This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8955-SSA

for the current year.

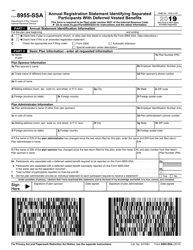

Instructions for IRS Form 8955-SSA Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits

This document contains official instructions for IRS Form 8955-SSA , Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8955-SSA is available for download through this link.

FAQ

Q: What is IRS Form 8955-SSA?

A: IRS Form 8955-SSA is an annual registration statement used to identify separated participants with deferred vested benefits.

Q: Who needs to file IRS Form 8955-SSA?

A: Plan administrators of certain retirement plans are required to file IRS Form 8955-SSA.

Q: What is the purpose of IRS Form 8955-SSA?

A: The purpose of IRS Form 8955-SSA is to provide the IRS with information about separated participants who have deferred vested benefits in retirement plans.

Q: When is IRS Form 8955-SSA due?

A: IRS Form 8955-SSA is generally due by the last day of the seventh month after the plan year ends.

Q: What happens if I don't file IRS Form 8955-SSA?

A: Failure to file IRS Form 8955-SSA or filing it late may result in penalties imposed by the IRS.

Q: Are there any exceptions to filing IRS Form 8955-SSA?

A: Some retirement plans may be exempt from filing IRS Form 8955-SSA. It is recommended to consult with a tax professional or review the IRS instructions to determine if an exemption applies.

Q: Is there a fee to file IRS Form 8955-SSA?

A: There is no fee to file IRS Form 8955-SSA.

Q: Can I electronically file IRS Form 8955-SSA?

A: Yes, you can electronically file IRS Form 8955-SSA using the IRS's FIRE (Filing Information Returns Electronically) system or through an approved third-party e-file provider.

Instruction Details:

- This 7-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.