This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8850

for the current year.

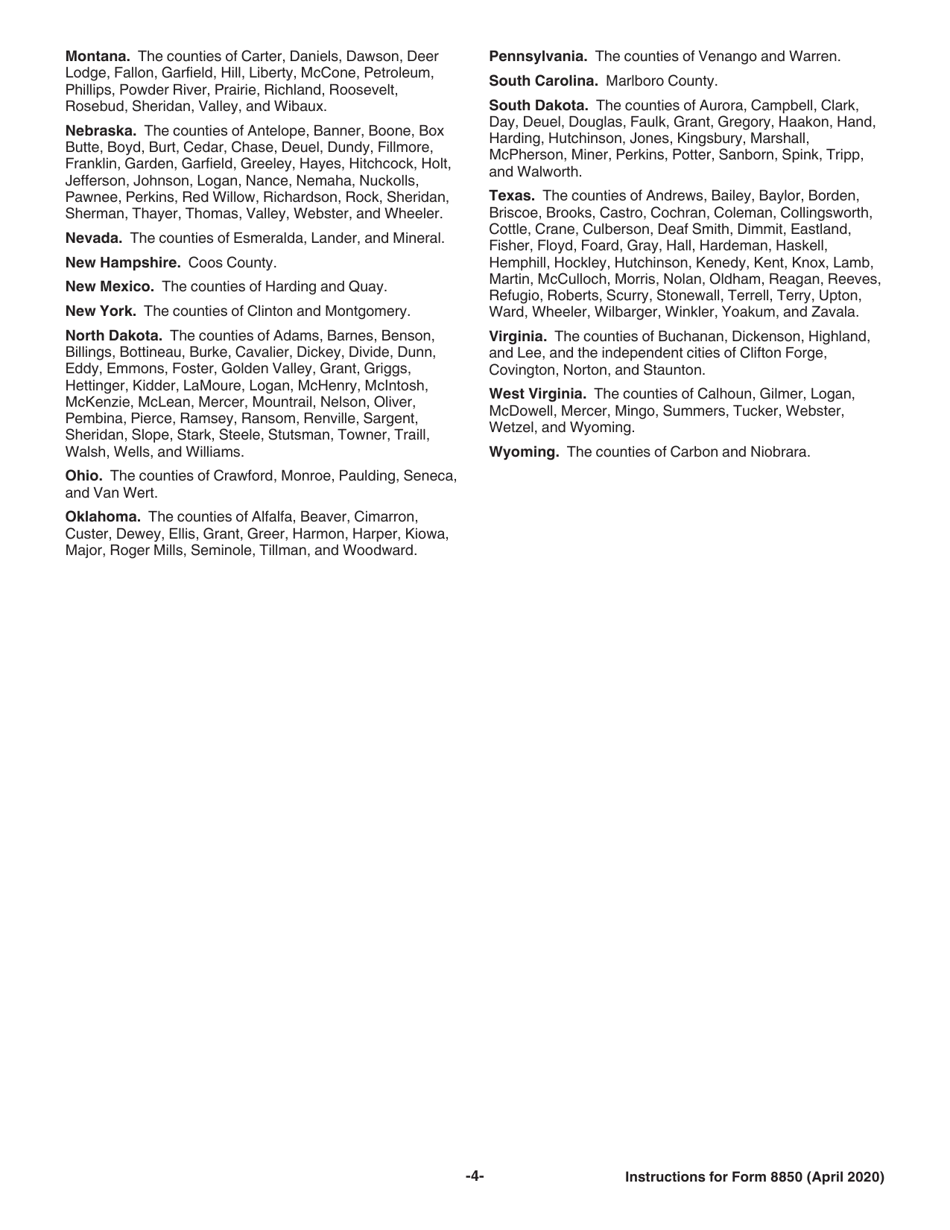

Instructions for IRS Form 8850 Pre-screening Notice and Certification Request for the Work Opportunity Credit

This document contains official instructions for IRS Form 8850 , Pre-screening Notice and Certification Request for the Work Opportunity Credit - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8850 is available for download through this link.

FAQ

Q: What is IRS Form 8850?

A: IRS Form 8850 is a Pre-screening Notice and Certification Request for the Work Opportunity Credit.

Q: What is the Work Opportunity Credit?

A: The Work Opportunity Credit is a federal tax credit available to employers who hire individuals from certain target groups.

Q: Who should use IRS Form 8850?

A: Employers who are planning to claim the Work Opportunity Credit for hiring eligible individuals should use IRS Form 8850.

Q: What information is required on Form 8850?

A: Form 8850 requires information about the employer, the eligible individual being hired, and the target group to which the individual belongs.

Q: How do I submit Form 8850?

A: Form 8850 should be submitted to the state workforce agency within 28 days after the eligible individual begins work.

Q: What is the deadline for submitting Form 8850?

A: Form 8850 should be submitted within 28 days after the eligible individual begins work.

Q: What is the purpose of pre-screening?

A: Pre-screening helps determine if an individual is a member of a target group eligible for the Work Opportunity Credit.

Q: Can multiple individuals be listed on a single Form 8850?

A: No, each eligible individual should have a separate Form 8850.

Q: What if I have additional questions?

A: If you have additional questions, you can refer to the instructions provided with Form 8850 or contact the Internal Revenue Service (IRS) for assistance.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.