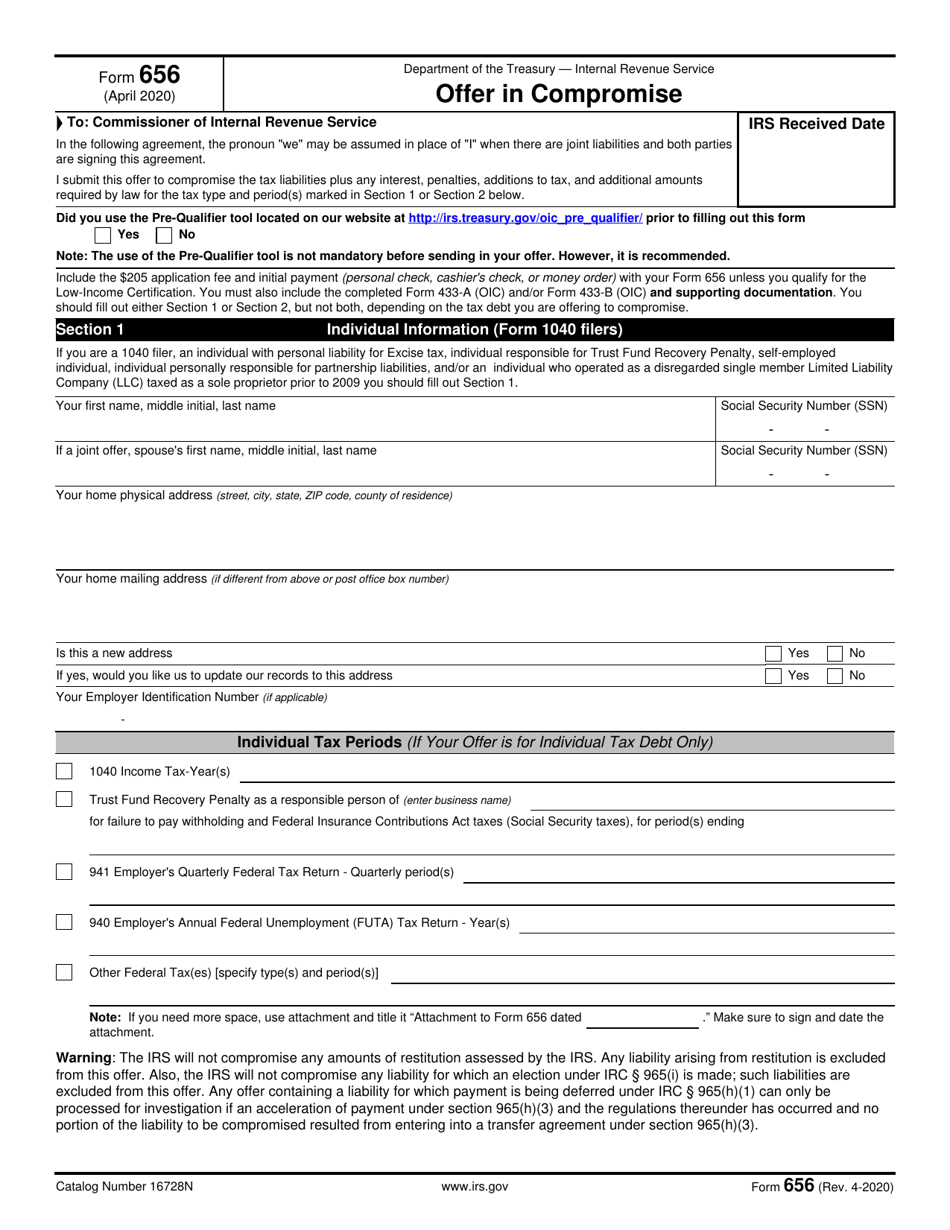

IRS Form 656

for the current year.

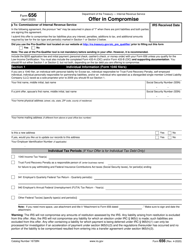

IRS Form 656 Offer in Compromise

What Is IRS Form 656?

