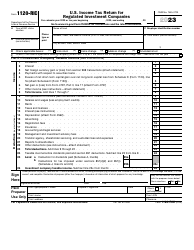

This version of the form is not currently in use and is provided for reference only. Download this version of

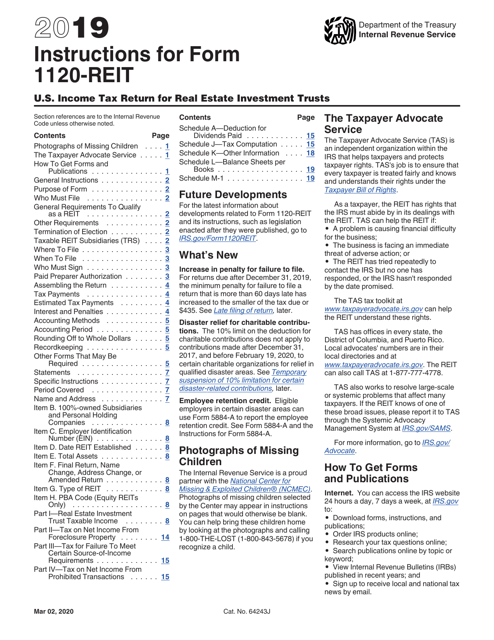

Instructions for IRS Form 1120-REIT

for the current year.

Instructions for IRS Form 1120-REIT U.S. Income Tax Return for Real Estate Investment Trusts

This document contains official instructions for IRS Form 1120-REIT , U.S. Income Tax Return for Real Estate Investment Trusts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-REIT is available for download through this link.

FAQ

Q: What is Form 1120-REIT?

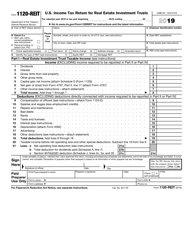

A: Form 1120-REIT is the U.S. Income Tax Return for Real Estate Investment Trusts.

Q: Who needs to file Form 1120-REIT?

A: Real Estate Investment Trusts need to file Form 1120-REIT.

Q: What is the purpose of Form 1120-REIT?

A: Form 1120-REIT is used to report the income, expenses, and deductions of a Real Estate Investment Trust.

Q: When is the due date for filing Form 1120-REIT?

A: Form 1120-REIT is due by the 15th day of the 4th month following the end of the REIT's tax year.

Q: Can Form 1120-REIT be filed electronically?

A: Yes, Form 1120-REIT can be filed electronically.

Q: Are there any penalties for late filing of Form 1120-REIT?

A: Yes, there are penalties for late filing of Form 1120-REIT. It is important to file on time to avoid these penalties.

Instruction Details:

- This 21-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.