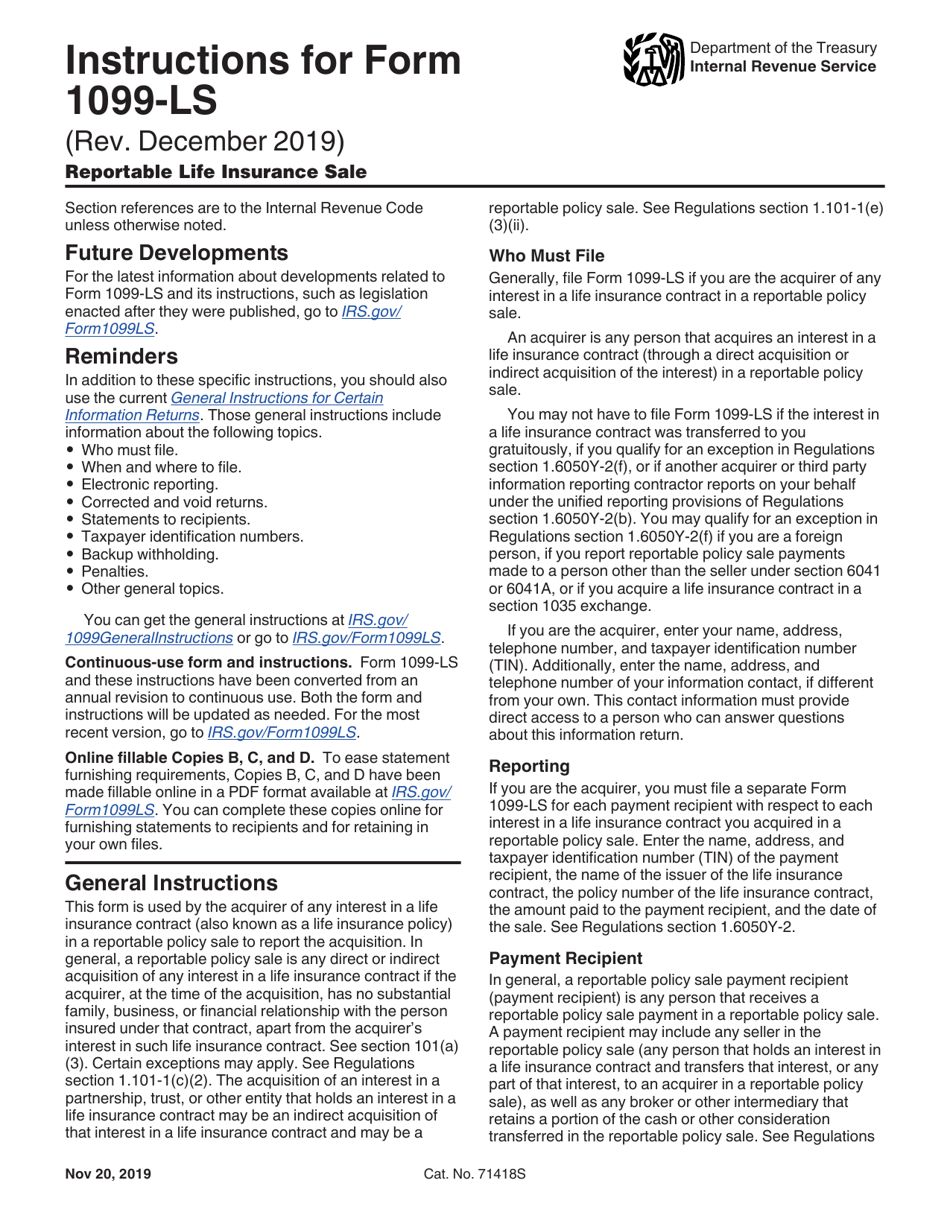

Instructions for IRS Form 1099-LS Reportable Life Insurance Sale

This document contains official instructions for IRS Form 1099-LS , Reportable Life Insurance Sale - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-LS is available for download through this link.

FAQ

Q: What is IRS Form 1099-LS?

A: IRS Form 1099-LS is a form used to report the sale of a life insurance policy.

Q: Who needs to file IRS Form 1099-LS?

A: The person or organization that acquires a life insurance policy through a reportable sale needs to file IRS Form 1099-LS.

Q: What is a reportable sale?

A: A reportable sale is a sale or transfer of a life insurance policy to a third party.

Q: What information is required on IRS Form 1099-LS?

A: IRS Form 1099-LS requires information about the buyer and seller of the life insurance policy, as well as details about the policy itself.

Q: When is the deadline to file IRS Form 1099-LS?

A: The deadline to file IRS Form 1099-LS is usually January 31st of the year following the sale.

Q: Are there any penalties for not filing IRS Form 1099-LS?

A: Yes, there can be penalties for not filing IRS Form 1099-LS, so it is important to comply with the reporting requirements.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.