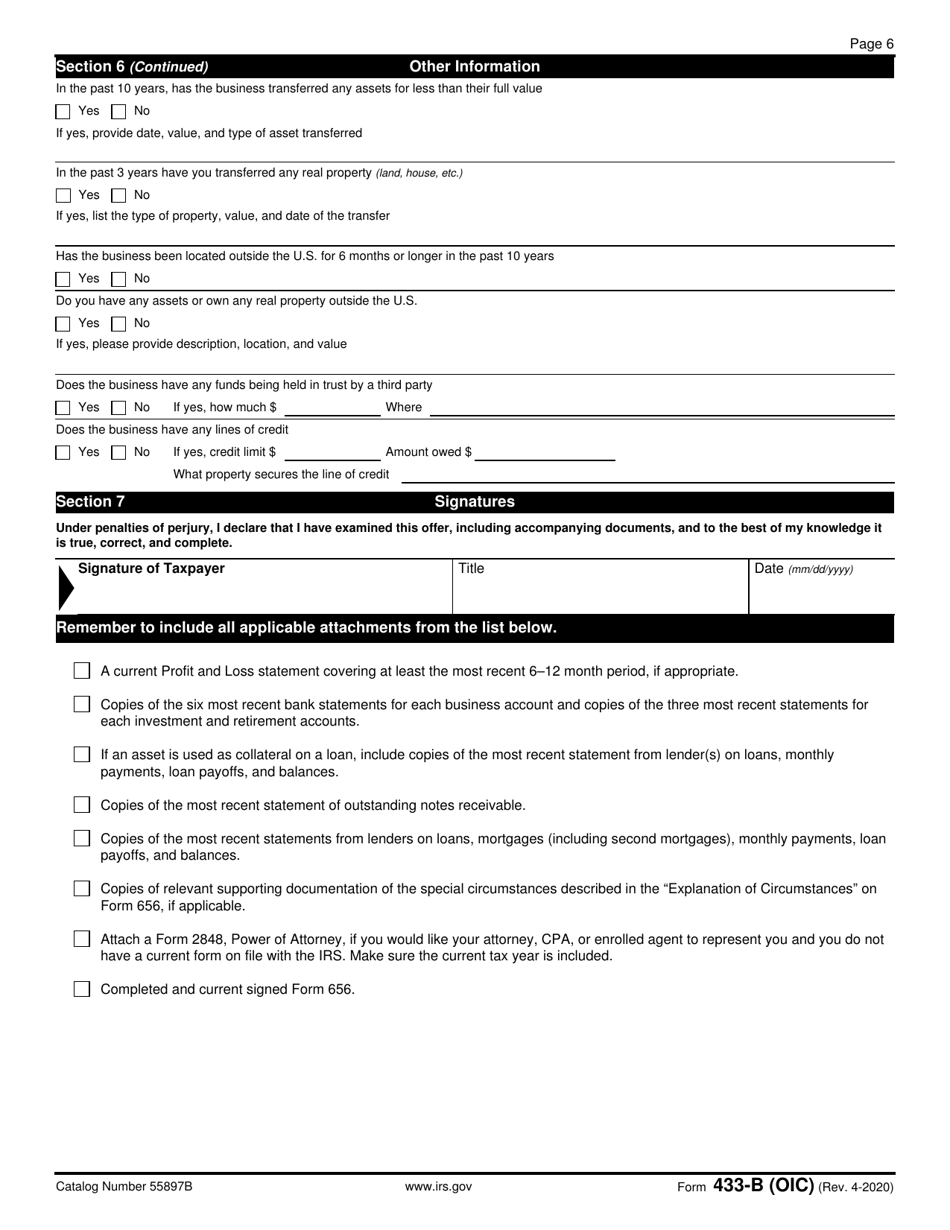

This version of the form is not currently in use and is provided for reference only. Download this version of

