This version of the form is not currently in use and is provided for reference only. Download this version of

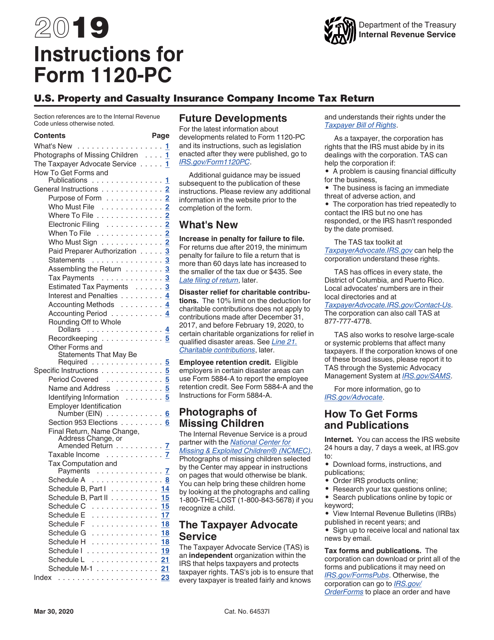

Instructions for IRS Form 1120-PC

for the current year.

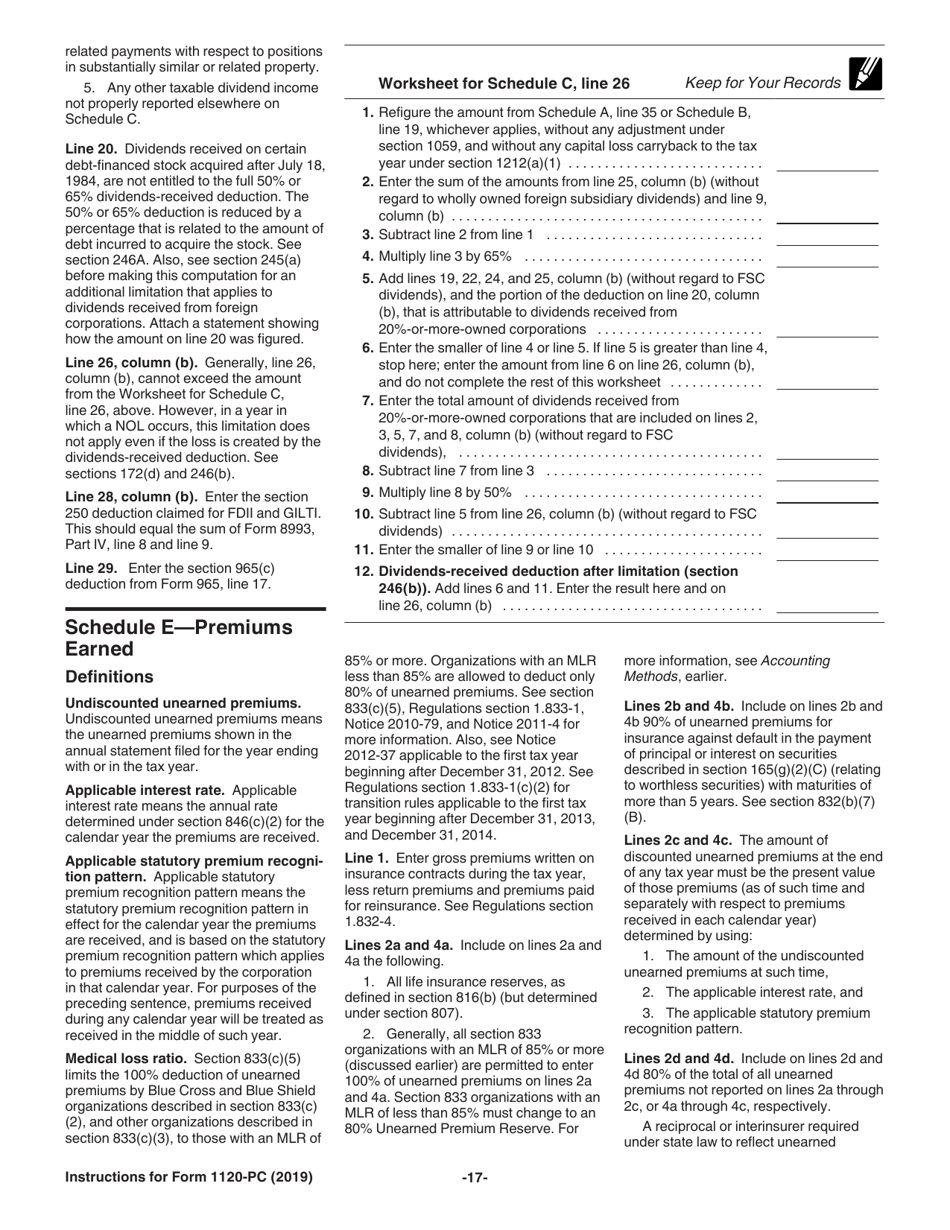

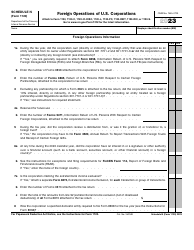

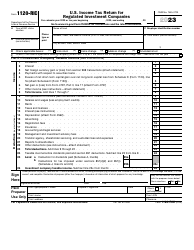

Instructions for IRS Form 1120-PC U.S. Property and Casualty Insurance Company Income Tax Return

This document contains official instructions for IRS Form 1120-PC , U.S. Property and Casualty Insurance Company Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-PC is available for download through this link.

FAQ

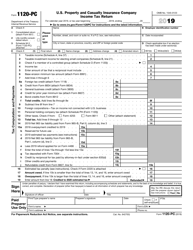

Q: What is Form 1120-PC?

A: Form 1120-PC is the U.S. Property and Casualty Insurance Company Income Tax Return.

Q: Who needs to file Form 1120-PC?

A: Property and casualty insurance companies in the United States need to file Form 1120-PC.

Q: What is the purpose of Form 1120-PC?

A: The purpose of Form 1120-PC is to report income, deductions, credits, and other information for property and casualtyinsurance companies.

Q: When is Form 1120-PC due?

A: Form 1120-PC is due on the 15th day of the 3rd month following the end of the tax year.

Q: Are there any extensions to file Form 1120-PC?

A: Yes, extensions of time to file Form 1120-PC can be requested using Form 7004.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing of Form 1120-PC. It is best to file the return and pay the tax by the due date to avoid penalties.

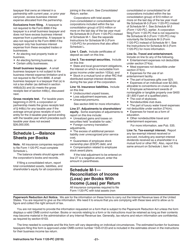

Q: What are some common deductions for property and casualty insurance companies?

A: Some common deductions for property and casualty insurance companies include claims and claim adjustment expenses, commissions, legal and professional fees, and policyholder dividends.

Q: Are property and casualty insurance companies subject to any special tax provisions?

A: Yes, property and casualty insurance companies are subject to special tax provisions such as the tax on insurance premiums and the loss discount.

Instruction Details:

- This 23-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.