This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8910

for the current year.

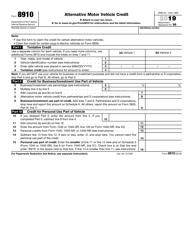

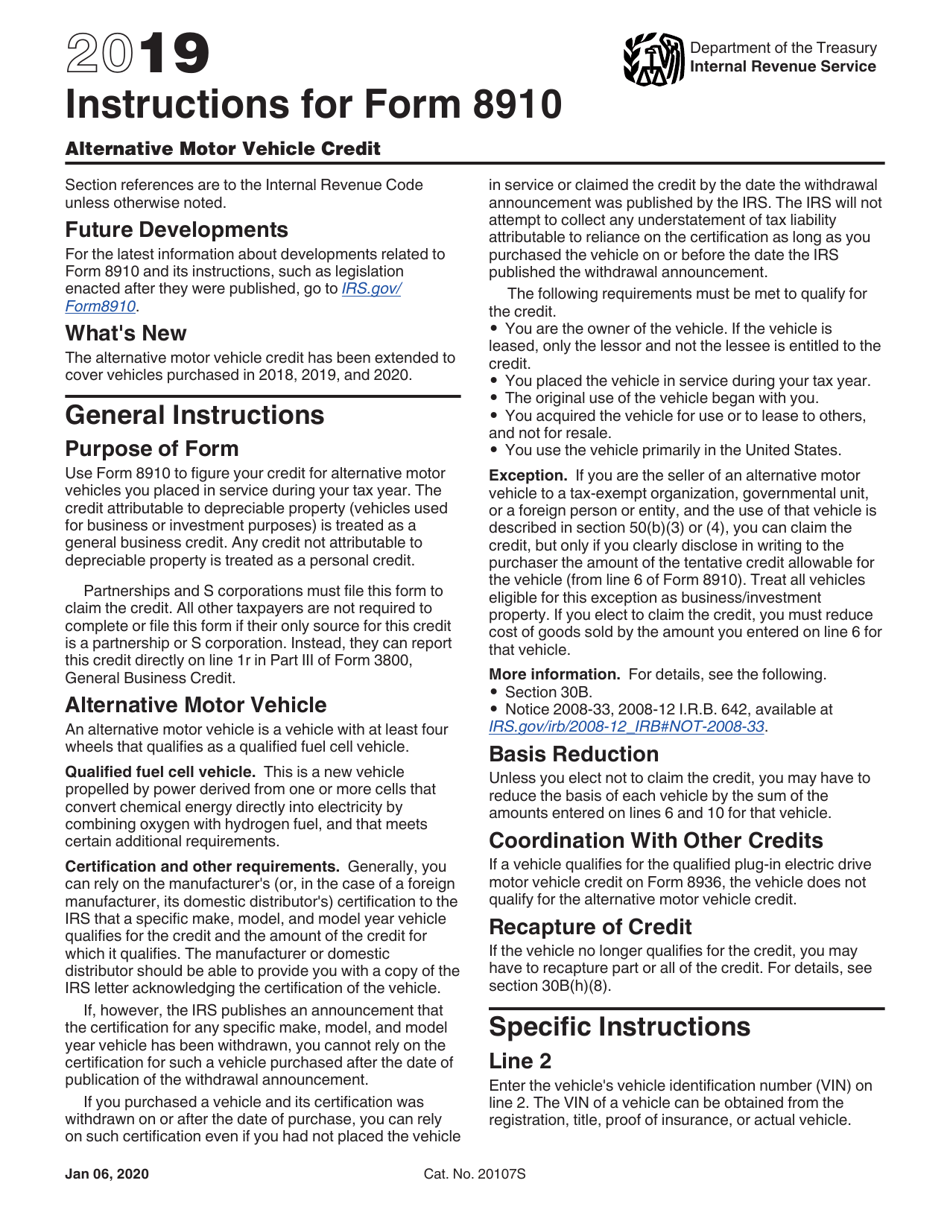

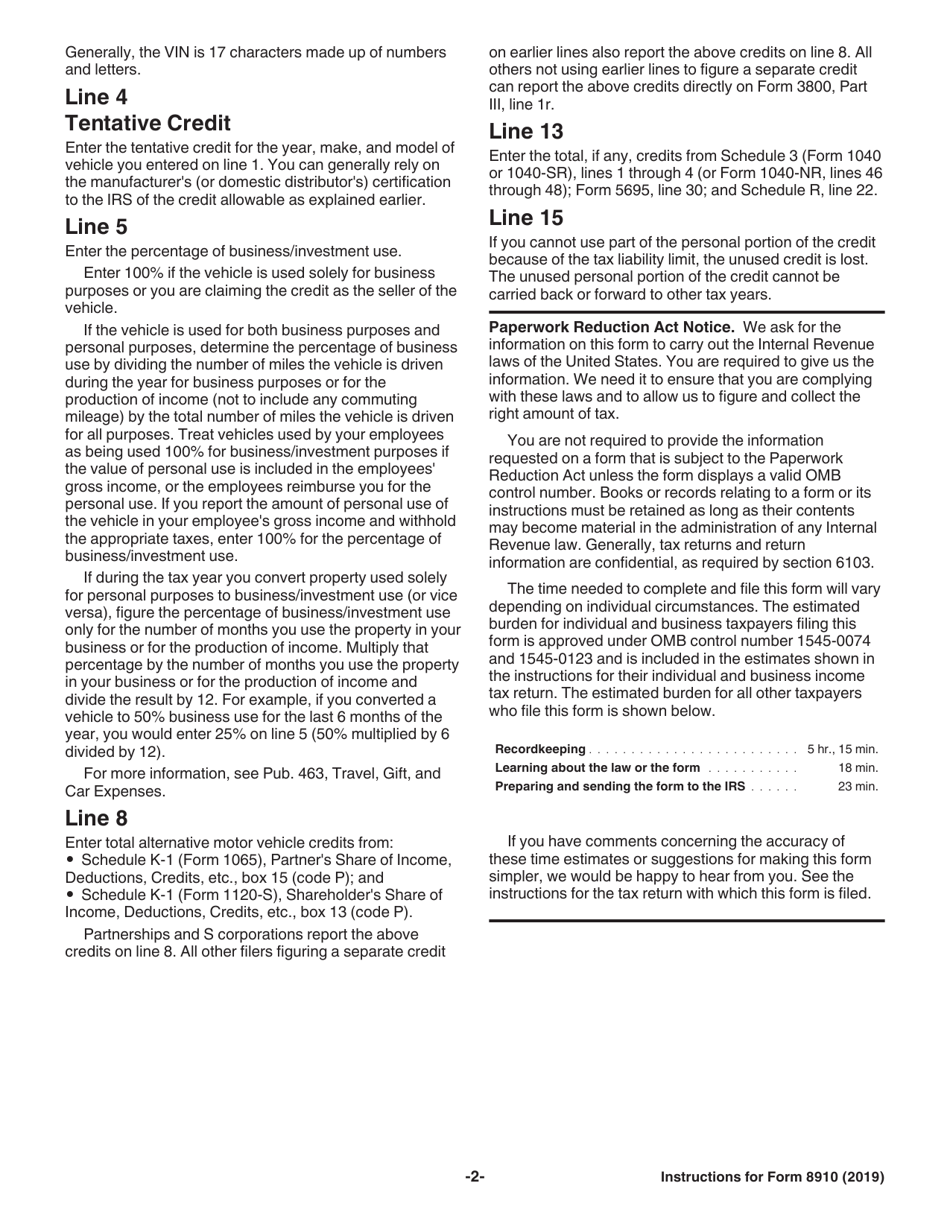

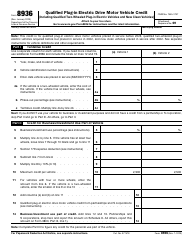

Instructions for IRS Form 8910 Alternative Motor Vehicle Credit

This document contains official instructions for IRS Form 8910 , Alternative Motor Vehicle Credit - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8910 is available for download through this link.

FAQ

Q: What is IRS Form 8910?

A: IRS Form 8910 is a tax form used to claim the Alternative Motor Vehicle Credit.

Q: Who can use Form 8910?

A: Form 8910 is used by individuals and businesses who purchased a qualified plug-in electric drive motor vehicle.

Q: What is the purpose of Form 8910?

A: The purpose of Form 8910 is to calculate and claim the Alternative Motor Vehicle Credit.

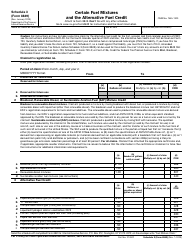

Q: What vehicles qualify for the credit?

A: Vehicles that qualify for the credit include certain electric vehicles and plug-in hybrid vehicles.

Q: How much is the credit?

A: The amount of the credit varies depending on the type of vehicle and its battery capacity.

Q: What other requirements are there to claim the credit?

A: Some additional requirements include purchasing a new vehicle, using it primarily in the United States, and meeting certain battery capacity thresholds.

Q: When is the deadline to file Form 8910?

A: The deadline to file Form 8910 is usually April 15th of the following year, but it may vary.

Q: Can I claim the credit for multiple vehicles?

A: Yes, you can claim the credit for multiple vehicles as long as they meet the qualifying criteria.

Q: Can I claim the credit if I lease a vehicle?

A: If you lease a vehicle, the credit may be available to the leasing company, and they may pass the benefit on to you.

Instruction Details:

- This 2-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.