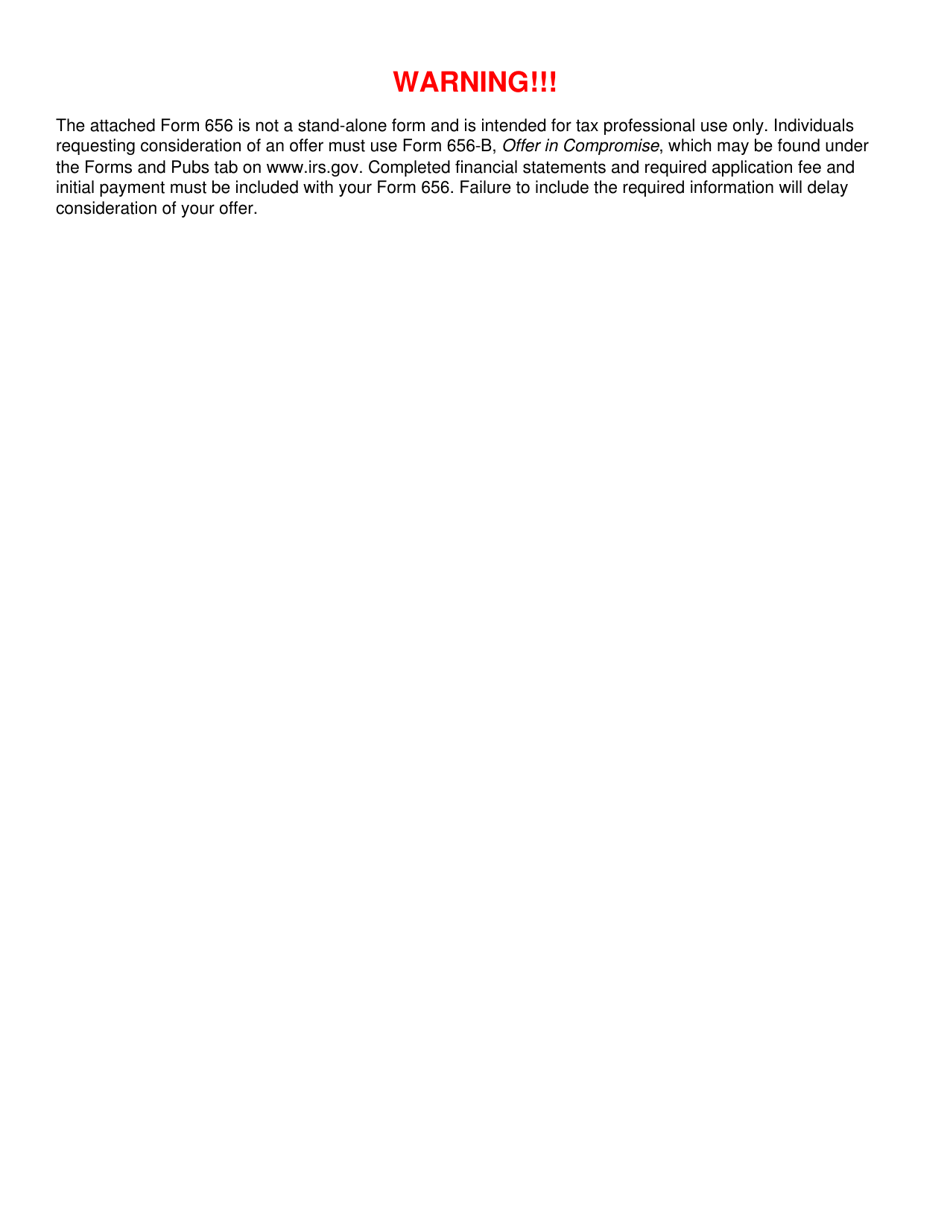

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on April 1, 2020. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 656?

A: IRS Form 656 is used for submitting an Offer in Compromise to the Internal Revenue Service.

Q: What is an Offer in Compromise?

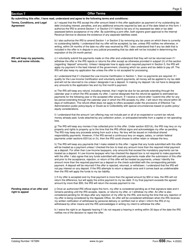

A: An Offer in Compromise is an agreement between a taxpayer and the IRS to settle a tax debt for less than the full amount owed.

Q: Who is eligible to file an Offer in Compromise?

A: Taxpayers who are unable to pay their tax debt in full and can demonstrate financial hardship may be eligible to file an Offer in Compromise.

