This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 982

for the current year.

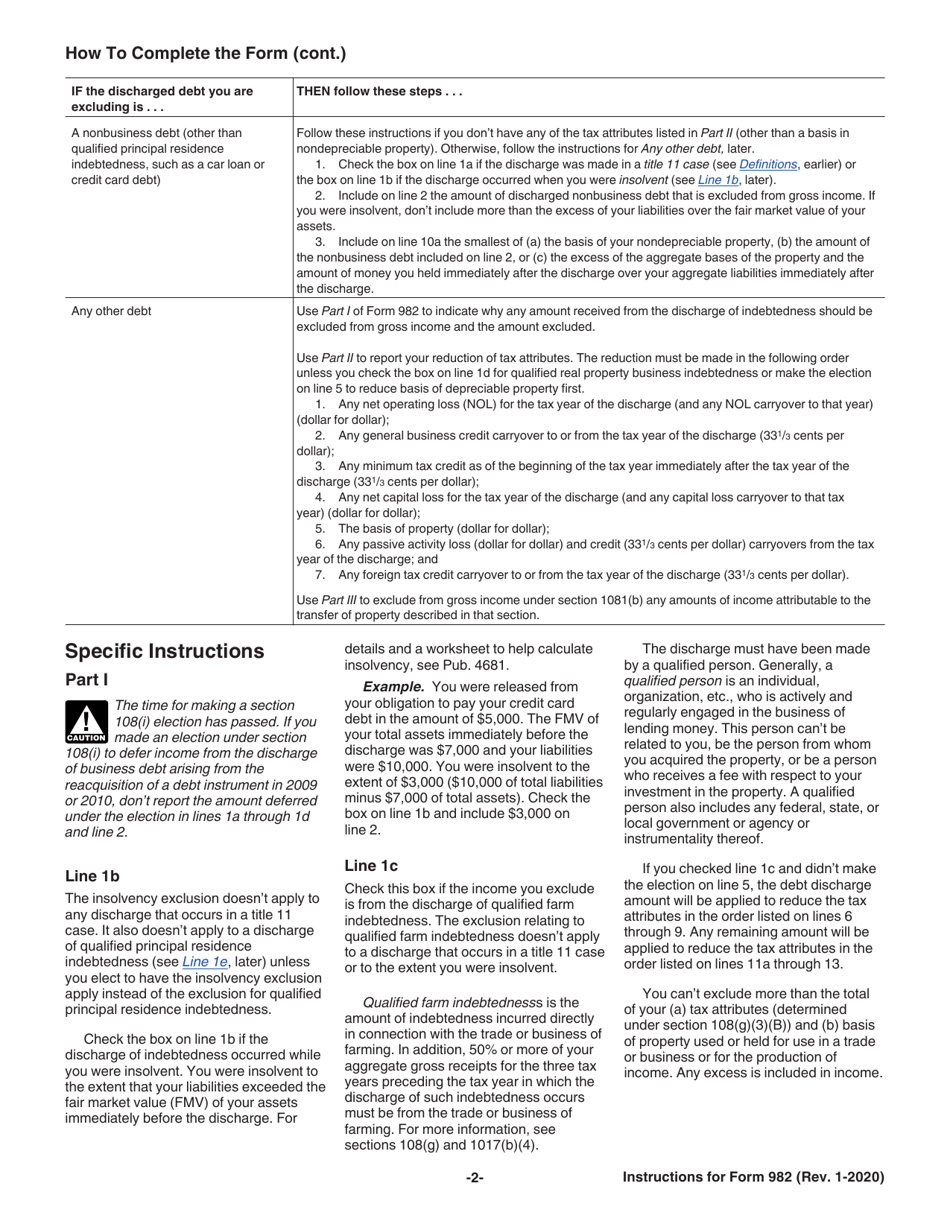

