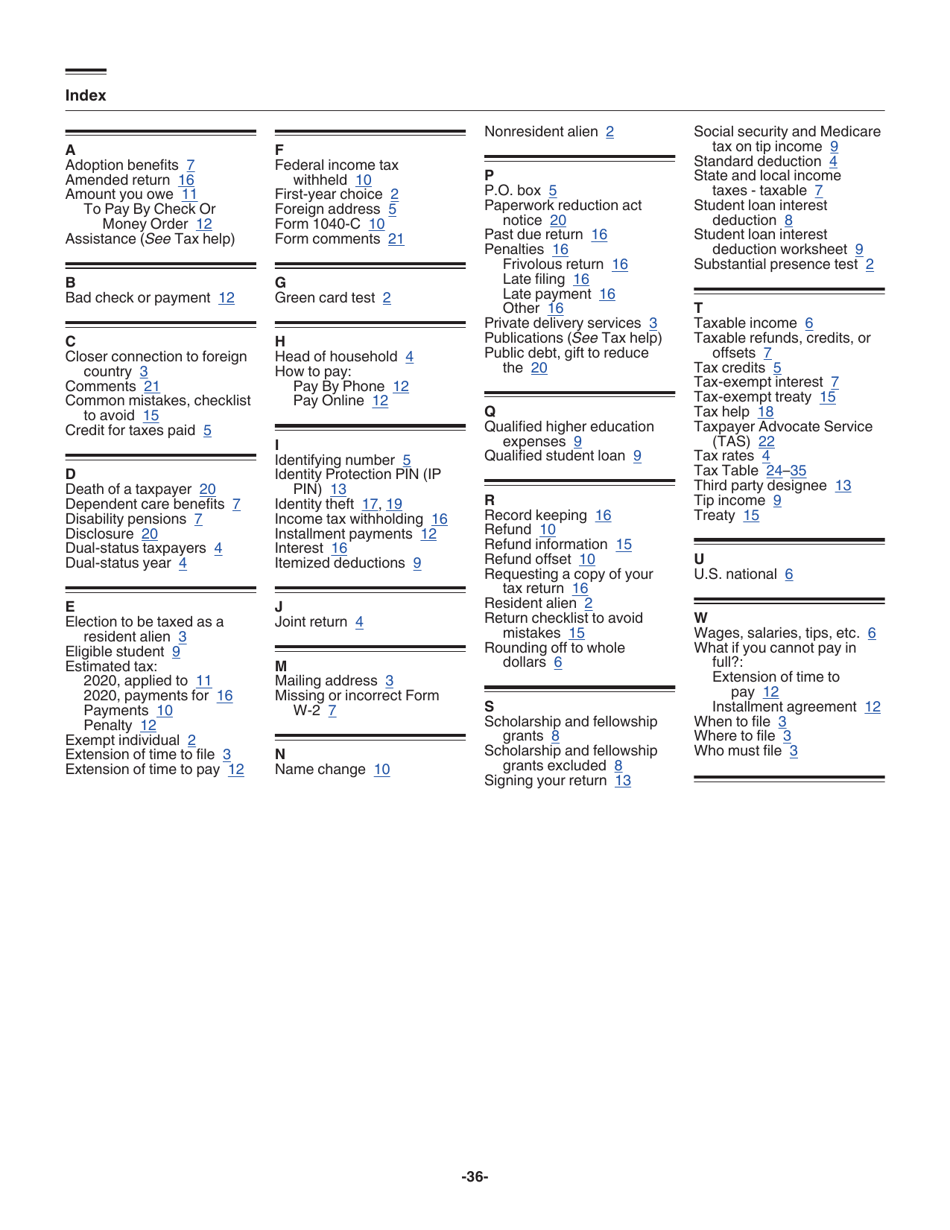

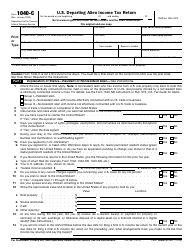

Instructions for IRS Form 1040-NR-EZ U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents

This document contains official instructions for IRS Form 1040-NR-EZ , U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040-NR-EZ is available for download through this link.

FAQ

Q: What is IRS Form 1040-NR-EZ?

A: IRS Form 1040-NR-EZ is the U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents.

Q: Who can use Form 1040-NR-EZ?

A: Nonresident aliens who have no dependents and meet certain criteria can use Form 1040-NR-EZ.

Q: What is the purpose of Form 1040-NR-EZ?

A: The purpose of Form 1040-NR-EZ is to report U.S. income and claim any applicable deductions, credits, and exemptions.

Q: What information do I need to complete Form 1040-NR-EZ?

A: You will need to gather your income information, including wages, salaries, and other earnings, as well as any deductions or credits you are eligible for.

Q: When is the deadline to file Form 1040-NR-EZ?

A: The deadline to file Form 1040-NR-EZ is typically April 15th, unless an extension has been granted.

Instruction Details:

- This 36-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.