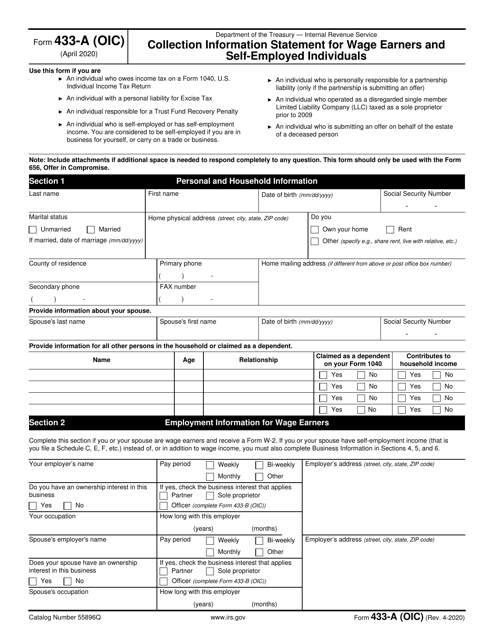

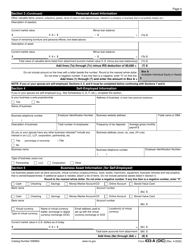

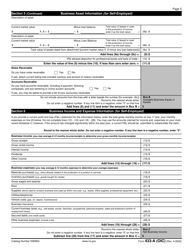

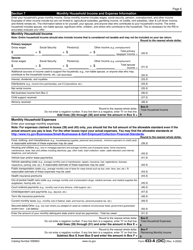

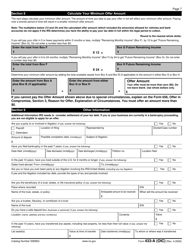

