This version of the form is not currently in use and is provided for reference only. Download this version of

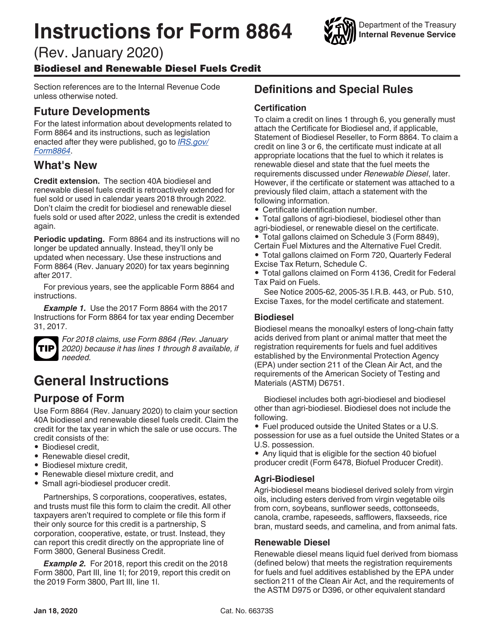

Instructions for IRS Form 8864

for the current year.

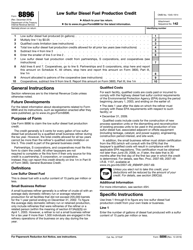

Instructions for IRS Form 8864 Biodiesel and Renewable Diesel Fuels Credit

This document contains official instructions for IRS Form 8864 , Biodiesel and Renewable Diesel Fuels Credit - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8864 is available for download through this link.

FAQ

Q: What is IRS Form 8864?

A: IRS Form 8864 is a form used to claim the Biodiesel and Renewable Diesel Fuels Credit.

Q: What is the Biodiesel and Renewable Diesel Fuels Credit?

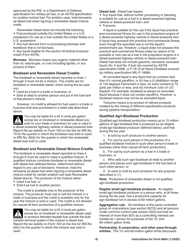

A: The Biodiesel and Renewable Diesel Fuels Credit is a tax credit available for producers and users of qualified biodiesel and renewable diesel fuels.

Q: Who can claim the Biodiesel and Renewable Diesel Fuels Credit?

A: Producers, blenders, and users of qualified biodiesel and renewable diesel fuels can claim the credit.

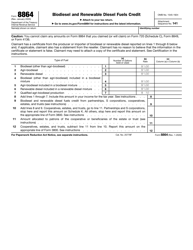

Q: What information is required to complete Form 8864?

A: You will need to provide the quantity of biodiesel or renewable diesel fuels produced, blended, or used during the tax year.

Q: How much is the Biodiesel and Renewable Diesel Fuels Credit?

A: The credit amount varies depending on the type of fuel and the tax year. Check the instructions for the specific credit rates.

Q: When is Form 8864 due?

A: Form 8864 is due on or before the 15th day of the 4th month following the close of the tax year.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.