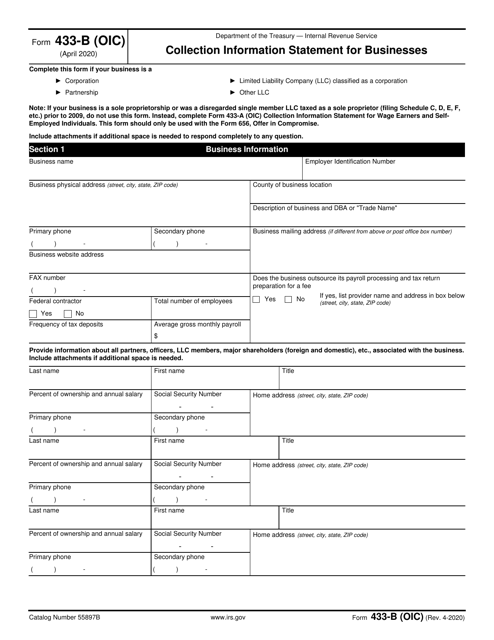

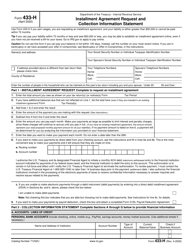

IRS Form 433-B (OIC)

for the current year.

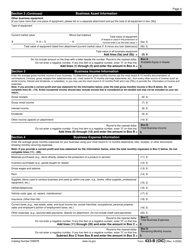

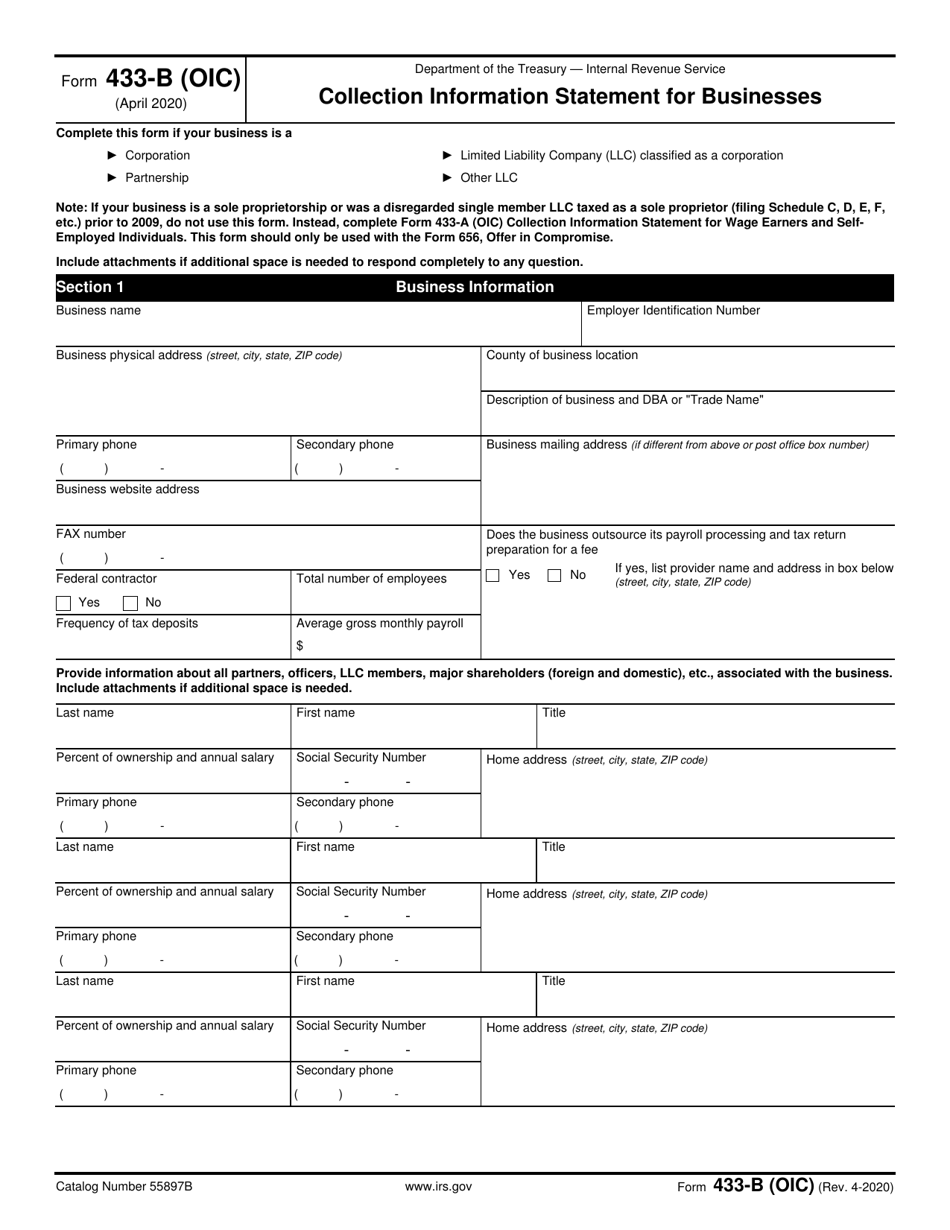

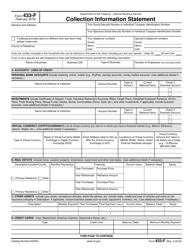

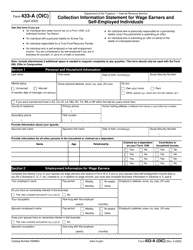

IRS Form 433-B (OIC) Collection Information Statement for Businesses

What Is IRS Form 433-B (OIC)?

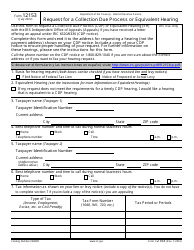

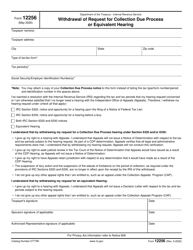

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on April 1, 2020. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 433-B (OIC)?

