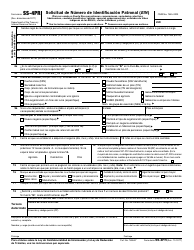

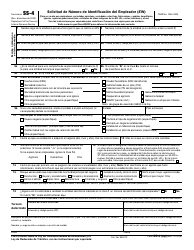

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form SS-4

for the current year.

Instructions for IRS Form SS-4 Application for Employer Identification Number (Ein)

This document contains official instructions for IRS Form SS-4 , Application for Employer Identification Number (Ein) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form SS-4 is available for download through this link.

FAQ

Q: What is IRS Form SS-4?

A: IRS Form SS-4 is an application form used to apply for an Employer Identification Number (EIN).

Q: Why do I need an EIN?

A: You need an EIN if you are starting a business, hiring employees, opening a bank account in the name of your business, or forming a trust or estate.

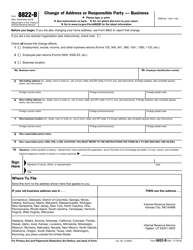

Q: What information do I need to provide on Form SS-4?

A: You need to provide information about your business, such as the legal name, address, and type of entity, as well as the name and contact information of the responsible party.

Q: Are there any fees associated with applying for an EIN?

A: No, there are no fees to apply for an EIN.

Q: Is an EIN the same as a Social Security Number (SSN)?

A: No, an EIN is a nine-digit number used for tax purposes by businesses and other entities, while an SSN is a nine-digit number assigned to individuals for various purposes, including employment and government benefits.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.