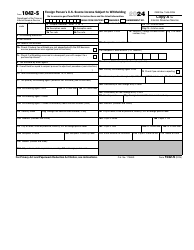

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1042

for the current year.

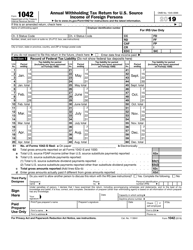

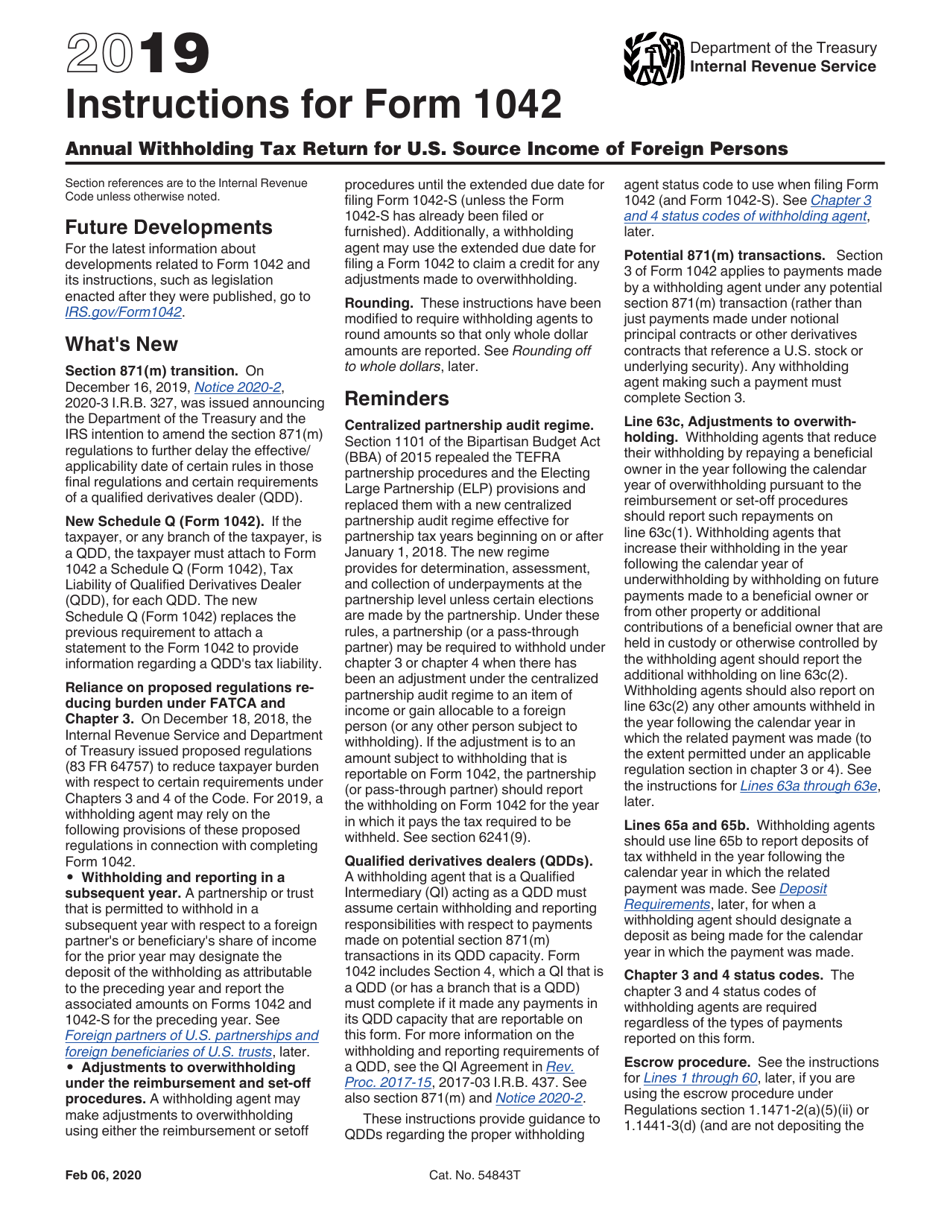

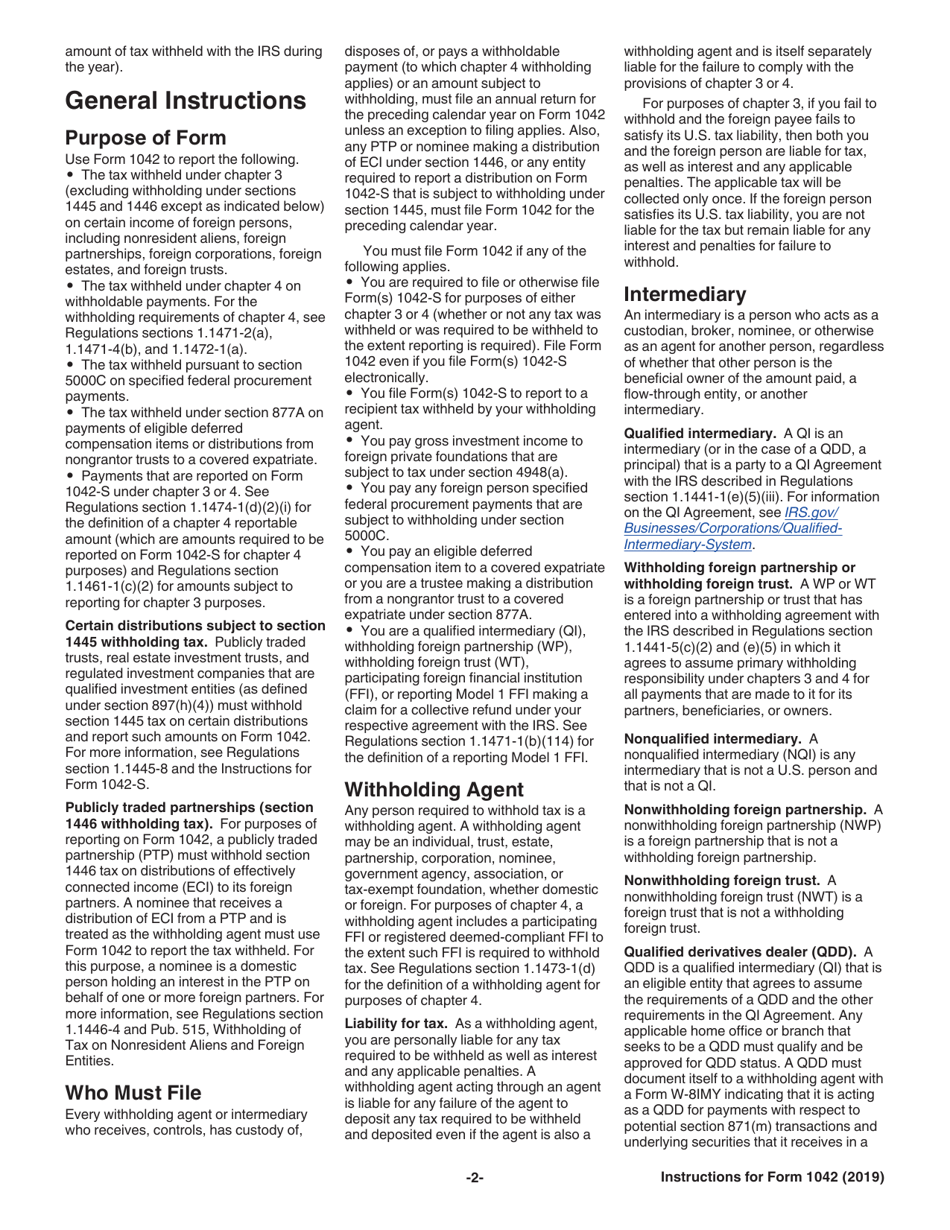

Instructions for IRS Form 1042 Annual Withholding Tax Return for U.S. Source Income of Foreign Persons

This document contains official instructions for IRS Form 1042 , Annual Source Income of Foreign Persons - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1042 is available for download through this link.

FAQ

Q: What is IRS Form 1042?

A: IRS Form 1042 is an annual withholding tax return for U.S. source income of foreign persons.

Q: Who needs to file IRS Form 1042?

A: Foreign persons who receive U.S. source income and have withholding tax obligations are required to file Form 1042.

Q: What is U.S. source income?

A: U.S. source income refers to income that is generated or derived from sources within the United States. Examples include wages, salaries, dividends, interest, and rents.

Q: What are withholding tax obligations?

A: Withholding tax obligations refer to the responsibility of withholding and remitting taxes on behalf of foreign persons who receive U.S. source income.

Q: When is the deadline for filing Form 1042?

A: The deadline for filing Form 1042 is March 15th of the year following the calendar year in which the income was paid.

Q: Are there any extensions available for filing Form 1042?

A: Yes, extensions of time to file Form 1042 can be requested by filing Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns.

Q: Do I need to attach any supporting documents with Form 1042?

A: Yes, you may need to attach certain supporting documents, such as Forms 1042-S, Foreign Person's U.S. Source Income Subject to Withholding, and Form 1099.

Q: What happens if I fail to file Form 1042 or make errors on the form?

A: Failure to file Form 1042 or making errors on the form may result in penalties and interest charges, and can also affect the withholding agent's ability to claim a credit or refund of overwithheld taxes.

Instruction Details:

- This 11-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.