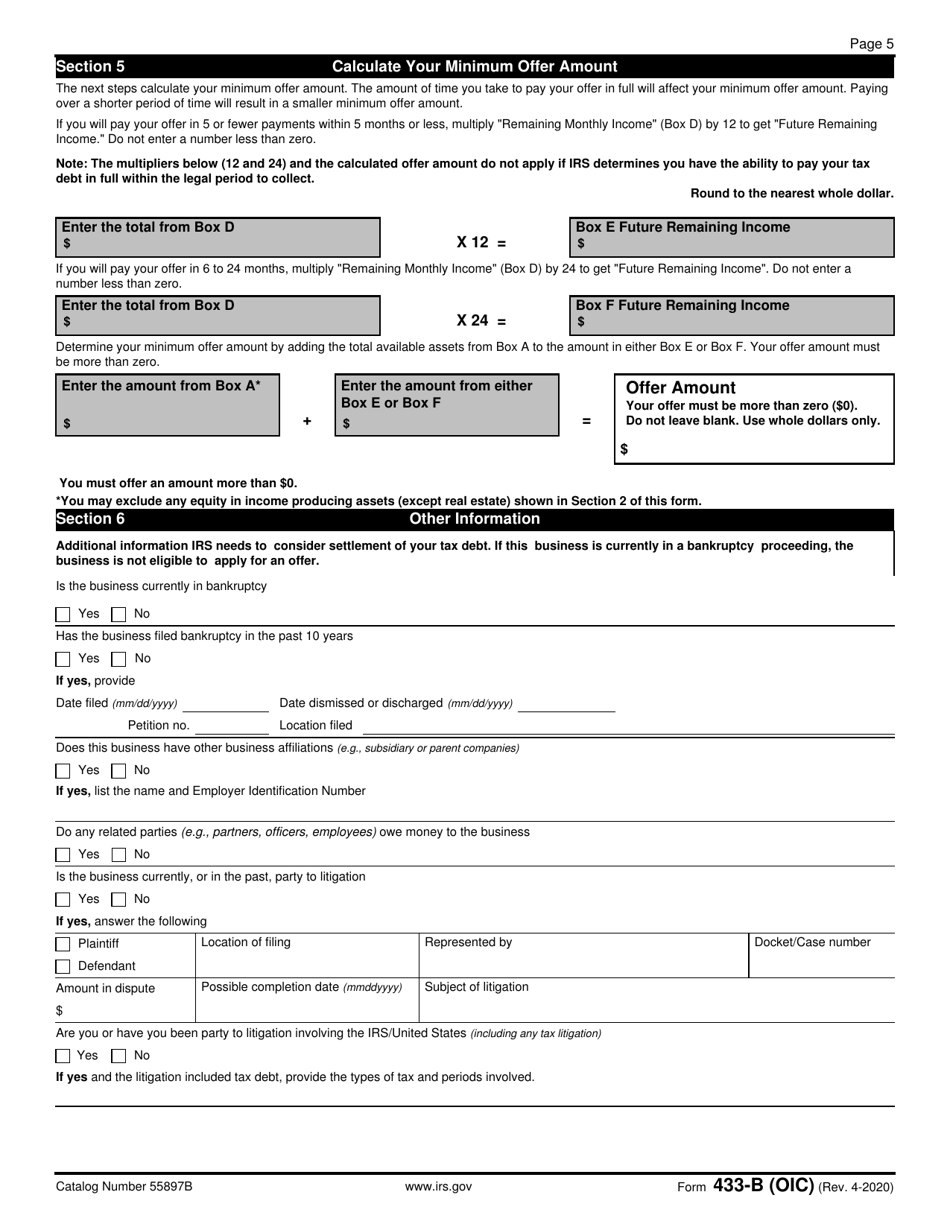

A: IRS Form 433-B (OIC) is a form used by businesses to provide financial information to the Internal Revenue Service (IRS) when seeking to settle tax debts through an Offer in Compromise (OIC) program.

Q: What is the purpose of IRS Form 433-B (OIC)?

A: The purpose of IRS Form 433-B (OIC) is to gather detailed financial information about a business to determine its ability to pay taxes owed and to evaluate eligibility for the OIC program.

Q: Who needs to fill out IRS Form 433-B (OIC)?

A: Businesses that want to settle their tax debts through the OIC program need to fill out IRS Form 433-B (OIC).

