This version of the form is not currently in use and is provided for reference only. Download this version of

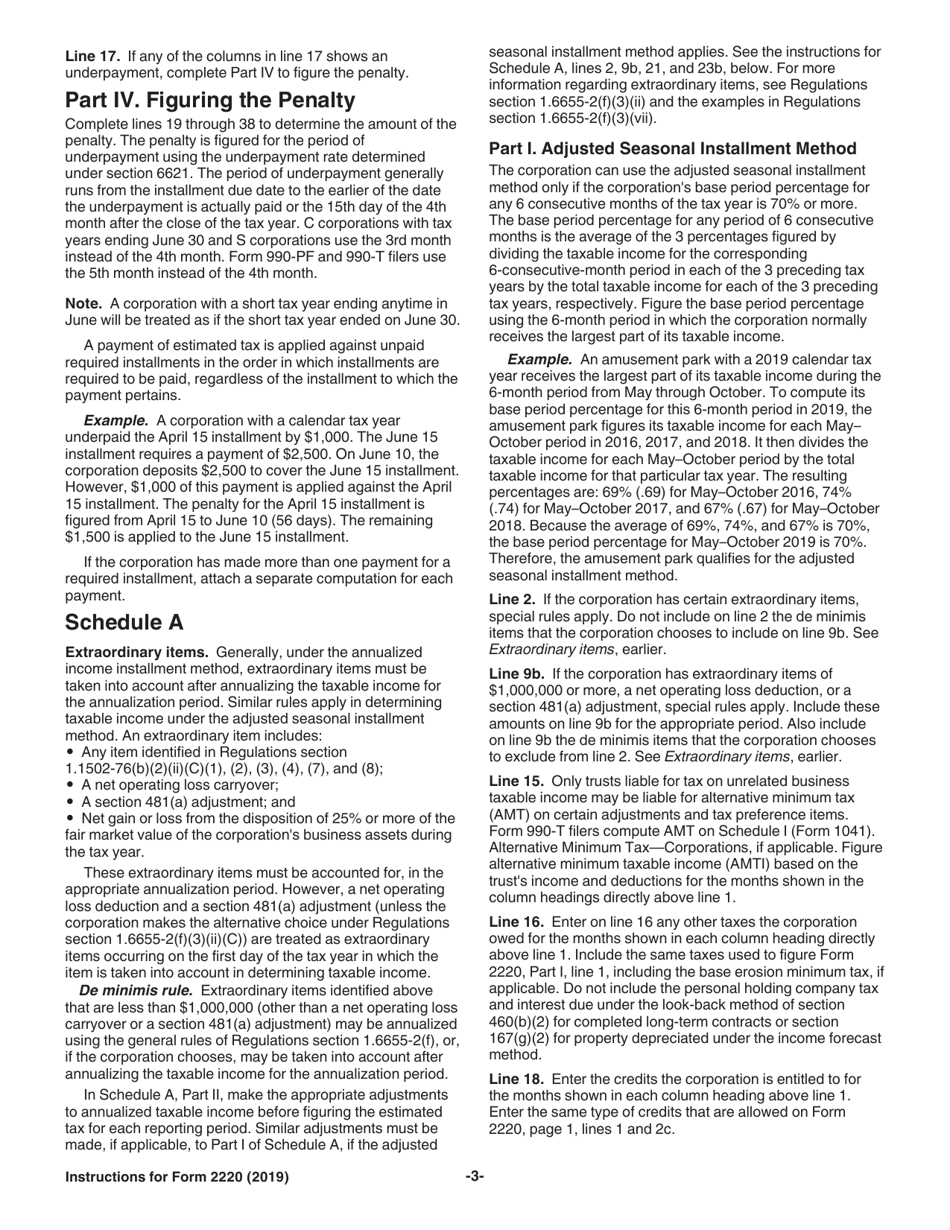

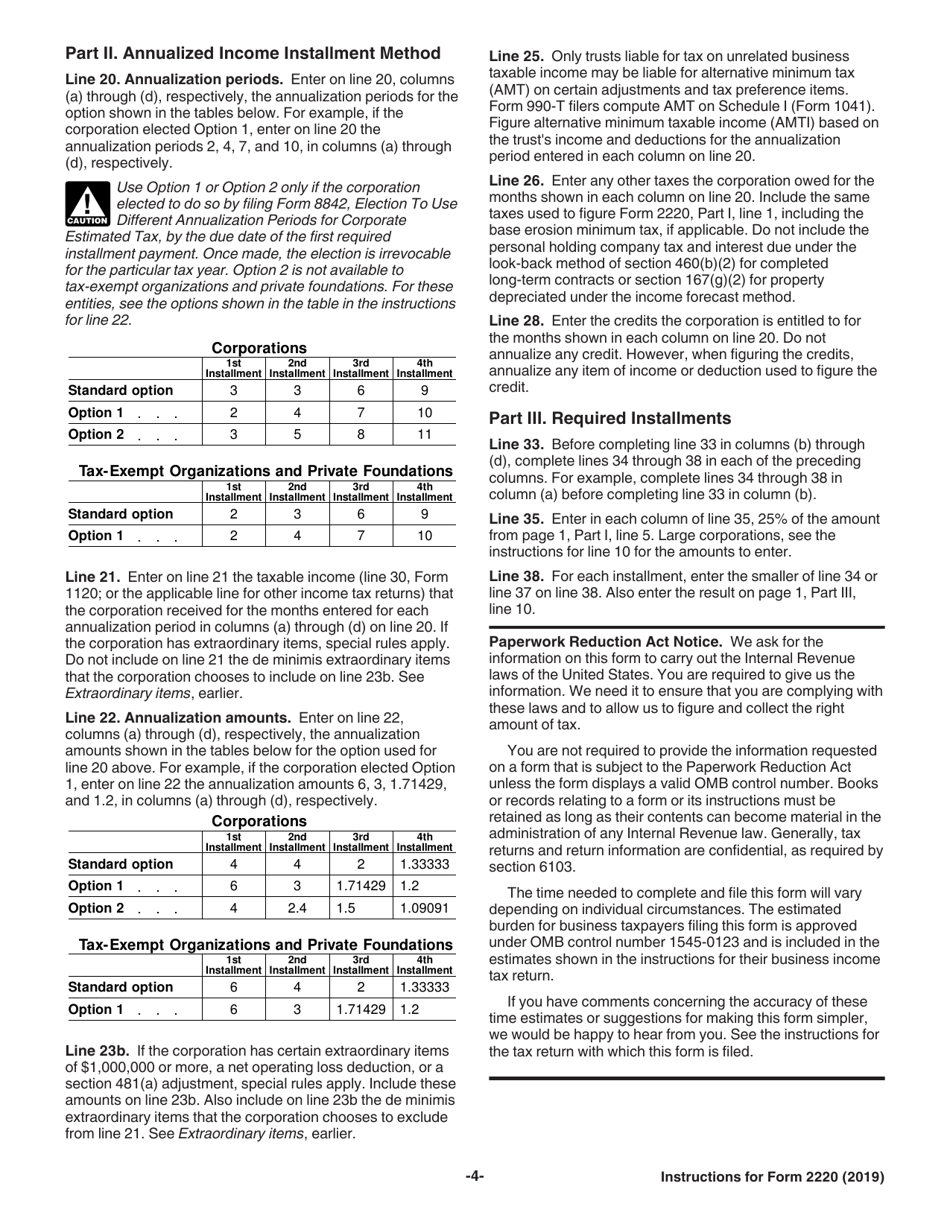

Instructions for IRS Form 2220

for the current year.

