This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-PC Schedule M-3

for the current year.

Instructions for IRS Form 1120-PC Schedule M-3 Net Income (Loss) Reconciliation for U.S. Property and Casualty Insurance Companies With Total Assets of $10 Million or More

This document contains official instructions for IRS Form 1120-PC Schedule M-3, Total Assets of $10 Million or More - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-PC Schedule M-3 is available for download through this link.

FAQ

Q: What is IRS Form 1120-PC?

A: IRS Form 1120-PC is a tax form specifically designed for U.S. property and casualtyinsurance companies.

Q: What is Schedule M-3?

A: Schedule M-3 is a part of IRS Form 1120-PC that is used to reconcile the net income (loss) of U.S. property and casualty insurance companies.

Q: Who is required to file Form 1120-PC?

A: U.S. property and casualty insurance companies with total assets of $10 million or more are required to file IRS Form 1120-PC.

Q: What is the purpose of Schedule M-3?

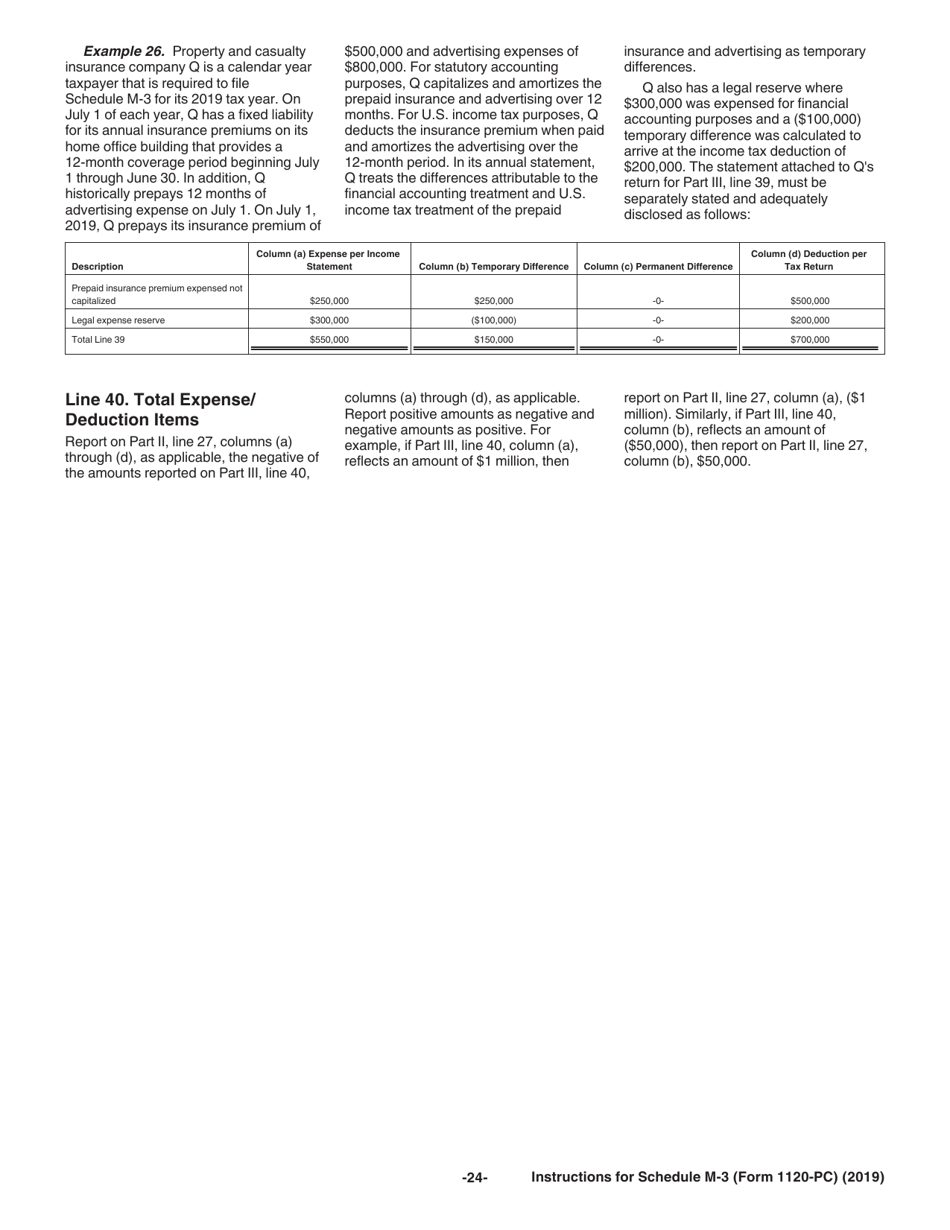

A: The purpose of Schedule M-3 is to provide a detailed reconciliation of the net income (loss) reported on the company's financial statements with the net income (loss) reported on their tax return.

Q: What information is required on Schedule M-3?

A: Schedule M-3 requires detailed information on various components of the company's net income (loss), including items that may have been deducted or included in net income (loss) for financial statement purposes but not for tax purposes.

Q: Are there any exceptions to filing Schedule M-3?

A: Yes, certain smaller property and casualty insurance companies may be exempt from filing Schedule M-3.

Instruction Details:

- This 24-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.