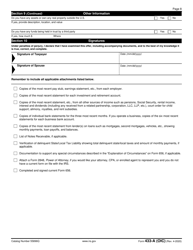

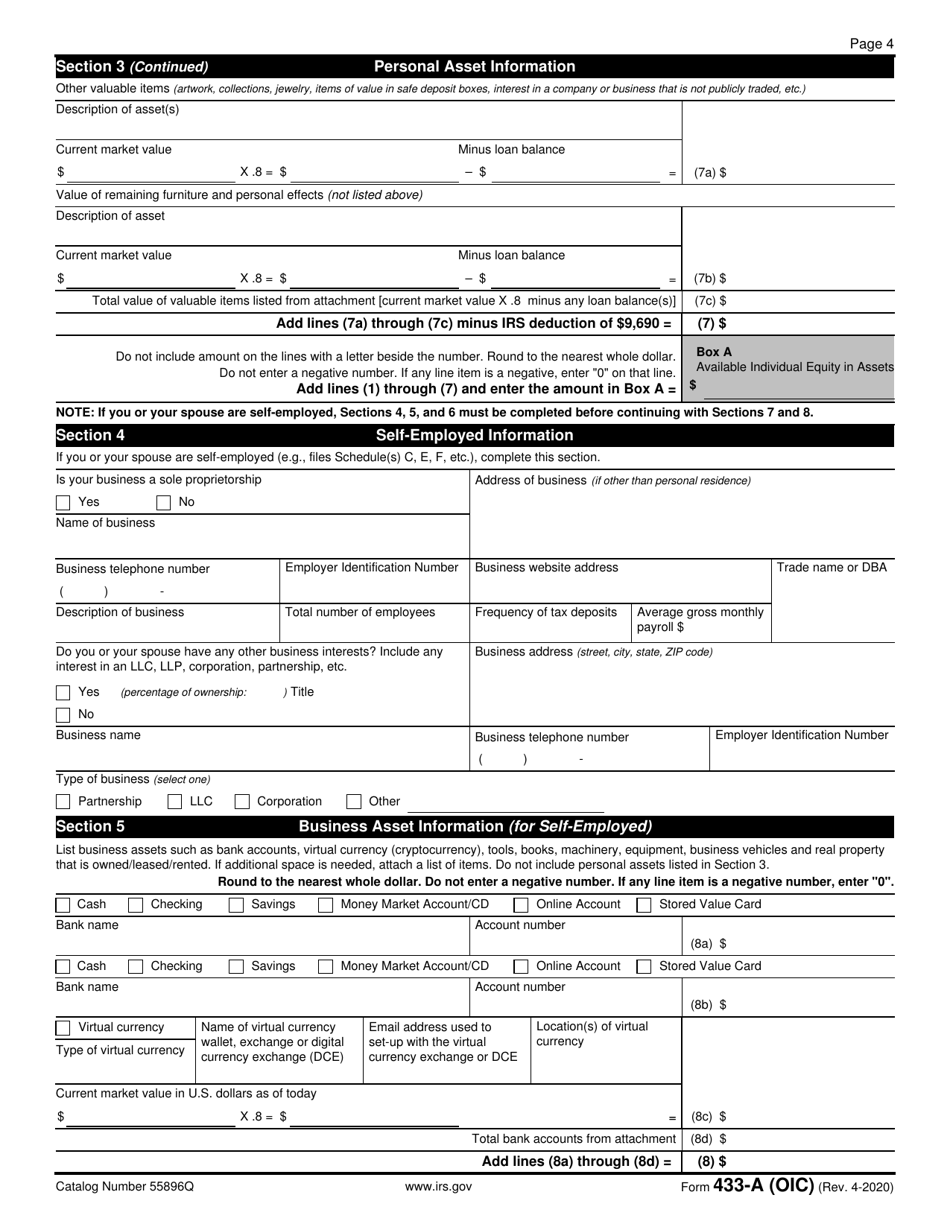

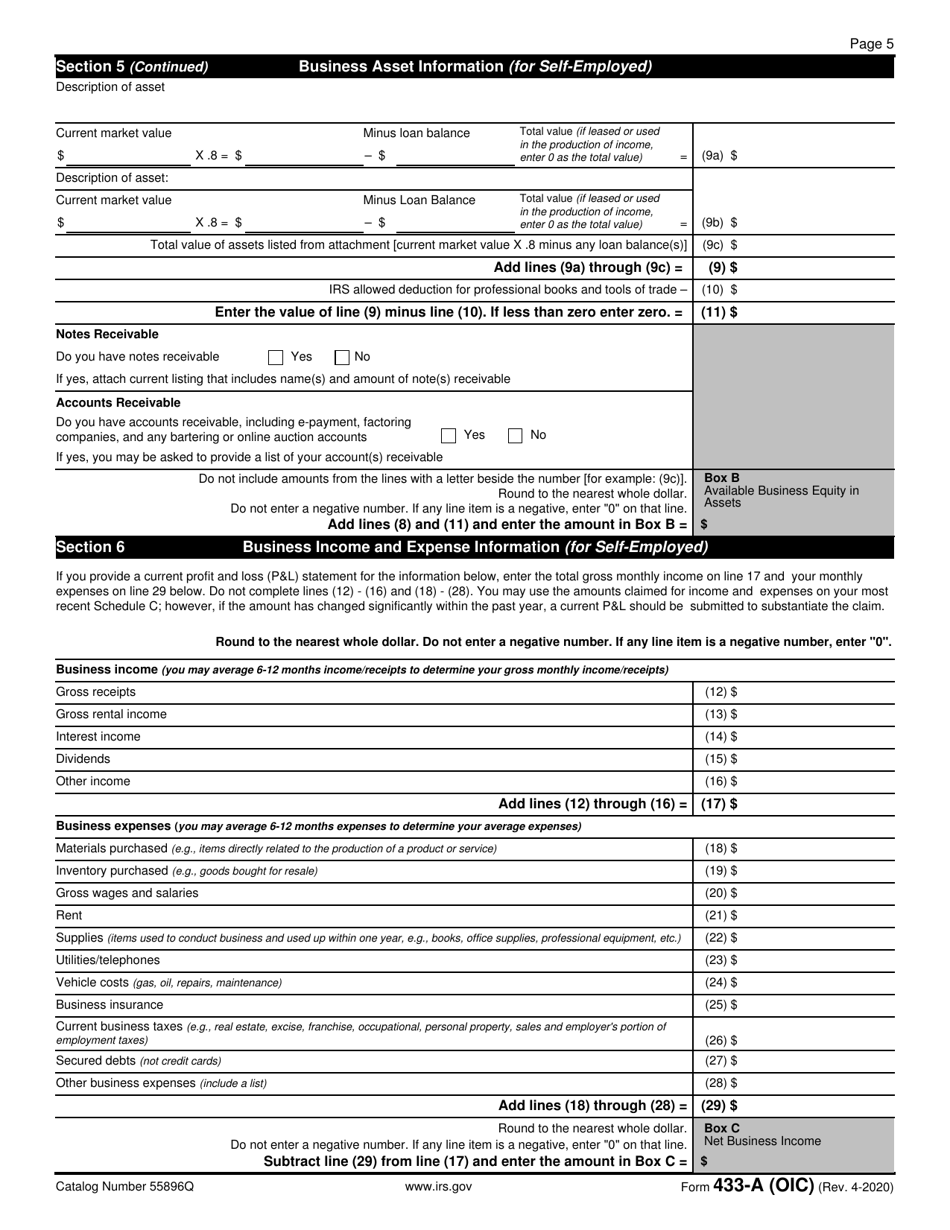

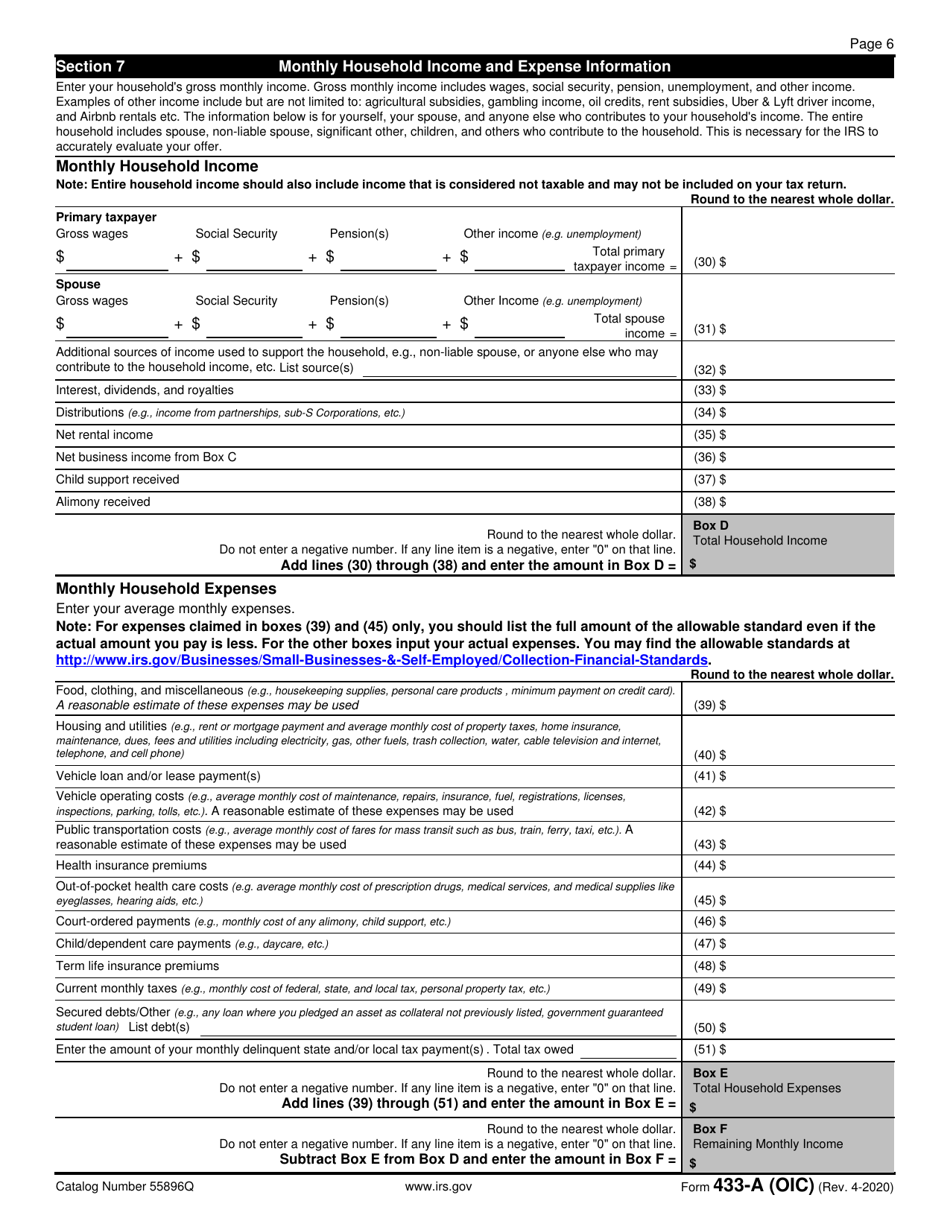

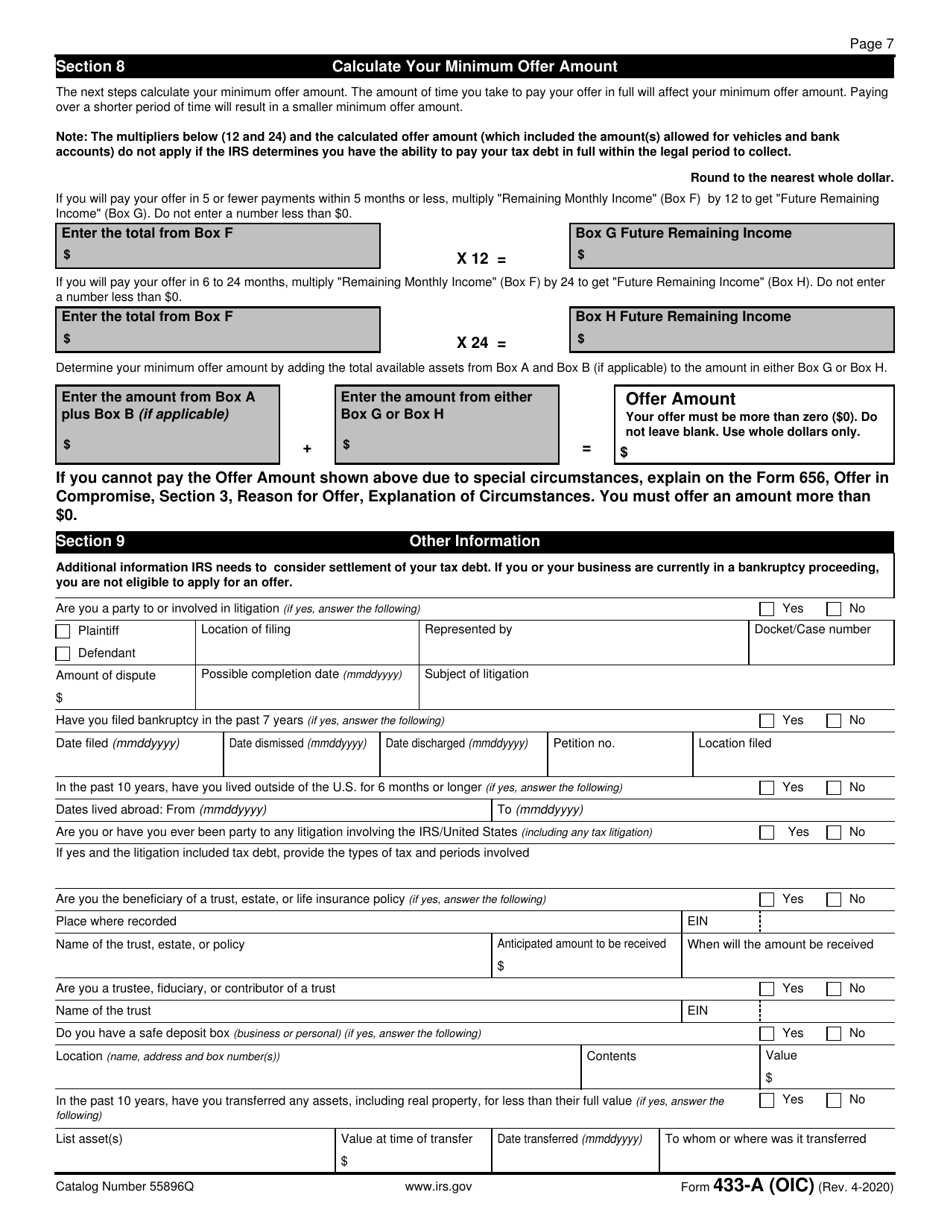

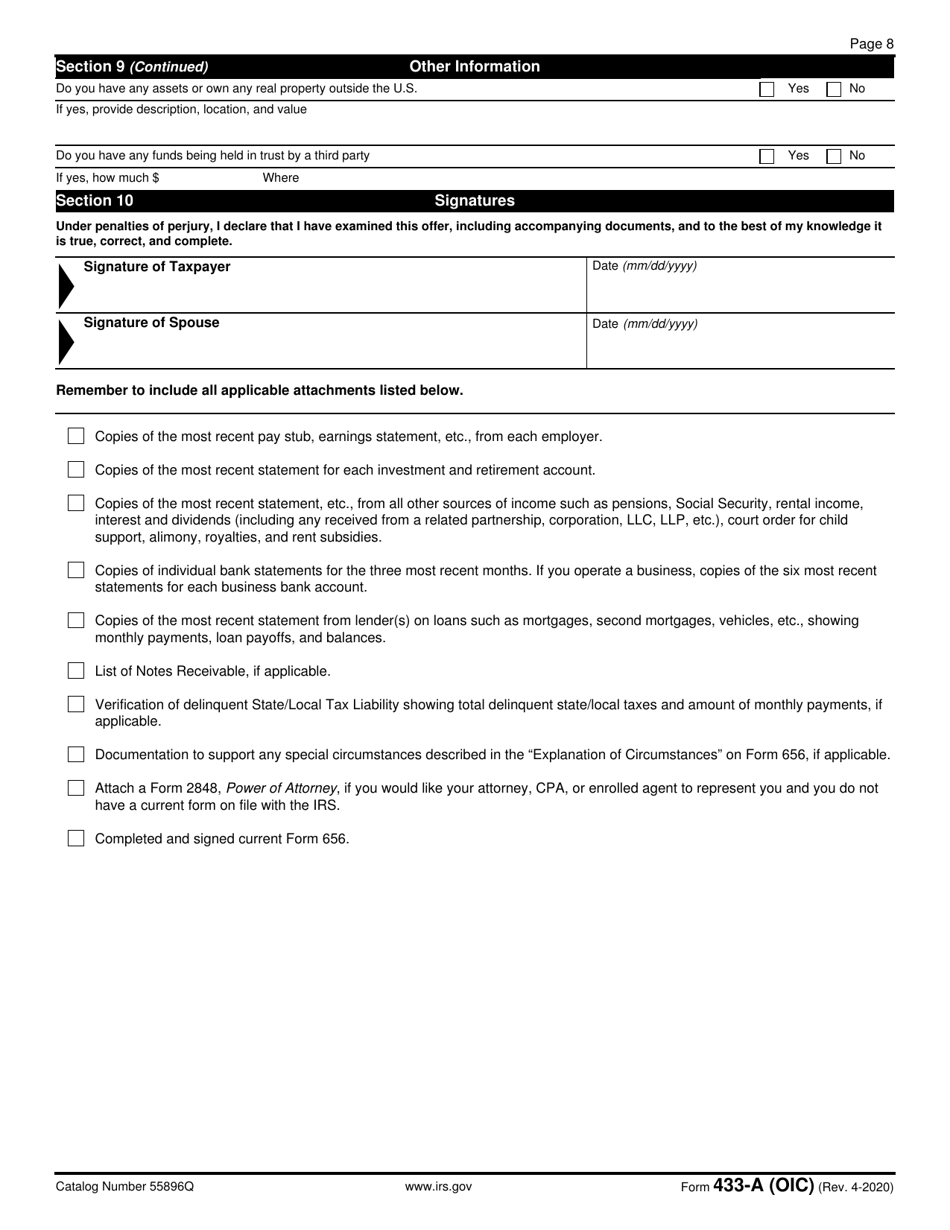

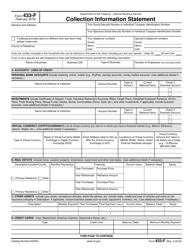

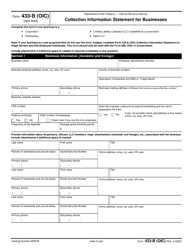

Form 433-A (OIC) Collection Information Statement for Wage Earners and Self-employed Individuals

What Is Form 433-A (OIC)?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on April 1, 2020. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is Form 433-A?

A: Form 433-A is a Collection Information Statement for Wage Earners and Self-employed Individuals.

Q: Who needs to fill out Form 433-A?

A: Wage earners and self-employed individuals who are dealing with collections from the Internal Revenue Service (IRS) need to fill out Form 433-A.

Q: What is the purpose of Form 433-A?

