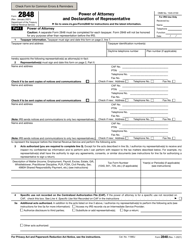

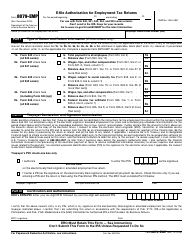

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8821

for the current year.

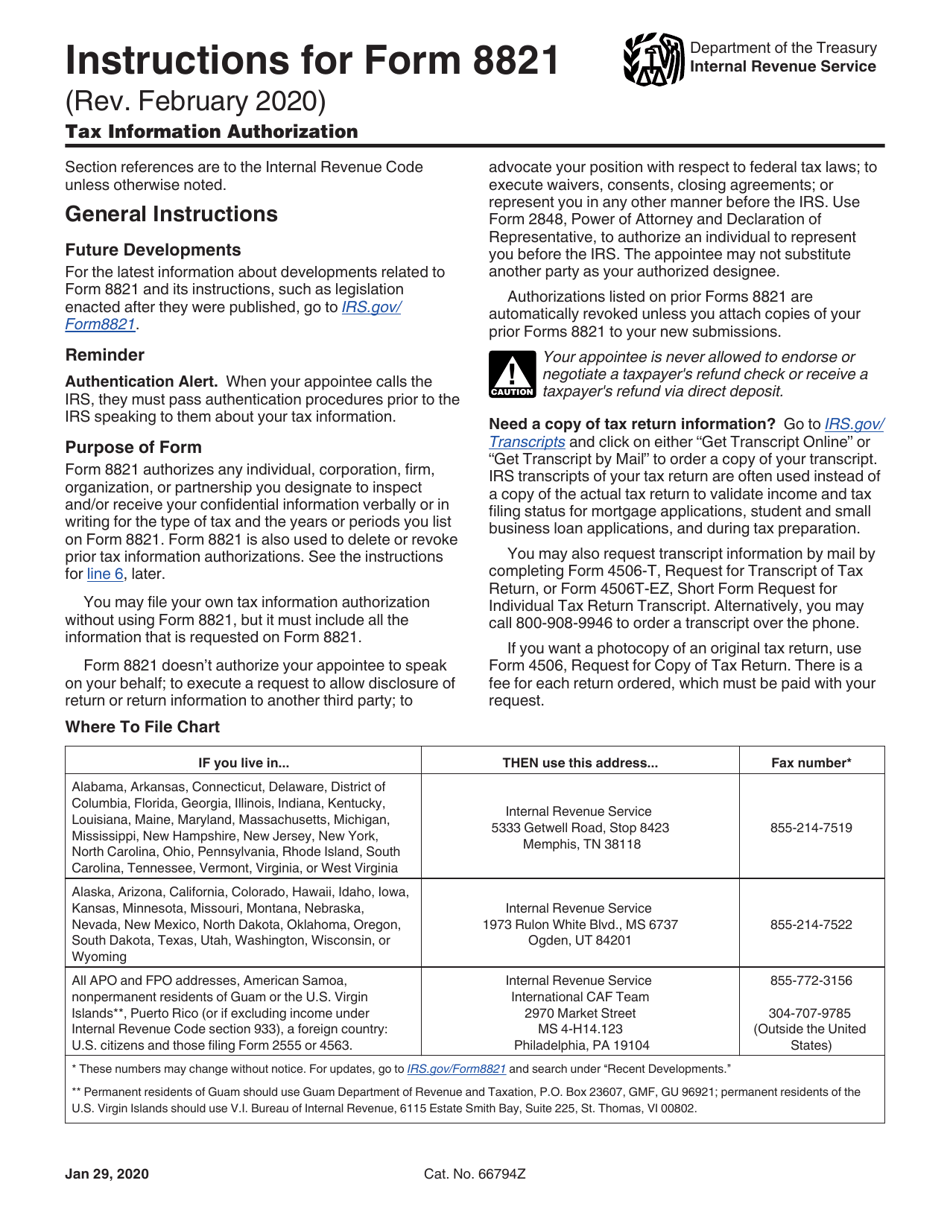

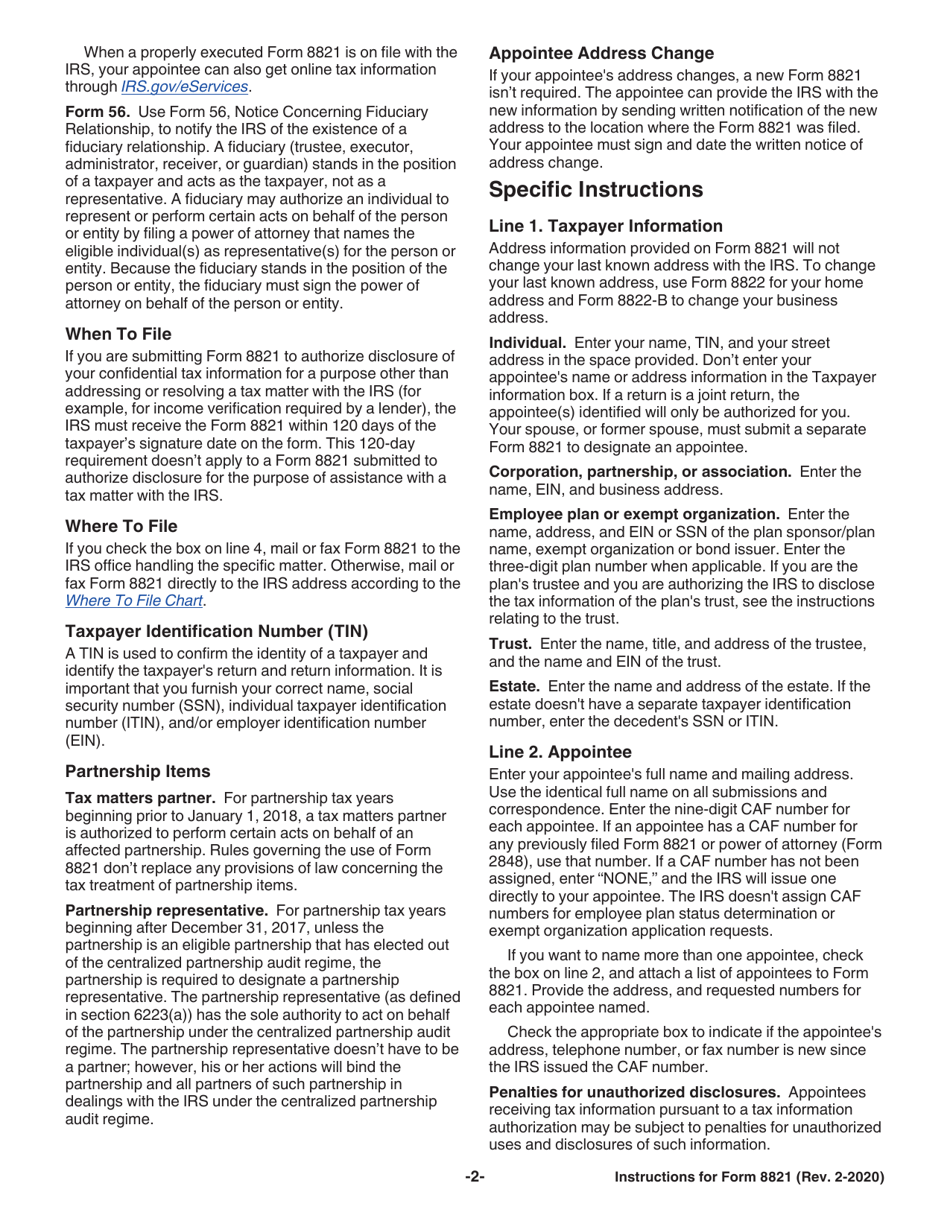

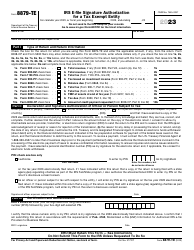

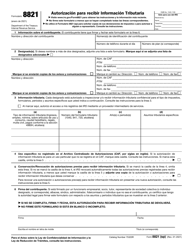

Instructions for IRS Form 8821 Tax Information Authorization

This document contains official instructions for IRS Form 8821 , Tax Information Authorization - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8821 is available for download through this link.

FAQ

Q: What is Form 8821?

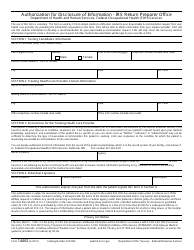

A: Form 8821 is a tax form used to authorize someone to receive or inspect your tax information.

Q: Who should file Form 8821?

A: You should file Form 8821 if you want to authorize another person to receive or inspect your tax information.

Q: Can I use Form 8821 to grant the authority to represent me in front of the IRS?

A: No, Form 8821 only authorizes someone to receive or inspect your tax information; it does not grant representation authority.

Q: How can I submit Form 8821?

A: You can submit Form 8821 by mail or fax according to the instructions provided with the form.

Q: Are there any fees associated with filing Form 8821?

A: No, there are no fees associated with filing Form 8821.

Q: How long does it take for Form 8821 to be processed?

A: Processing times may vary, but it generally takes about 10 business days for the IRS to process Form 8821.

Q: Can I revoke my authorization granted through Form 8821?

A: Yes, you can revoke the authorization by submitting a written statement to the IRS.

Q: Is there a deadline for filing Form 8821?

A: There is no specific deadline for filing Form 8821; you can file it at any time you wish to authorize someone to receive or inspect your tax information.

Instruction Details:

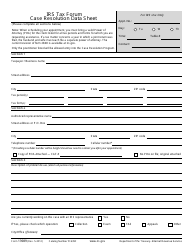

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- A version of the instructions in Spanish is available for spanish-speaking filers;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.