This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120 Schedule D

for the current year.

Instructions for IRS Form 1120 Schedule D Capital Gains and Losses

This document contains official instructions for IRS Form 1120 Schedule D, Capital Gains and Losses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120 Schedule D is available for download through this link.

FAQ

Q: What is IRS Form 1120 Schedule D?

A: IRS Form 1120 Schedule D is a tax form used by corporations to report capital gains and losses.

Q: What are capital gains and losses?

A: Capital gains are the profits from the sale of an asset, while capital losses are the losses from the sale of an asset.

Q: Do I need to fill out Schedule D if my corporation has no capital gains or losses?

A: No, if your corporation has no capital gains or losses, you do not need to fill out Schedule D.

Q: What is the purpose of Schedule D?

A: The purpose of Schedule D is to provide the IRS with a detailed breakdown of a corporation's capital gains and losses for tax reporting purposes.

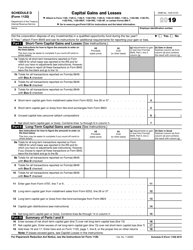

Q: What information is required on Schedule D?

A: On Schedule D, you will need to provide information about the assets bought and sold, the purchase and sale dates, the cost basis, and the resulting gains or losses.

Q: Are there any specific instructions for filling out Schedule D?

A: Yes, there are specific instructions provided by the IRS for filling out Schedule D. It is important to follow these instructions carefully to ensure accurate reporting.

Q: When is the deadline for filing Schedule D?

A: The deadline for filing Schedule D is the same as the deadline for filing your corporation's tax return, which is generally the 15th day of the third month after the end of the corporation's tax year.

Q: What happens if I don't file Schedule D?

A: If you are required to file Schedule D and fail to do so, you may be subject to penalties and interest charges by the IRS.

Q: Can I amend Schedule D if I made an error?

A: Yes, if you made an error on Schedule D, you can file an amended form, known as Form 1120-X, to correct the mistake.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.