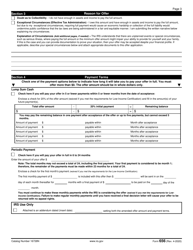

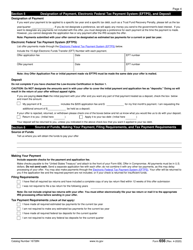

Q: How does IRS Form 656 work?

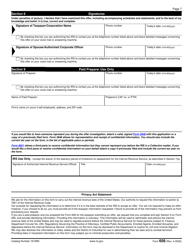

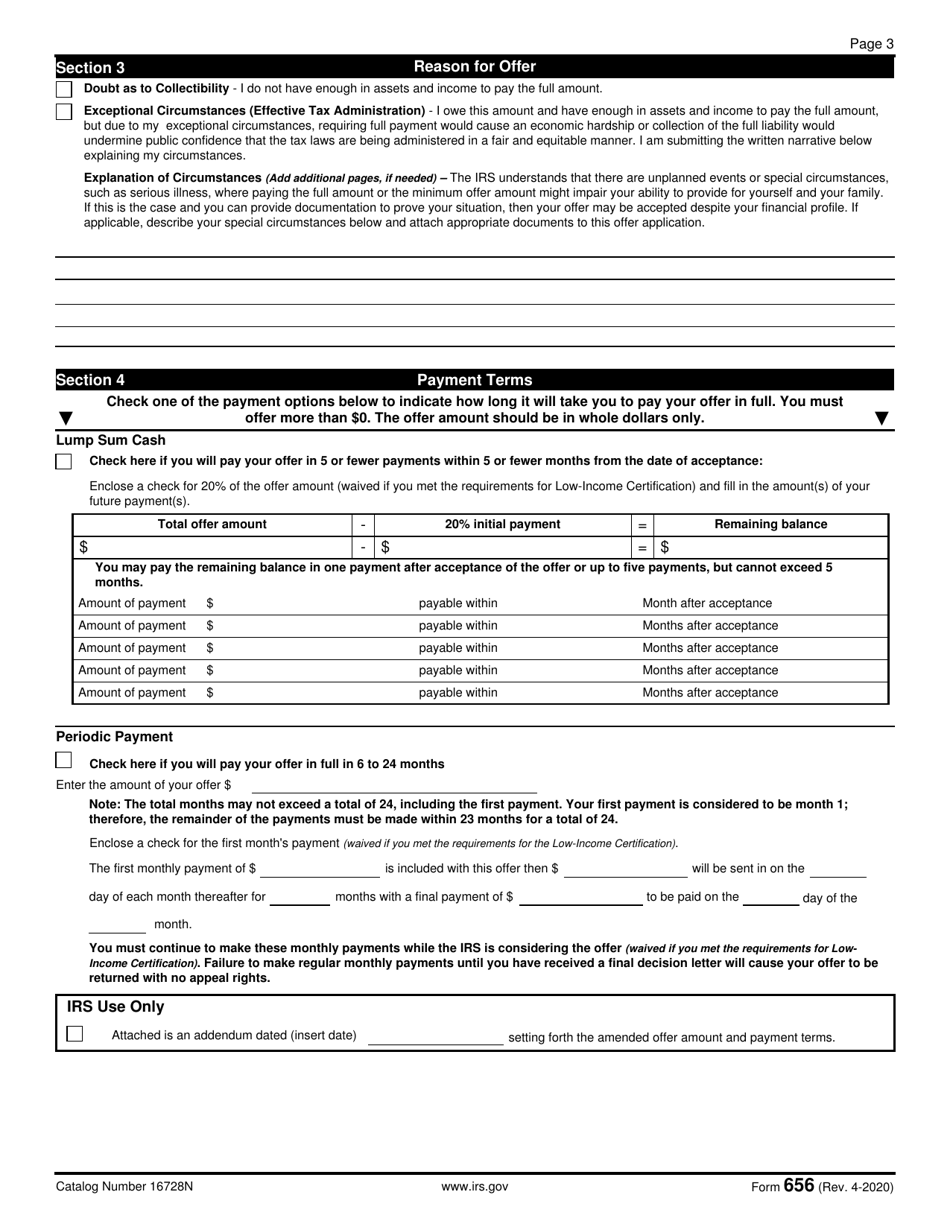

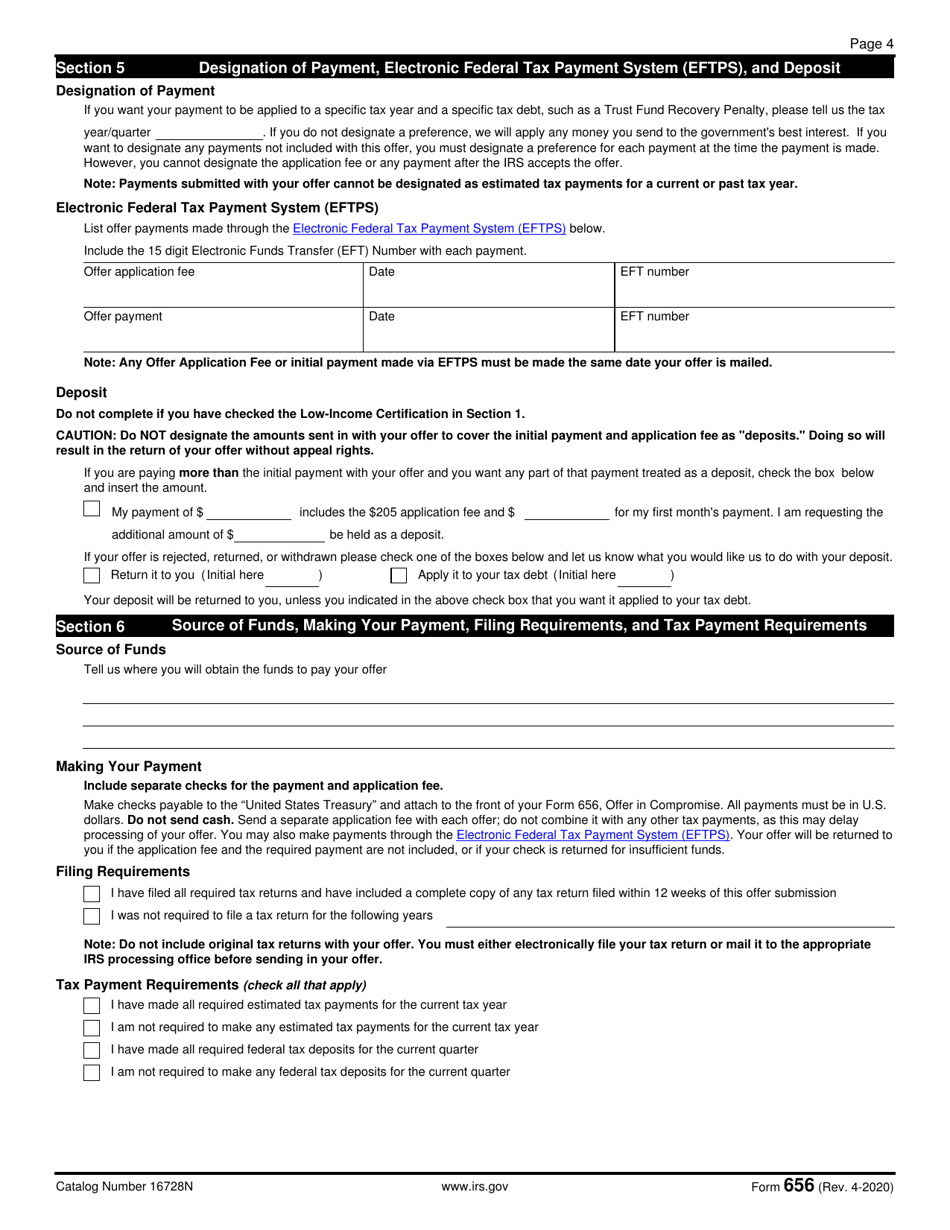

A: When submitting IRS Form 656, taxpayers provide detailed financial information to support their offer amount. The IRS will review the offer and consider accepting a reduced amount to settle the tax debt.

Q: Are there any fees associated with filing IRS Form 656?

