This version of the form is not currently in use and is provided for reference only. Download this version of

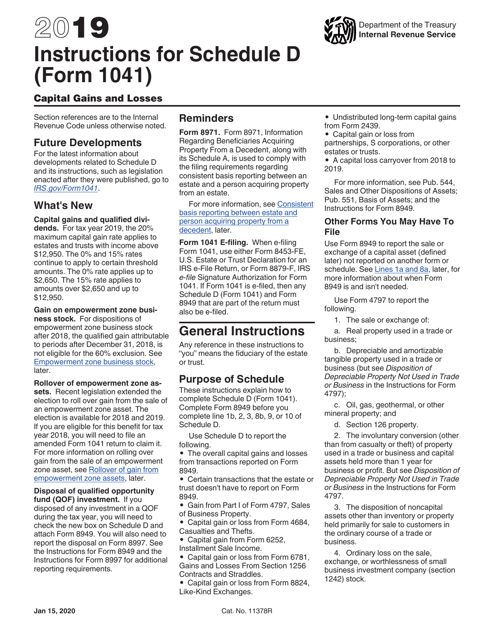

Instructions for IRS Form 1041 Schedule D

for the current year.

Instructions for IRS Form 1041 Schedule D Capital Gains and Losses

This document contains official instructions for IRS Form 1041 Schedule D, Capital Gains and Losses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1041 Schedule D is available for download through this link.

FAQ

Q: What is IRS Form 1041 Schedule D?

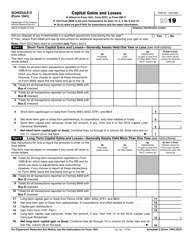

A: IRS Form 1041 Schedule D is a tax form used to report capital gains and losses from investment activities of an estate or trust.

Q: What are capital gains and losses?

A: Capital gains are profits made from the sale of investments, while capital losses are losses incurred from the sale of investments.

Q: Who needs to file IRS Form 1041 Schedule D?

A: Estate or trust entities that have capital gains or losses need to file IRS Form 1041 Schedule D.

Q: What information is required on IRS Form 1041 Schedule D?

A: Information needed includes details about the investments sold, the purchase and sale dates, and the purchase and sale prices.

Q: Do I need to attach IRS Form 1041 Schedule D to my tax return?

A: If you are filing Form 1041 for an estate or trust, you need to attach Schedule D to your tax return.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.