This version of the form is not currently in use and is provided for reference only. Download this version of

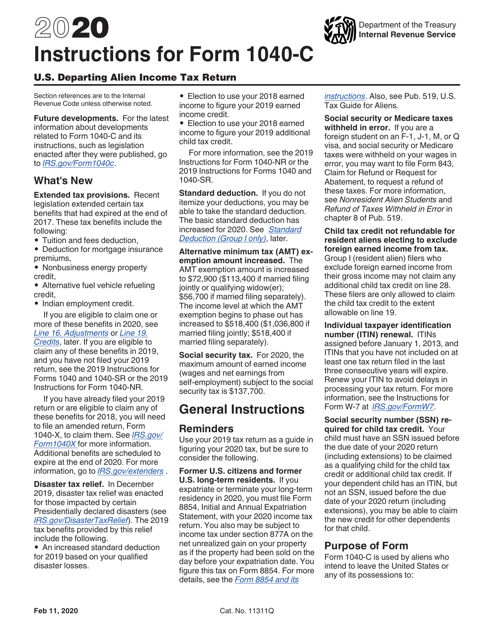

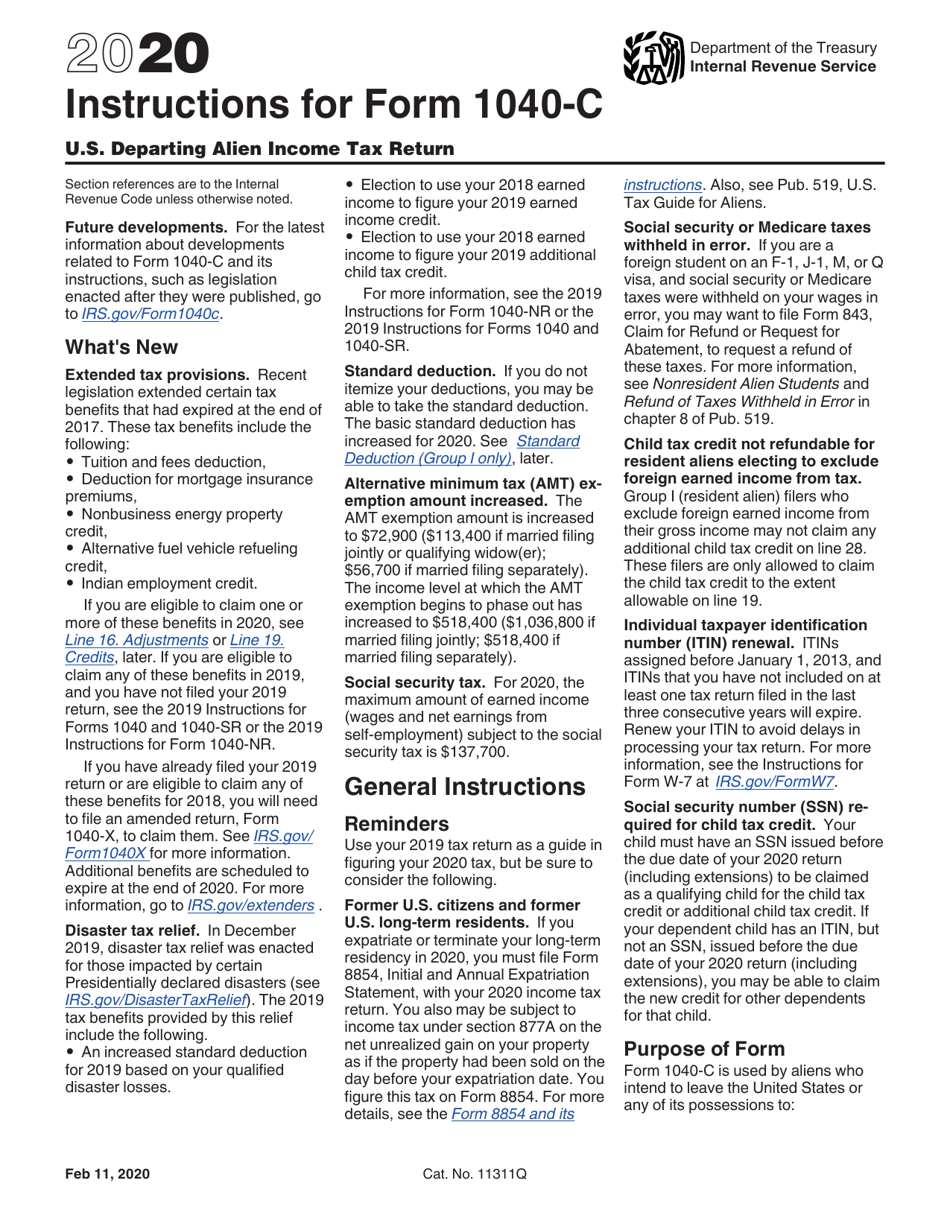

Instructions for IRS Form 1040-C

for the current year.

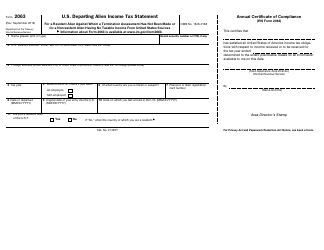

Instructions for IRS Form 1040-C U.S. Departing Alien Income Tax Return

This document contains official instructions for IRS Form 1040-C , U.S. Departing Alien Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040-C is available for download through this link.

FAQ

Q: What is IRS Form 1040-C?

A: IRS Form 1040-C is the U.S. Departing Alien Income Tax Return.

Q: Who should file IRS Form 1040-C?

A: Aliens who are leaving the United States and need to report their income for the portion of the year they were in the country.

Q: What is the purpose of IRS Form 1040-C?

A: The purpose of IRS Form 1040-C is to report income earned by non-resident aliens who are leaving the United States.

Q: When should IRS Form 1040-C be filed?

A: IRS Form 1040-C should be filed within 10 days of the alien's departure from the United States.

Q: What information is required on IRS Form 1040-C?

A: IRS Form 1040-C requires the alien's personal information, details of their income, and any taxes withheld.

Q: Are there any exceptions to filing IRS Form 1040-C?

A: Yes, there are certain exceptions for aliens who meet specific requirements, such as diplomats, students, and certain nonresident aliens.

Q: Can IRS Form 1040-C be filed electronically?

A: No, IRS Form 1040-C cannot be filed electronically and must be filed by mail.

Q: Do I need to attach any documents to IRS Form 1040-C?

A: Yes, certain documents such as a copy of the alien's passport and a copy of their U.S. visa must be attached to IRS Form 1040-C.

Q: What happens if I don't file IRS Form 1040-C?

A: Failure to file IRS Form 1040-C may result in penalties and consequences for the alien's future immigration or tax status.

Instruction Details:

- This 10-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.