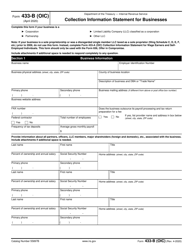

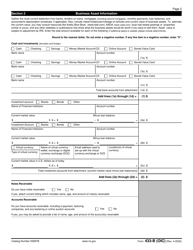

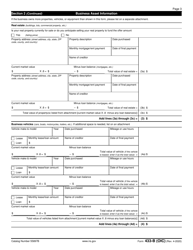

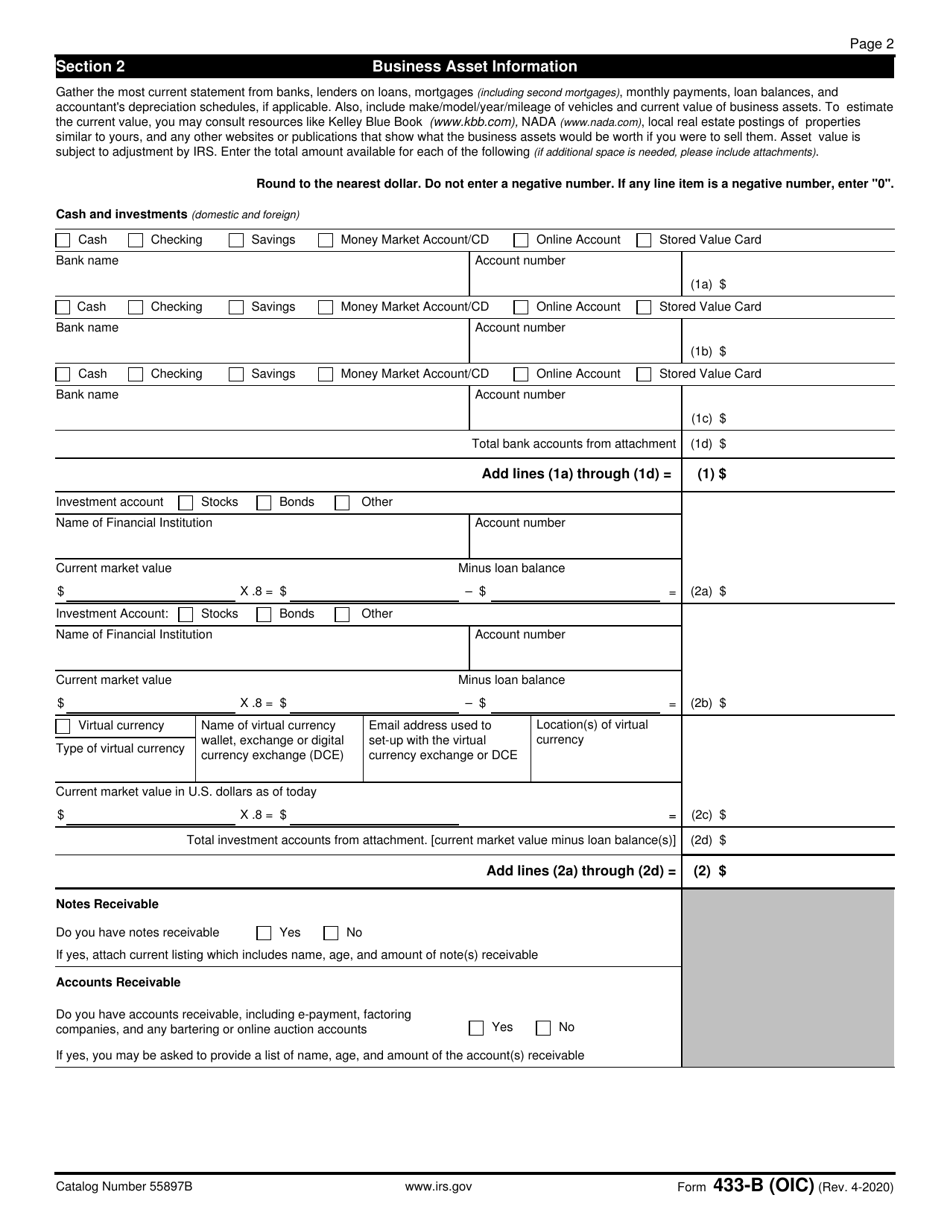

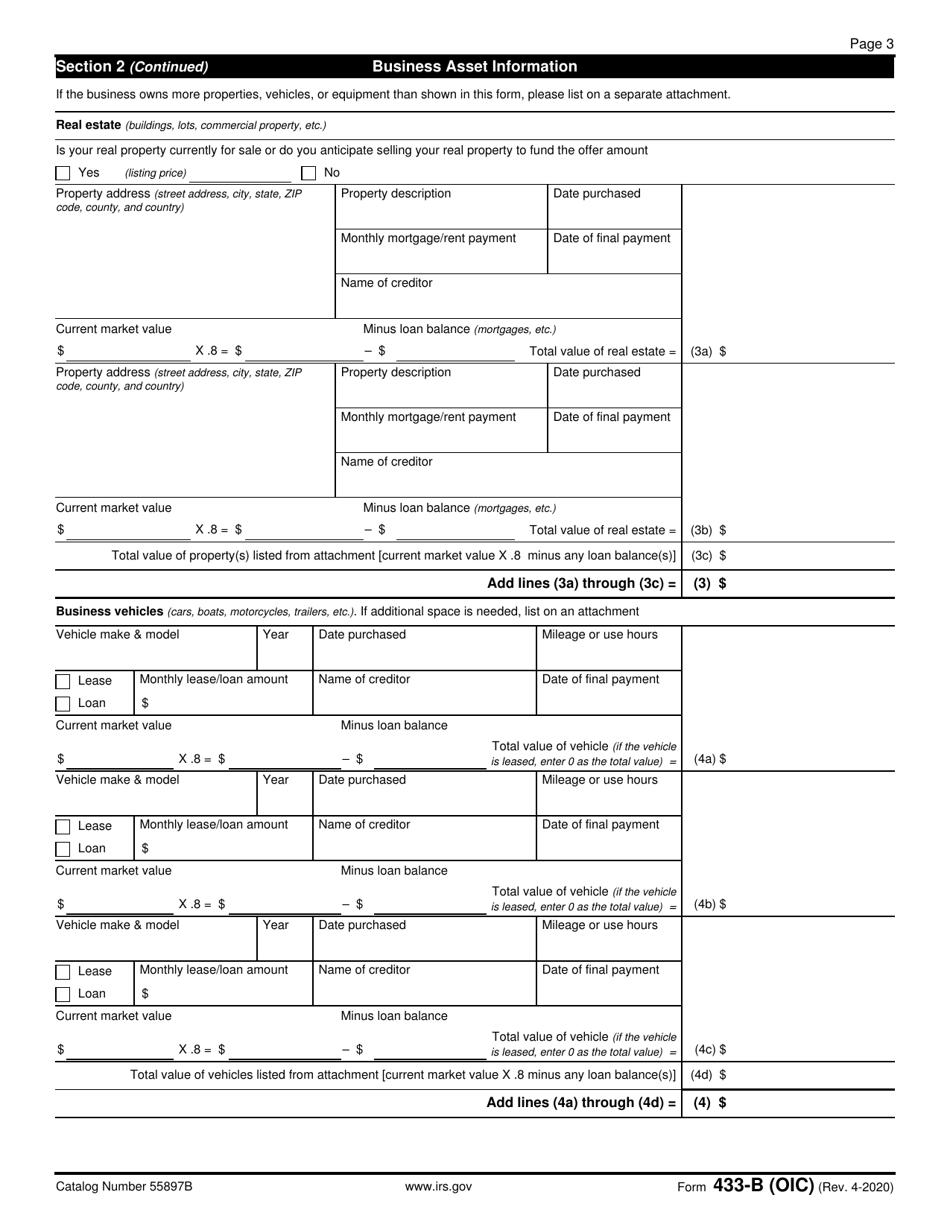

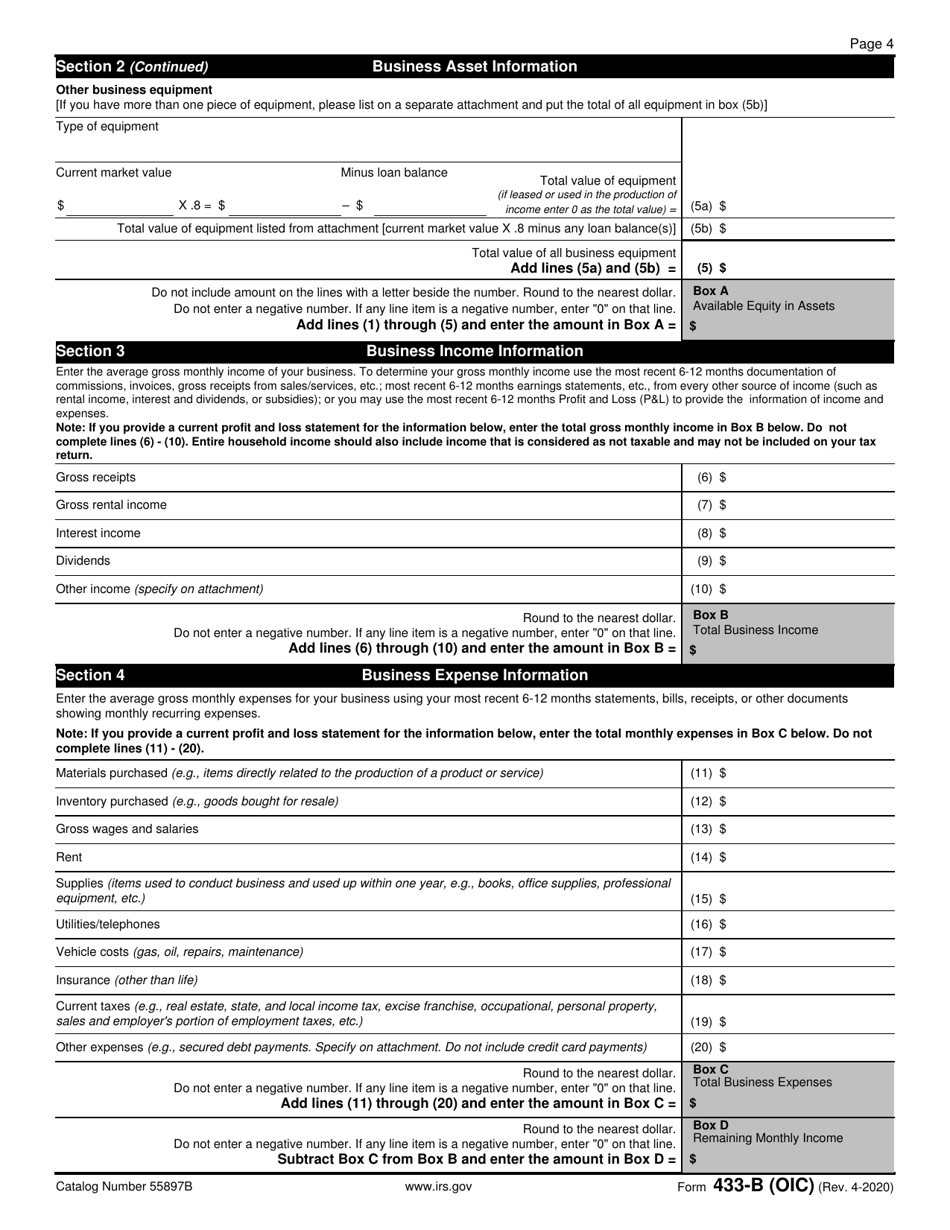

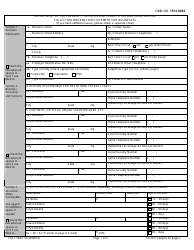

Q: What information is required on IRS Form 433-B (OIC)?

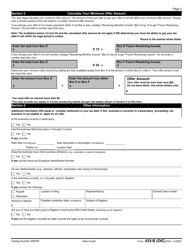

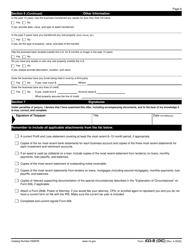

A: IRS Form 433-B (OIC) requires information about the business's assets, income, expenses, and debts, including loans and taxes owed.

Q: Are there any fees associated with IRS Form 433-B (OIC)?

A: There are no fees specifically associated with submitting IRS Form 433-B (OIC), but there may be fees for other services related to the OIC program.

