This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8995

for the current year.

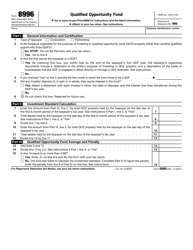

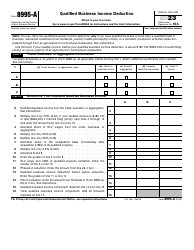

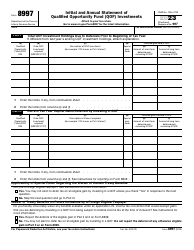

Instructions for IRS Form 8995 Qualified Business Income Deduction Simplified Computation

This document contains official instructions for IRS Form 8995 , Qualified Business Income Deduction Simplified Computation - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8995 is available for download through this link.

FAQ

Q: What is IRS Form 8995?

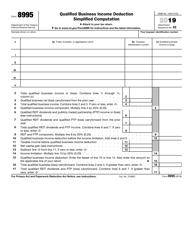

A: IRS Form 8995 is a form used to calculate the Qualified Business Income Deduction.

Q: What is the Qualified Business Income Deduction?

A: The Qualified Business Income Deduction is a deduction that allows eligible taxpayers to deduct up to 20% of their qualified business income.

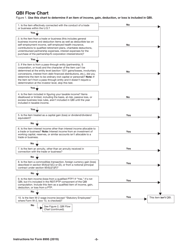

Q: Who is eligible for the Qualified Business Income Deduction?

A: Most individuals, trusts, and estates with qualified business income are eligible for the deduction.