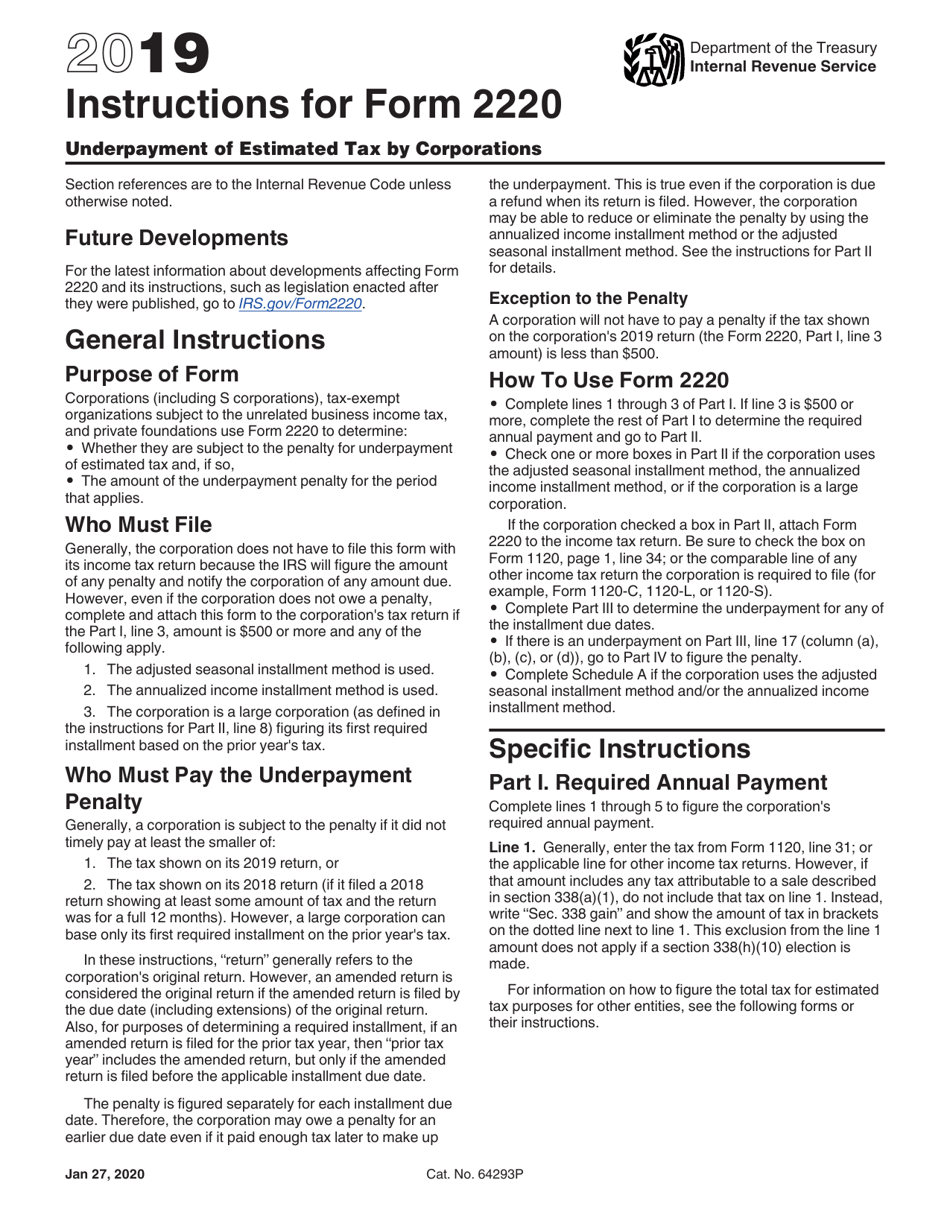

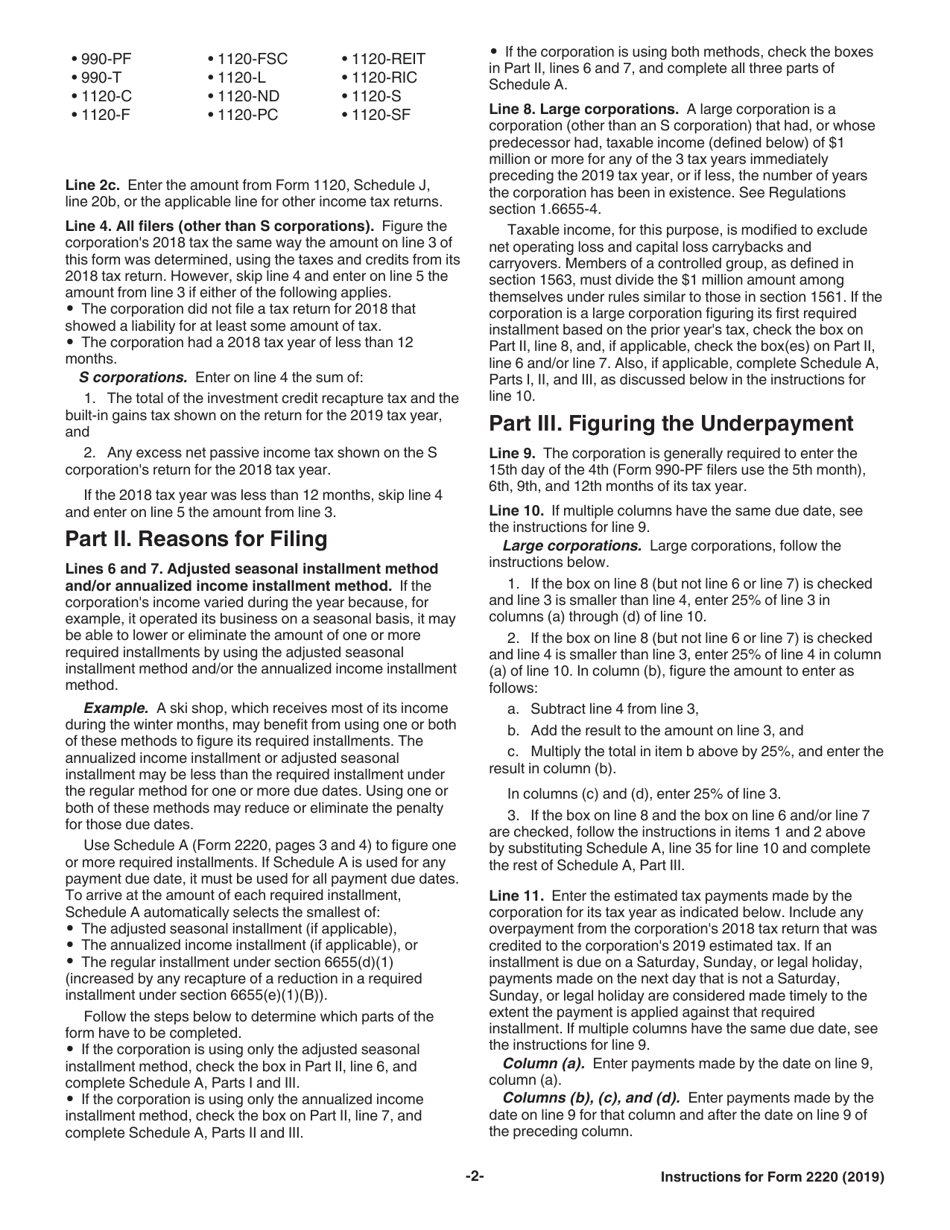

Instructions for IRS Form 2220 Underpayment of Estimated Tax by Corporations

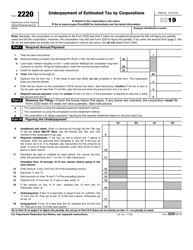

This document contains official instructions for IRS Form 2220 , Underpayment of Estimated Tax by Corporations - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 2220 is available for download through this link.

FAQ

Q: What is IRS Form 2220?

A: IRS Form 2220 is a form used by corporations to calculate the underpayment of estimated tax.

Q: Who needs to file IRS Form 2220?

A: Corporations that have underpaid their estimated tax payments need to file IRS Form 2220.

Q: How do I calculate the underpayment of estimated tax?

A: You can calculate the underpayment of estimated tax using the instructions provided on IRS Form 2220.

Q: When is IRS Form 2220 due?

A: IRS Form 2220 is typically due when you file your annual corporate income tax return.

Q: Why do corporations need to file IRS Form 2220?

A: Corporations need to file IRS Form 2220 to determine if they owe any additional tax for underpaying their estimated tax payments.

Q: What happens if a corporation underpays their estimated tax?

A: If a corporation underpays their estimated tax, they may be subject to penalties and interest on the underpaid amount.

Q: Can I e-file IRS Form 2220?

A: As of now, the IRS does not support e-filing for IRS Form 2220. It must be filed in paper format.

Q: Are there any exceptions to filing IRS Form 2220?

A: There may be exceptions for certain small corporations. Consult the instructions on IRS Form 2220 for more information.

Q: What should I do if I have questions about IRS Form 2220?

A: If you have questions or need assistance with IRS Form 2220, you can contact the IRS directly or seek help from a qualified tax professional.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.