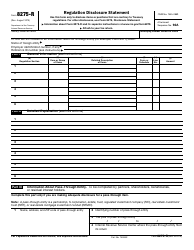

Instructions for IRS Form 8886-T Disclosure by Tax-Exempt Entity Regarding Prohibited Tax Shelter Transaction

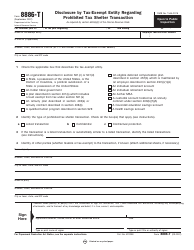

This document contains official instructions for IRS Form 8886-T , Disclosure by Tax-Exempt Entity Regarding Prohibited Tax Shelter Transaction - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8886-T is available for download through this link.

FAQ

Q: What is IRS Form 8886-T?

A: IRS Form 8886-T is a form used by tax-exempt entities to disclose information about prohibited tax shelter transactions.

Q: Who needs to file Form 8886-T?

A: Tax-exempt entities that engage in prohibited tax shelter transactions are required to file Form 8886-T.

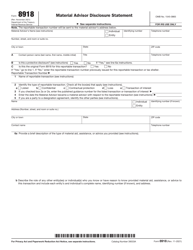

Q: What is a tax shelter transaction?

A: A tax shelter transaction is a transaction that has the potential to generate artificial losses, deductions, or credits designed to reduce tax liability.

Q: What information should be disclosed on Form 8886-T?

A: Form 8886-T requires the disclosure of details about the tax shelter transaction, including parties involved, tax benefits expected, and the promoter's information.

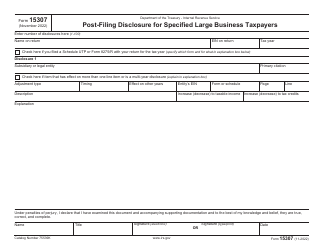

Q: When is Form 8886-T due?

A: Form 8886-T is generally due on the date the tax return is filed.

Q: Are there any penalties for not filing Form 8886-T?

A: Yes, there are penalties for failure to file Form 8886-T, including monetary fines and potential criminal charges.

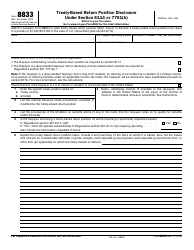

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.