This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 2210-F

for the current year.

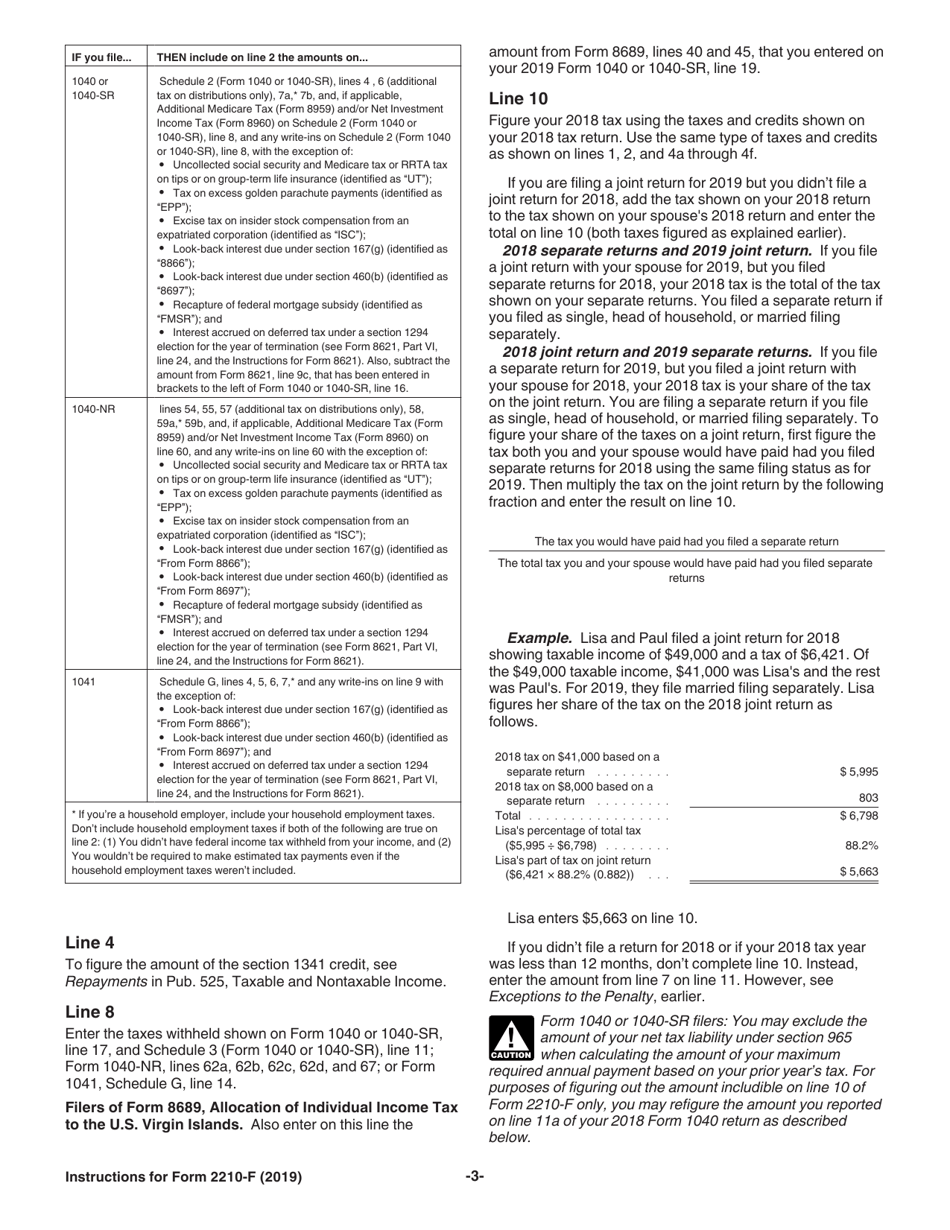

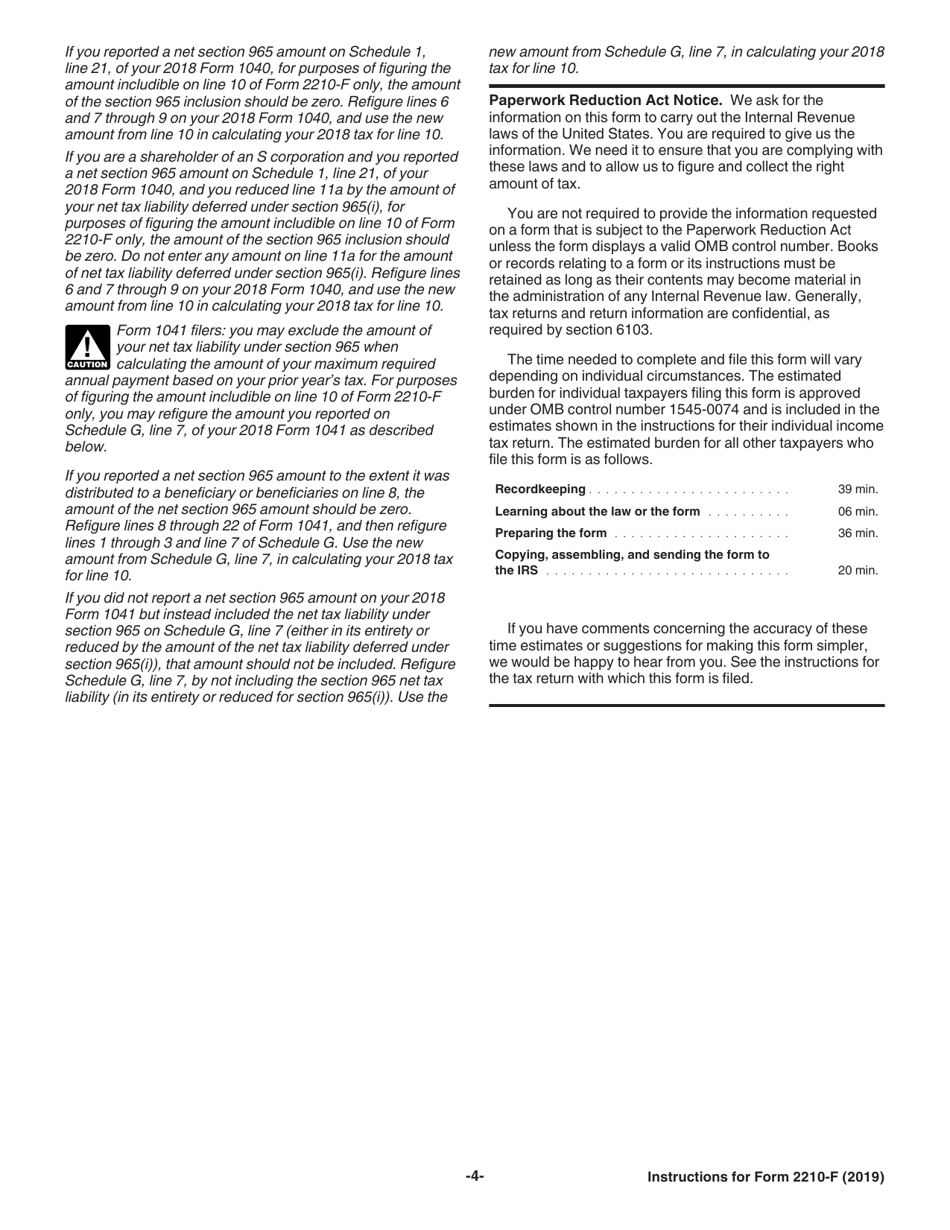

Instructions for IRS Form 2210-F Underpayment of Estimated Tax by Farmers and Fishermen

This document contains official instructions for IRS Form 2210-F , Underpayment of Estimated Tax by Farmers and Fishermen - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 2210-F is available for download through this link.

FAQ

Q: What is IRS Form 2210-F?

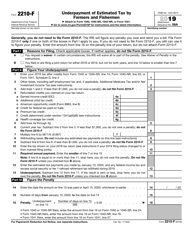

A: IRS Form 2210-F is a form used by farmers and fishermen to calculate any underpayment of estimated tax.

Q: Who needs to file IRS Form 2210-F?

A: Farmers and fishermen who did not pay enough estimated tax during the year need to file IRS Form 2210-F.

Q: What is the purpose of IRS Form 2210-F?

A: The purpose of IRS Form 2210-F is to determine if farmers and fishermen owe a penalty for underpayment of estimated tax.

Q: How do I calculate the underpayment penalty?

A: The underpayment penalty can be calculated using Schedule AI of IRS Form 2210-F.

Q: What are the deadlines for filing IRS Form 2210-F?

A: IRS Form 2210-F should be filed with your tax return by the due date of your return, generally April 15th.

Q: Are there any exceptions to the underpayment penalty for farmers and fishermen?

A: Yes, farmers and fishermen are eligible for certain exceptions to the underpayment penalty. These exceptions are explained in the instructions for IRS Form 2210-F.

Q: Do farmers and fishermen need to file any other forms in addition to IRS Form 2210-F?

A: Farmers and fishermen may need to file other tax forms depending on their specific circumstances. It is recommended to consult the IRS or a tax professional for guidance.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.