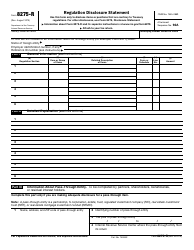

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8275

for the current year.

Instructions for IRS Form 8275 Disclosure Statement

This document contains official instructions for IRS Form 8275 , Disclosure Statement - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8275 is available for download through this link.

FAQ

Q: What is IRS Form 8275?

A: IRS Form 8275 is a Disclosure Statement that taxpayers use to disclose certain positions taken on their tax returns.

Q: Why would I need to use IRS Form 8275?

A: You may need to use IRS Form 8275 if you have taken a position on your tax return that may not be fully supported by the tax law, or if you want to disclose an item to avoid certain penalties.

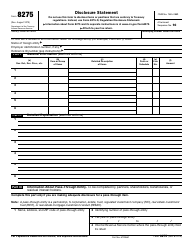

Q: What information should I include on IRS Form 8275?

A: You should include a description of the position you are disclosing, the reasons why you believe the position is reasonable, and any supporting documentation.

Q: When should I file IRS Form 8275?

A: IRS Form 8275 should be filed with your tax return, or it can be filed separately if you have already filed your tax return.

Q: Are there any risks associated with filing IRS Form 8275?

A: There is a risk of increased scrutiny from the IRS when you file IRS Form 8275, but it can also provide protection against penalties if the IRS disagrees with your position.

Q: Can I file IRS Form 8275 electronically?

A: No, IRS Form 8275 cannot be filed electronically and must be filed by mail.

Q: Is there a deadline for filing IRS Form 8275?

A: There is no specific deadline for filing IRS Form 8275, but it is recommended to file it with your tax return to avoid any potential penalties or issues with the IRS.

Q: Do I need to file IRS Form 8275 every year?

A: You only need to file IRS Form 8275 if you have taken a position on your tax return that may be questionable or if you want to disclose an item to avoid certain penalties.

Q: Can I amend my tax return to include IRS Form 8275?

A: Yes, you can file an amended tax return to include IRS Form 8275 if you realize that you need to disclose a position or item after you have already filed your original tax return.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.