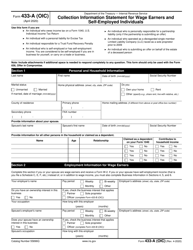

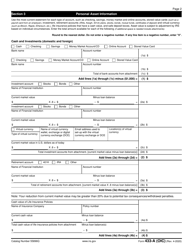

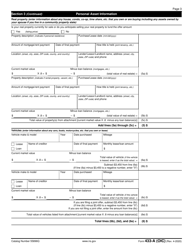

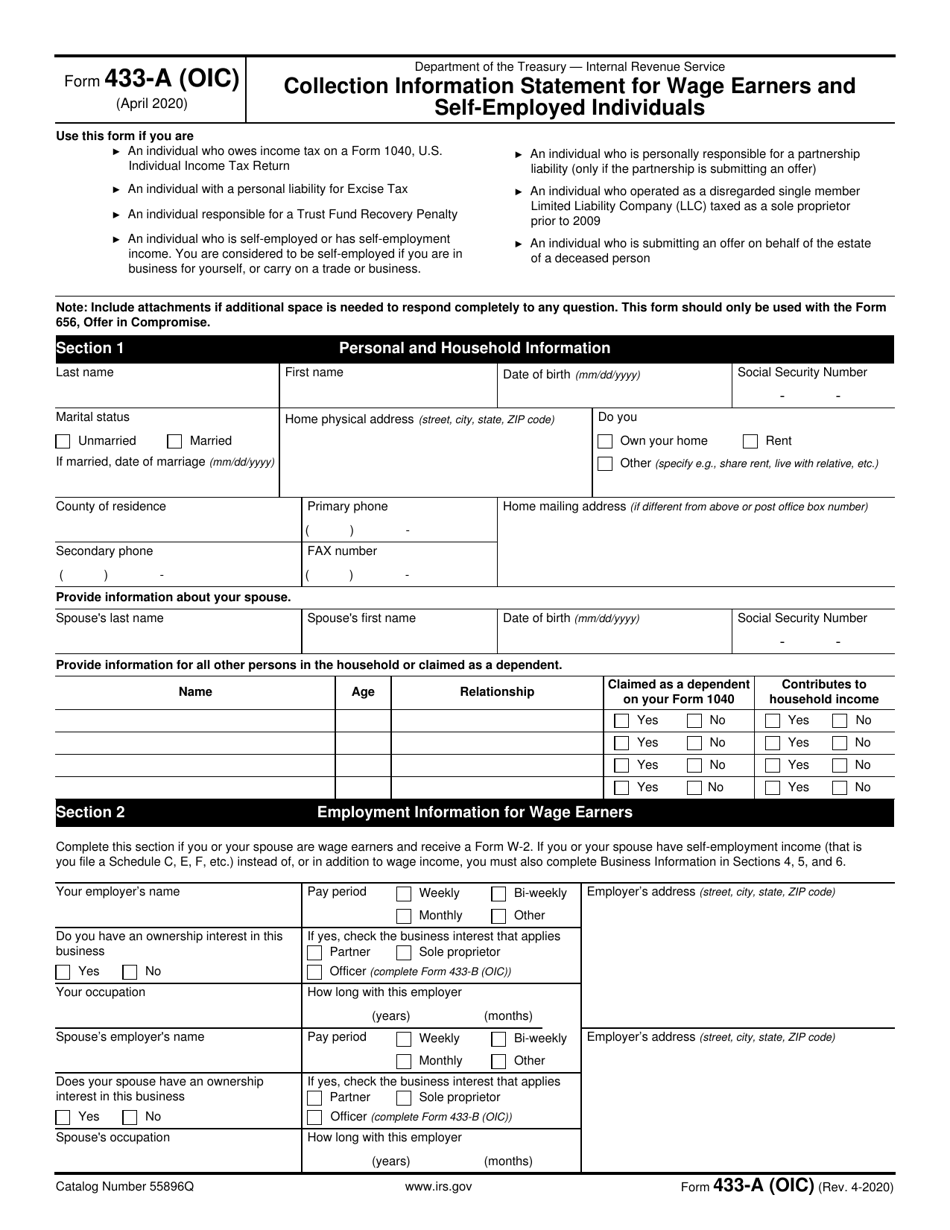

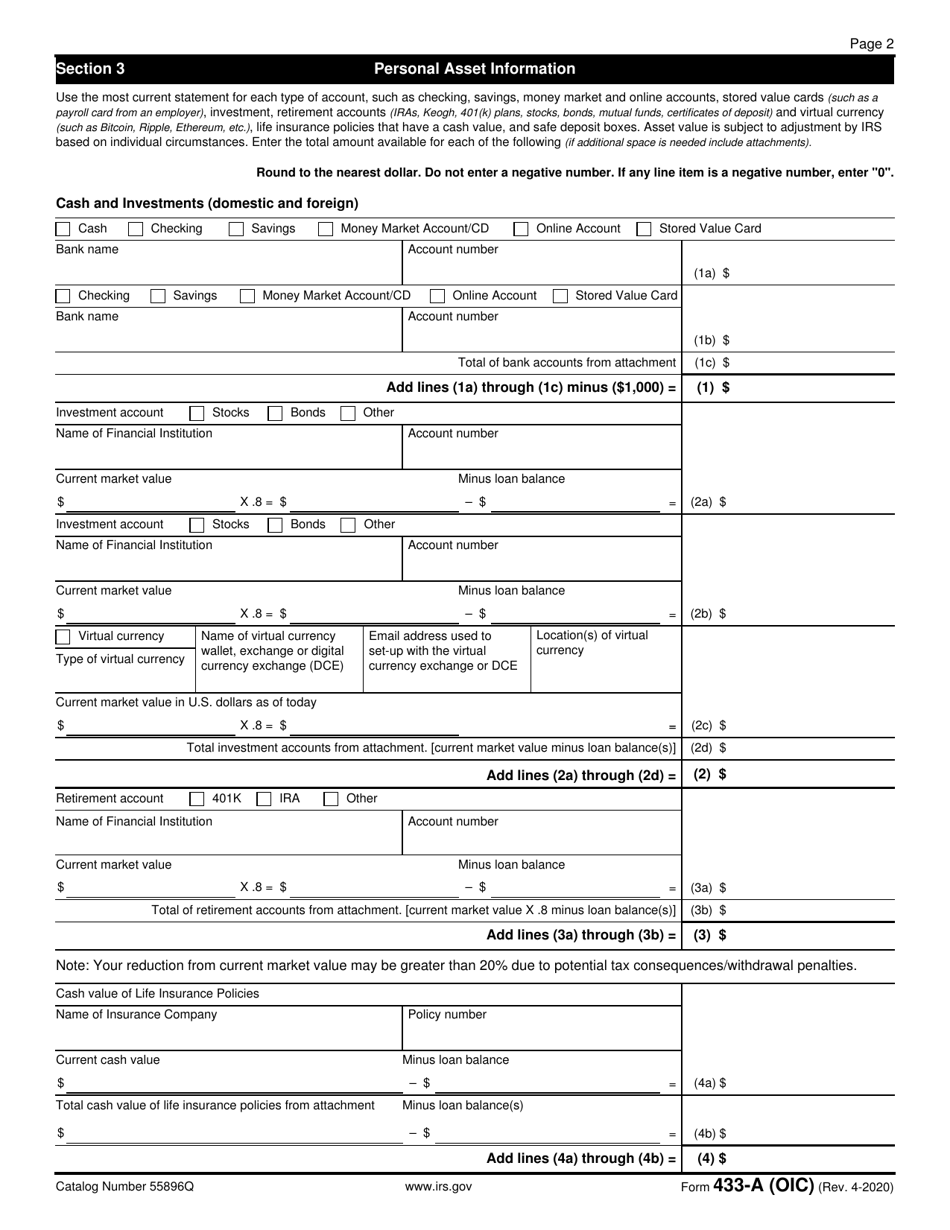

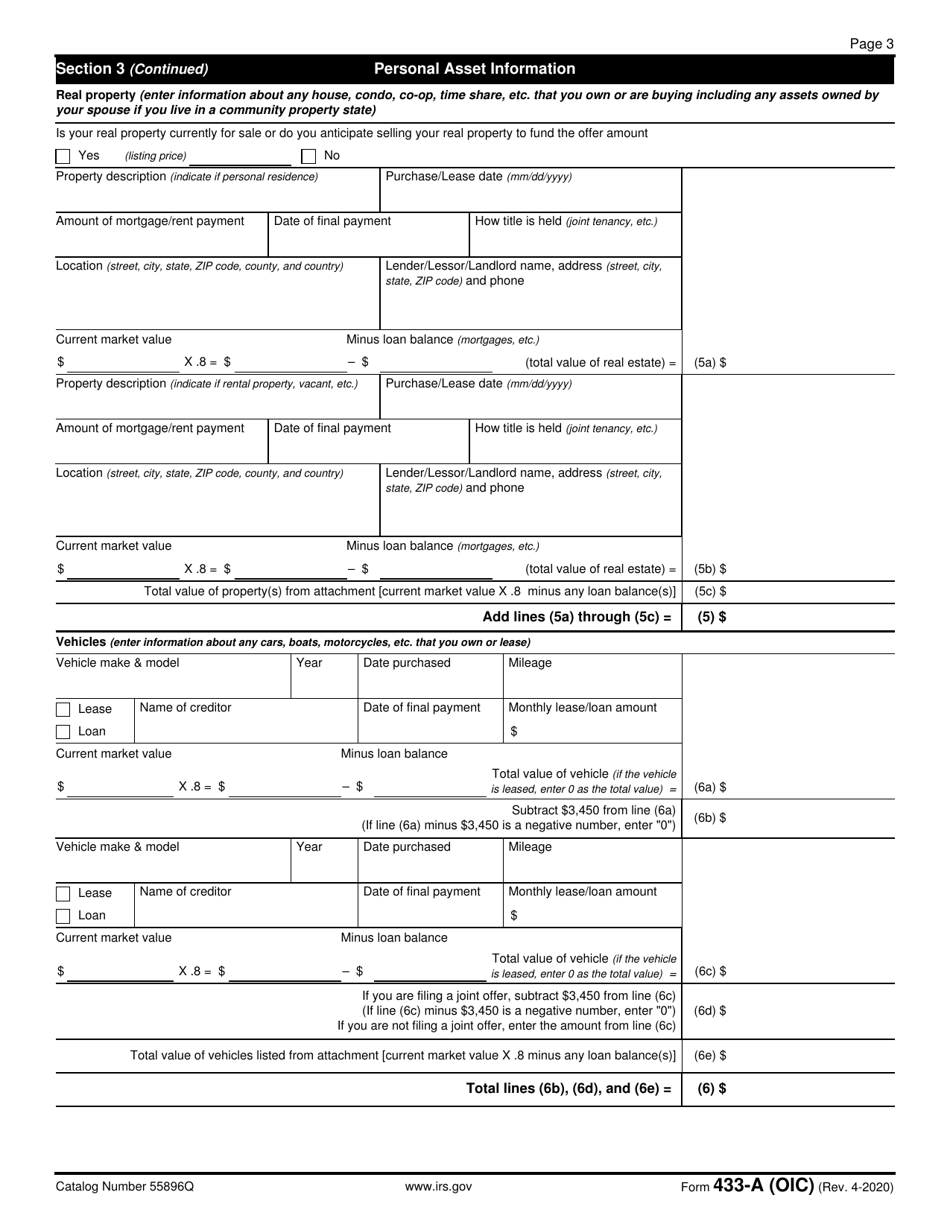

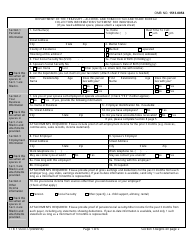

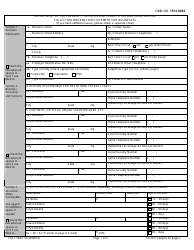

A: The purpose of Form 433-A is to provide the IRS with detailed financial information about the taxpayer's income, expenses, assets, and liabilities.

Q: Is Form 433-A only for the self-employed?

A: No, Form 433-A is also for wage earners who have income from employment.

Q: What information is required on Form 433-A?

A: Form 433-A requires information about the taxpayer's personal identification, income, expenses, assets, and liabilities.

Q: When should Form 433-A be submitted?

A: Form 433-A should be submitted when requested by the IRS as part of the collections process.

Q: Are there any penalties for not filling out Form 433-A?

A: Failure to provide the requested information on Form 433-A can result in enforcement actions by the IRS.

Q: Can I use Form 433-A to negotiate an offer in compromise?

A: Yes, Form 433-A can be used as part of the offer in compromise process to potentially settle tax debt for less than the full amount owed.

Q: Should I consult a tax professional to fill out Form 433-A?

A: It is recommended to consult a tax professional for assistance in filling out Form 433-A to ensure accuracy and compliance with IRS requirements.

Form Details:

- A 8-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- A Spanish version of Form 433-A (OIC) is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of Form 433-A (OIC) through the link below or browse more documents in our library of IRS Forms.