Q: Can IRS Form 433-B (OIC) be submitted electronically?

A: Currently, IRS Form 433-B (OIC) cannot be submitted electronically. It must be physically mailed to the IRS.

Q: Are there any alternatives to IRS Form 433-B (OIC) for businesses seeking tax debt relief?

A: Yes, businesses can explore other options such as installment agreements or requesting an offer in compromise without using Form 433-B (OIC). It's recommended to consult with a tax professional for guidance on the best approach.

Q: What happens after submitting IRS Form 433-B (OIC)?

A: After submitting IRS Form 433-B (OIC), the IRS will review the business's financial information and make a decision on whether to accept or reject the offer. If accepted, the business may be able to settle its tax debts for less than the full amount owed.

Q: Can I make changes to IRS Form 433-B (OIC) after submitting it?

A: Yes, you can make changes to IRS Form 433-B (OIC) after submitting it, but it's important to notify the IRS as soon as possible to avoid any delays or complications in the review process.

Form Details:

- A 6-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

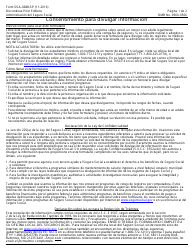

- A Spanish version of IRS Form 433-B (OIC) is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 433-B (OIC) through the link below or browse more documents in our library of IRS Forms.