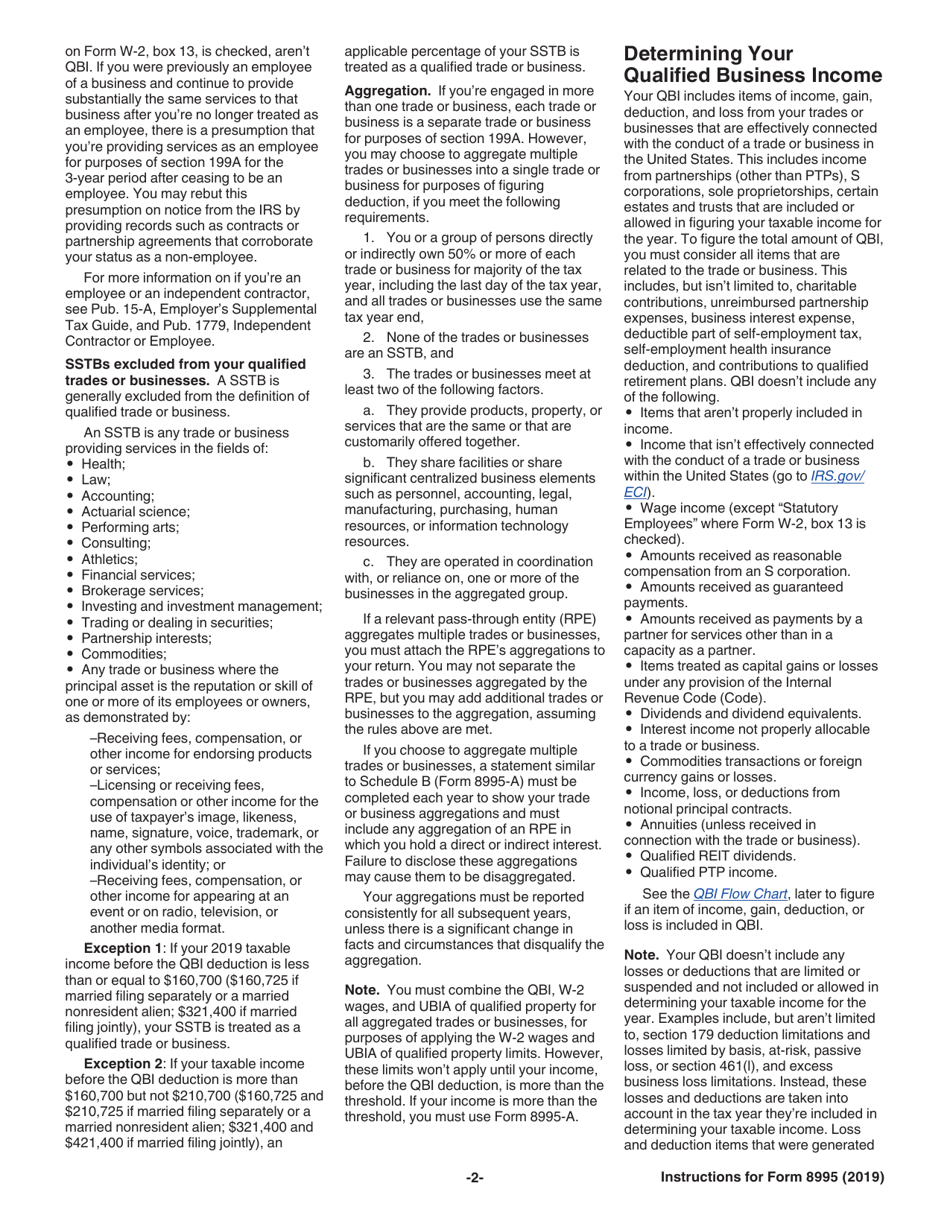

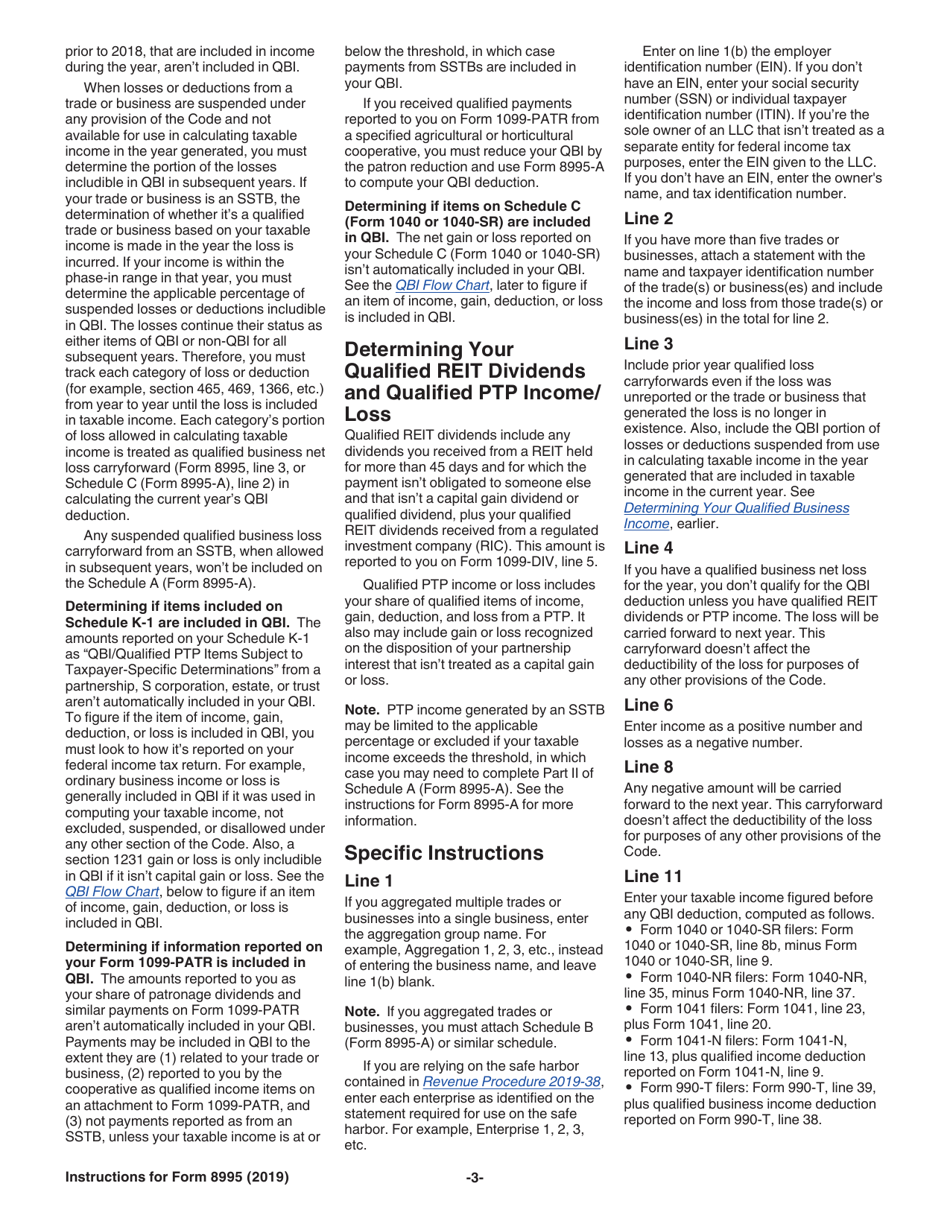

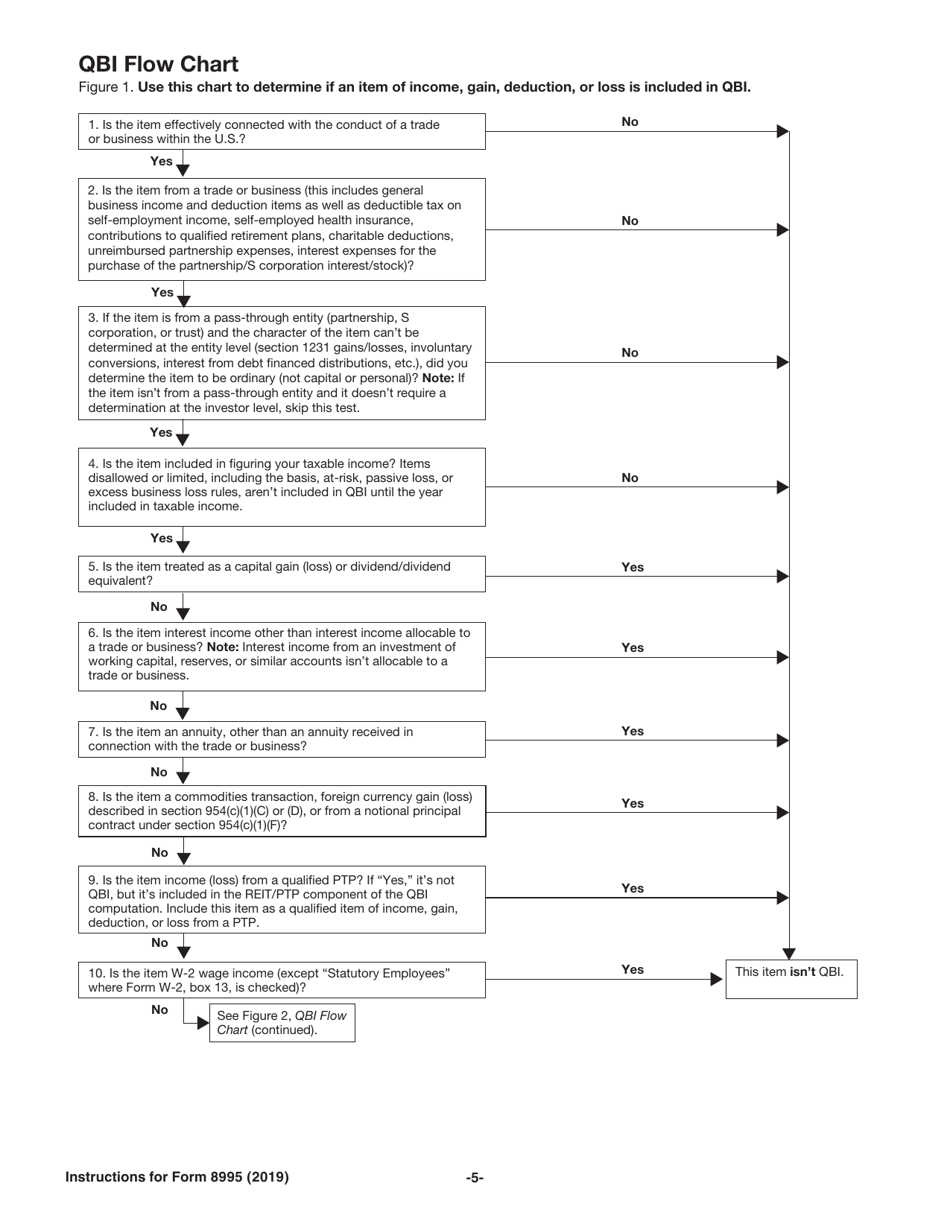

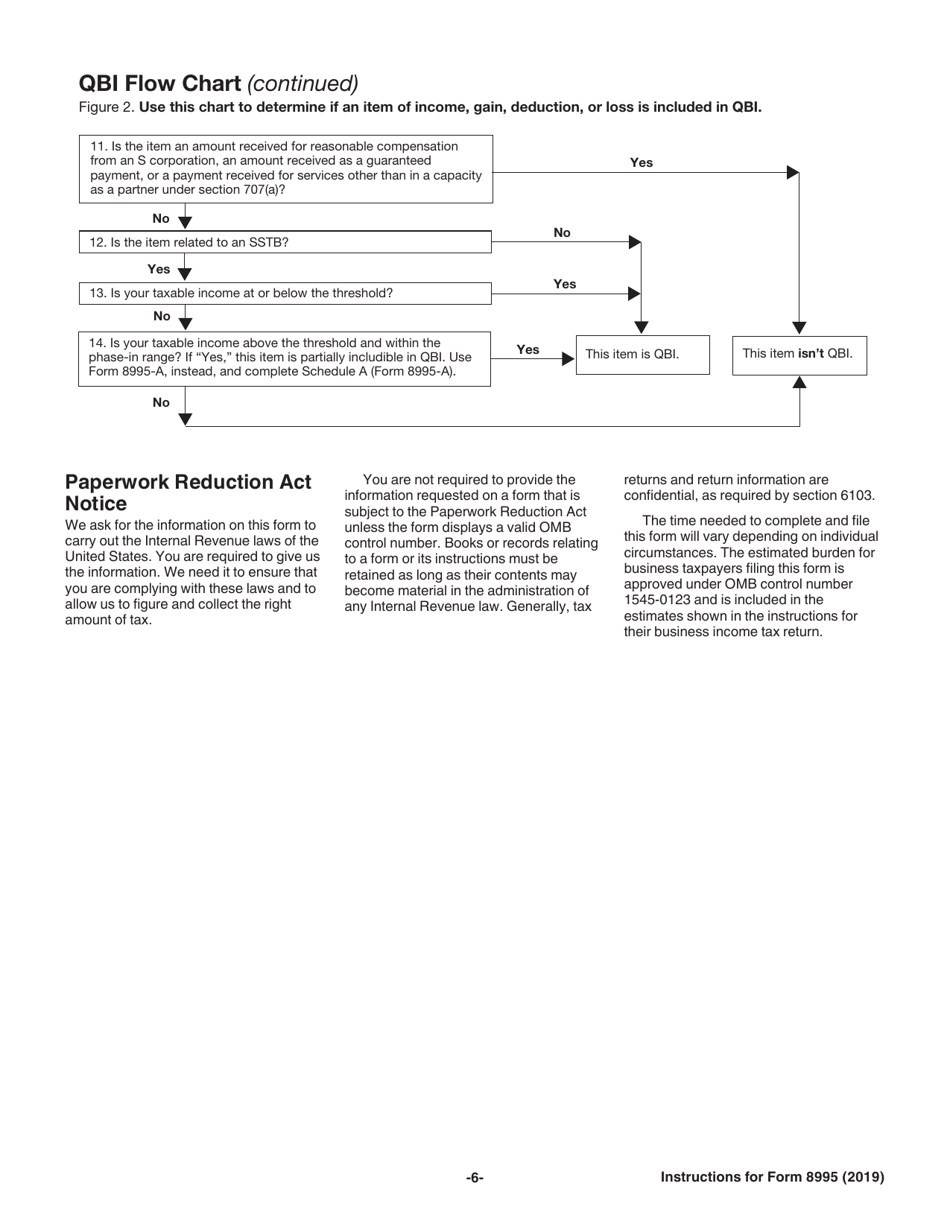

Q: What is qualified business income?

A: Qualified business income includes income from a qualified trade or business, such as income from a sole proprietorship, partnership, or S corporation.

Q: Is there a limit to the amount that can be deducted?

A: Yes, the deduction is limited to 20% of the taxpayer's taxable income, subject to certain thresholds and limitations.

Q: What is the simplified computation method for Form 8995?

A: The simplified computation method allows eligible taxpayers to calculate the Qualified Business Income Deduction using a simplified worksheet provided by the IRS.

Q: Are there any other requirements or considerations for claiming the deduction?

A: Yes, there are various other requirements and considerations, such as limitations based on the type of trade or business, the taxpayer's taxable income, and other factors. It's important to thoroughly review the instructions and consult a tax professional if needed.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.