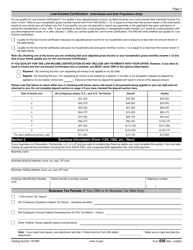

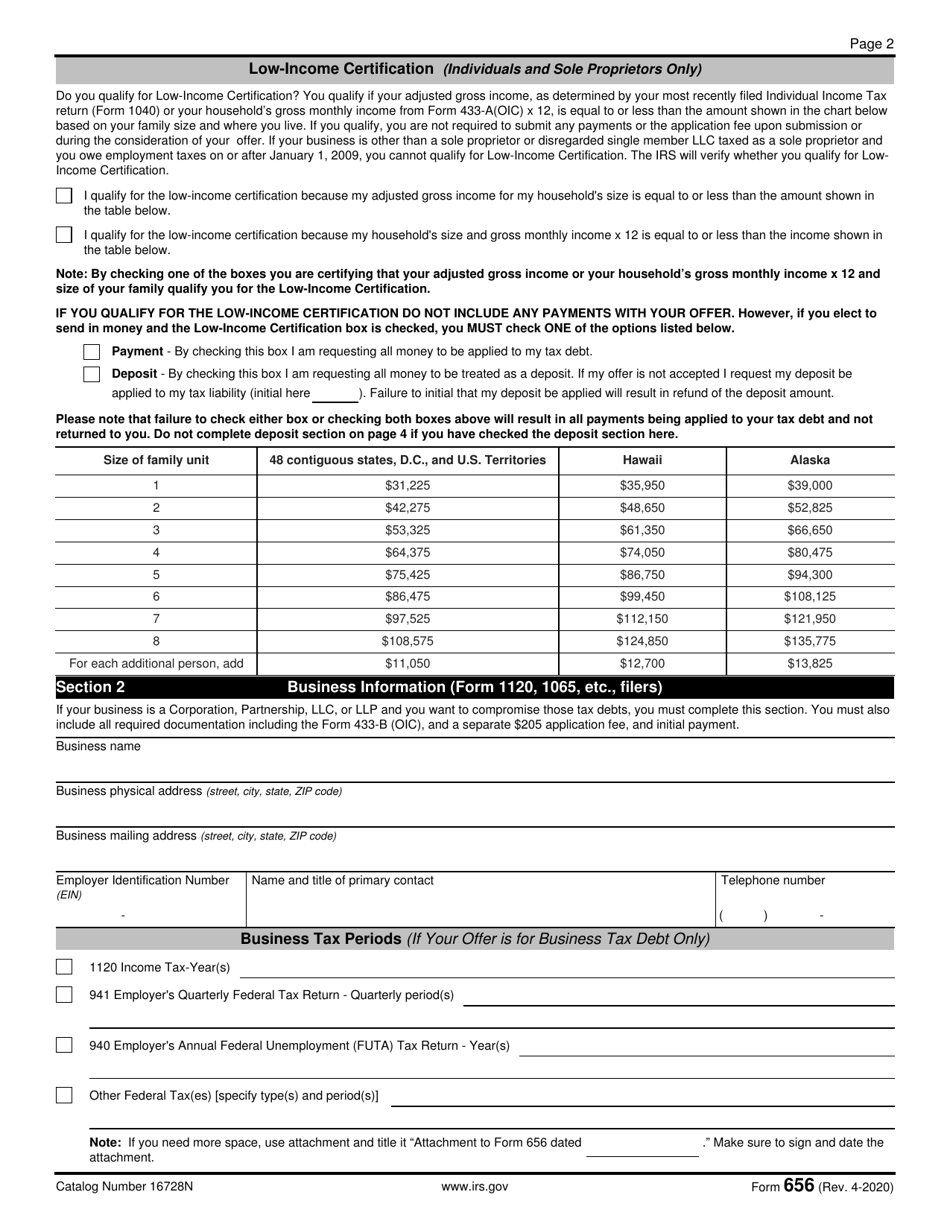

A: Yes, there is a non-refundable application fee of $205 for filing IRS Form 656. In some cases, this fee may be waived for low-income taxpayers.

Q: What happens after filing IRS Form 656?

A: After filing IRS Form 656, the IRS will review the offer and may request additional documentation or negotiate the offer amount. It can take several months to receive a decision on the offer.

Form Details:

- A 8-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- A Spanish version of IRS Form 656 is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 656 through the link below or browse more documents in our library of IRS Forms.