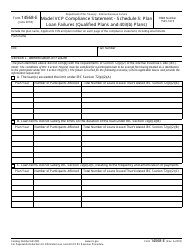

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8915-B

for the current year.

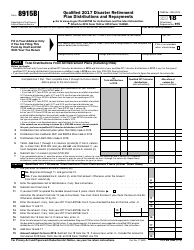

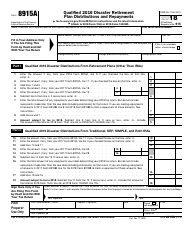

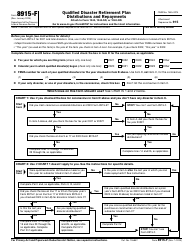

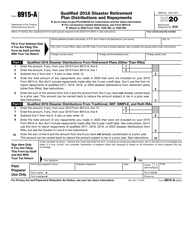

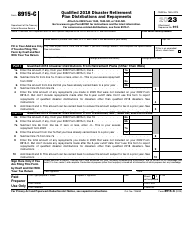

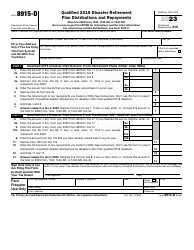

Instructions for IRS Form 8915-B Qualified 2017 Disaster Retirement Plan Distributions and Repayments

This document contains official instructions for IRS Form 8915-B , Qualified 2017 Disaster Retirement Plan Distributions and Repayments - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8915-B is available for download through this link.

FAQ

Q: What is IRS Form 8915-B?

A: IRS Form 8915-B is a form used for reporting qualified disaster retirement plan distributions and repayments.

Q: Who is eligible to use IRS Form 8915-B?

A: Individuals who received qualified disaster retirement plan distributions or made repayments of that distribution in 2017 are eligible to use IRS Form 8915-B.

Q: What is a qualified disaster retirement plan distribution?

A: A qualified disaster retirement plan distribution is a distribution from a qualified retirement plan, including an IRA or qualified annuity plan, made on account of a qualified disaster.

Q: What is a qualified disaster?

A: A qualified disaster is a disaster that the President of the United States declares as eligible for federal assistance.

Q: What are the types of qualified disasters?

A: The types of qualified disasters include hurricanes, floods, wildfires, earthquakes, and other federally declared disasters.

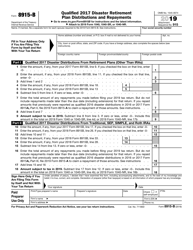

Q: What information does IRS Form 8915-B require?

A: IRS Form 8915-B requires information about the taxpayer, their qualified disaster retirement plan distribution, any repayments made, and the calculation of any tax owed.

Q: When is the deadline to file IRS Form 8915-B?

A: The deadline to file IRS Form 8915-B is usually the same as the deadline for filing your federal income tax return, which is April 15th.

Q: Can I e-file IRS Form 8915-B?

A: Yes, you can e-file IRS Form 8915-B if you are using tax software that supports this form.

Q: What are the penalties for not filing IRS Form 8915-B?

A: If you fail to file IRS Form 8915-B when required, you may be subject to penalties and interest on any taxes owed.

Instruction Details:

- This 3-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.