This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 6478

for the current year.

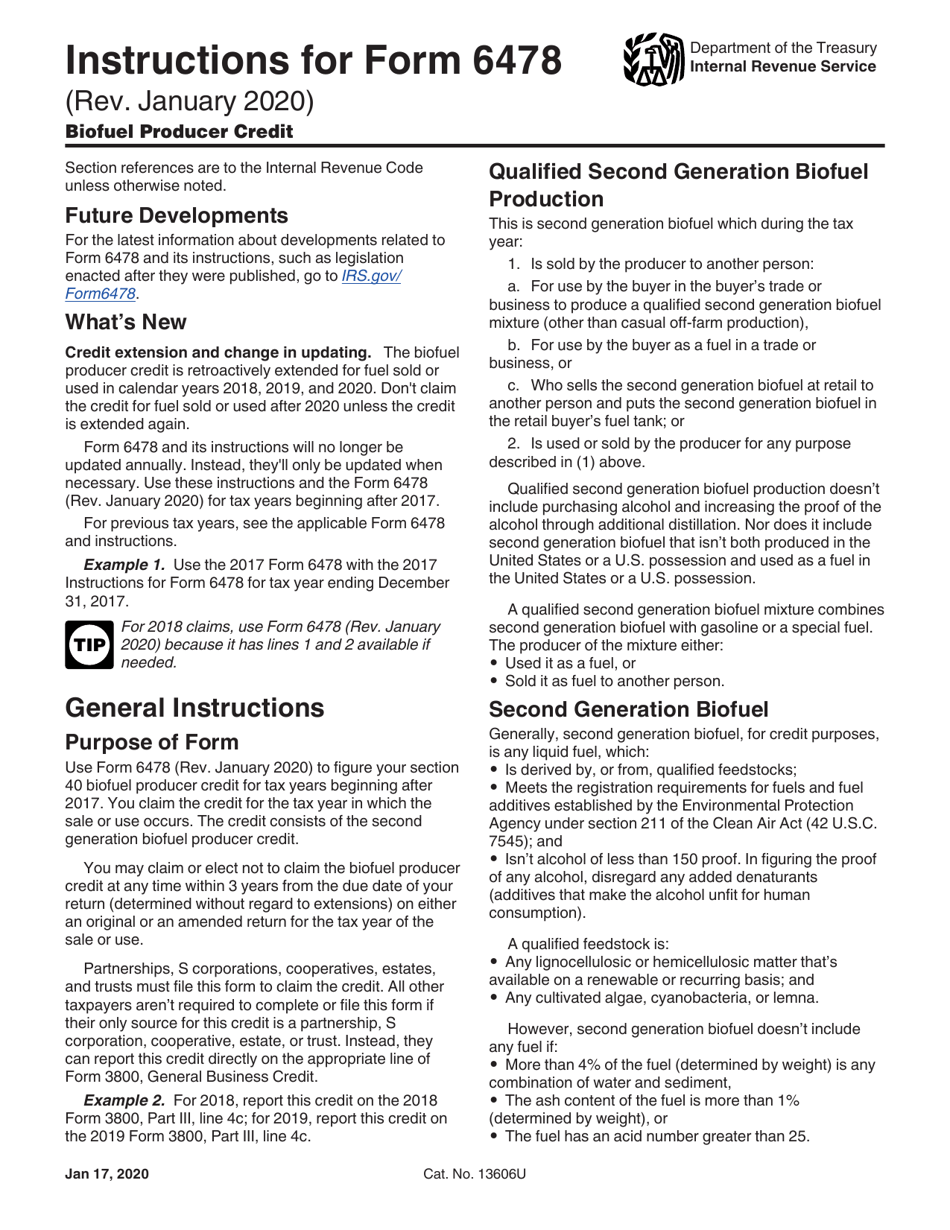

Instructions for IRS Form 6478 Biofuel Producer Credit

This document contains official instructions for IRS Form 6478 , Biofuel Producer Credit - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 6478 is available for download through this link.

FAQ

Q: What is IRS Form 6478?

A: IRS Form 6478 is a tax form used to claim the biofuel producer credit.

Q: Who is eligible to claim the biofuel producer credit?

A: Eligible taxpayers include individuals, partnerships, corporations, estates, and trusts that produce and sell qualified biofuels.

Q: What is the purpose of the biofuel producer credit?

A: The biofuel producer credit is designed to encourage the production and use of biofuels, which are renewable and environmentally friendly fuel sources.

Q: What are qualified biofuels?

A: Qualified biofuels include ethanol, biodiesel, renewable diesel, and other alternative fuels made from agricultural products, waste materials, or residues.

Q: How much is the biofuel producer credit worth?

A: The credit is generally based on the quantity of qualified biofuels produced and sold during the tax year, with different rates for different types of biofuels.

Q: How do I claim the biofuel producer credit?

A: To claim the credit, you must complete and file IRS Form 6478 along with your federal income tax return.

Q: Are there any limitations or restrictions on the biofuel producer credit?

A: Yes, there are certain limitations and restrictions, such as a cap on the total amount of credit that can be claimed and requirements to meet certain production and quality standards.

Q: Is the biofuel producer credit available every year?

A: The availability of the credit may vary from year to year, as it is subject to legislative changes and extensions. It is important to check the latest IRS guidance for the specific tax year you are filing.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.