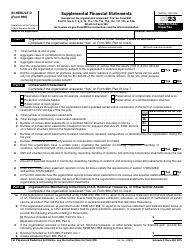

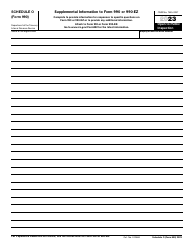

Instructions for IRS Form 1040, 1040-SR Schedule E Supplemental Income and Loss

This document contains official instructions for IRS Form 1040 Schedule E and IRS Form 1040-SR Schedule E . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 (1040-SR) Schedule E is available for download through this link.

FAQ

Q: What is IRS Form 1040?

A: IRS Form 1040 is the U.S. Individual Income Tax Return form that individuals use to file their federal income tax returns.

Q: What is IRS Form 1040-SR?

A: IRS Form 1040-SR is a simplified version of Form 1040 designed for taxpayers who are 65 years of age or older.

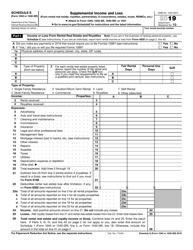

Q: What is Schedule E?

A: Schedule E is a supplemental form used with Form 1040 to report supplemental income and loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs.

Q: Who needs to file Schedule E?

A: Individuals who have rental income or loss, or certain types of supplemental income or loss, need to file Schedule E.

Q: What is considered supplemental income and loss?

A: Supplemental income and loss includes rental income, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs.

Q: How do I fill out Schedule E?

A: To fill out Schedule E, you'll need to provide information on your rental properties, partnerships, S corporations, or other sources of supplemental income or loss.

Q: Can I use Schedule E with Form 1040-SR?

A: Yes, Schedule E can be used with both Form 1040 and Form 1040-SR.

Q: When is the deadline to file Form 1040, 1040-SR, and Schedule E?

A: The deadline to file these forms is usually April 15th, but it may be extended in some years.

Q: Do I need to include supporting documents with Schedule E?

A: It's not necessary to include supporting documents with your initial filing, but you should keep them in case of an audit.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.