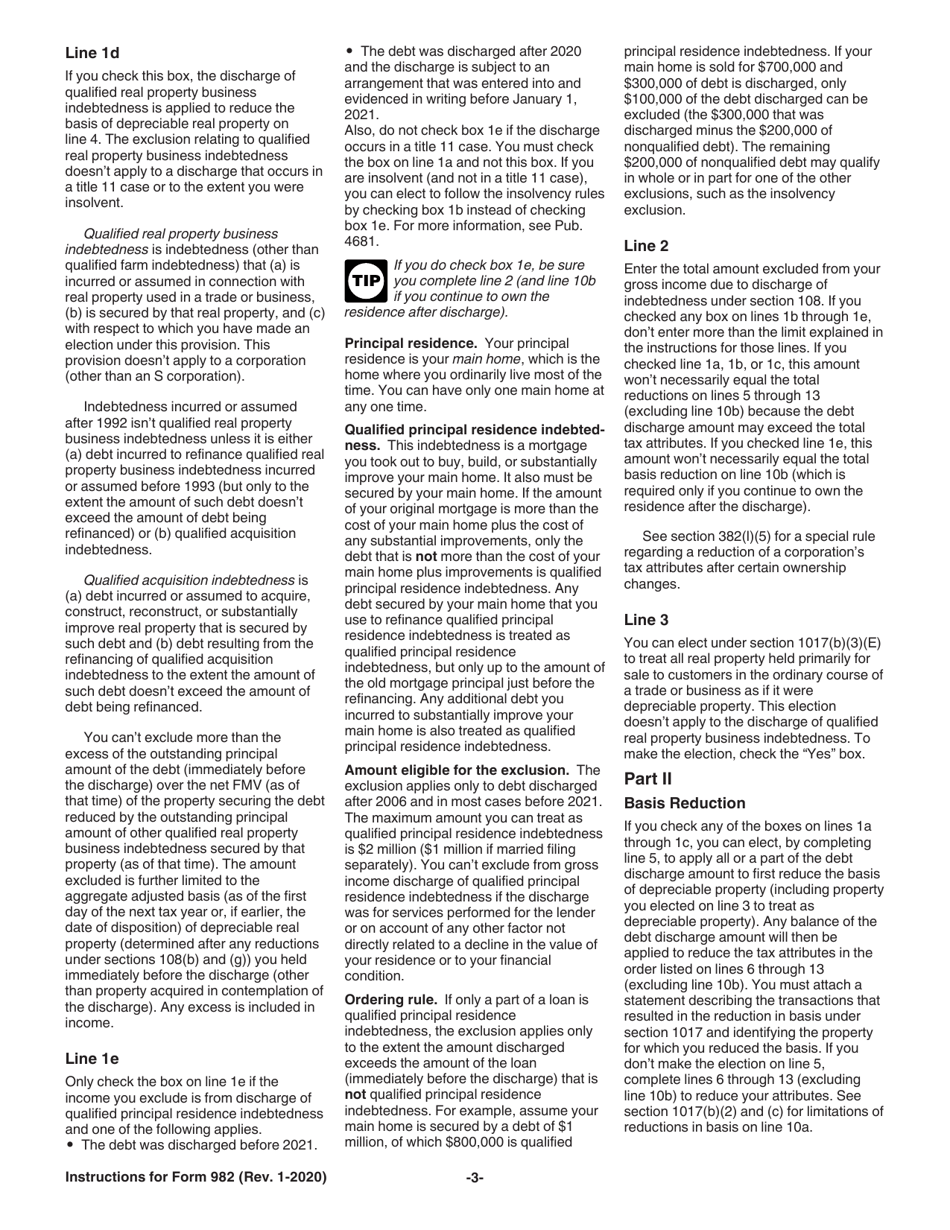

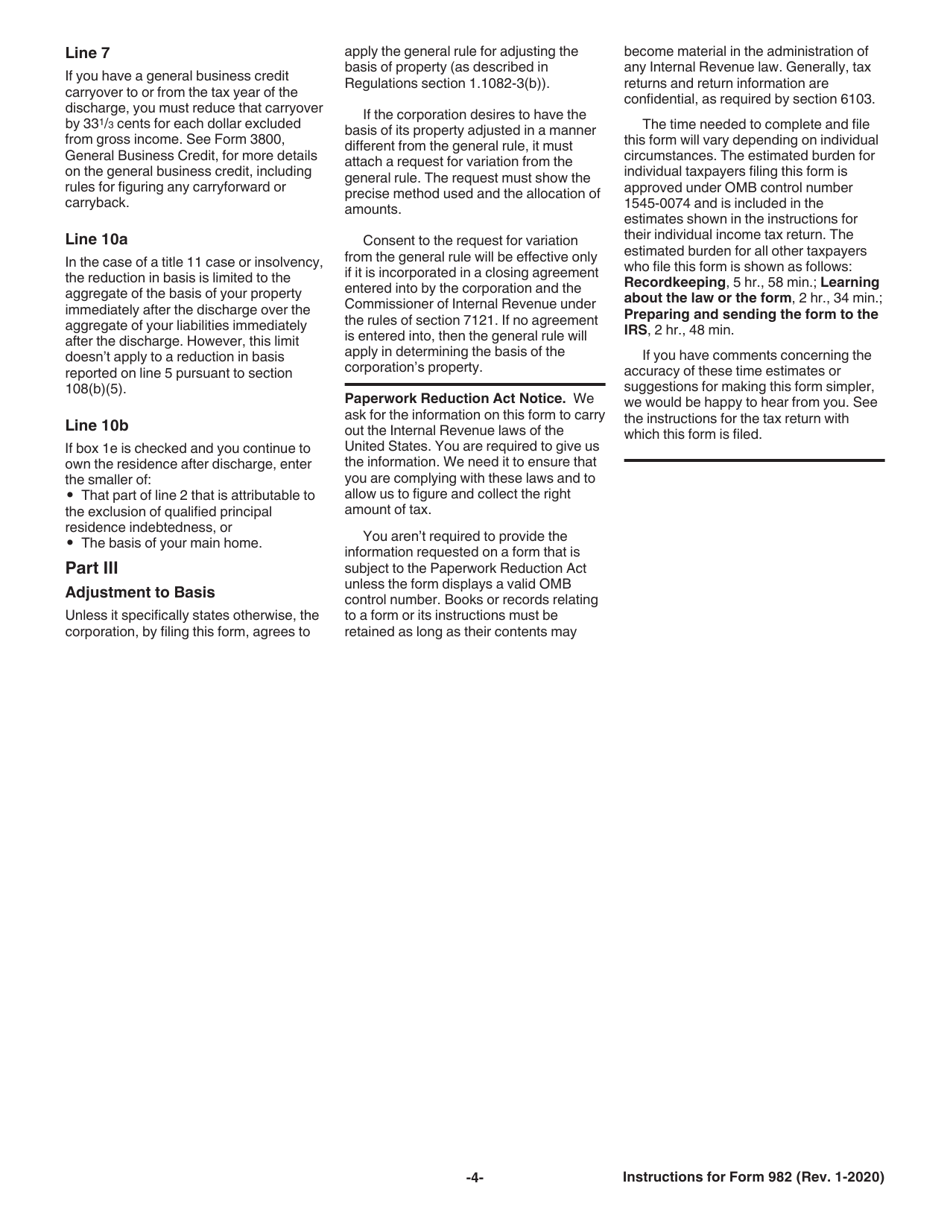

Instructions for IRS Form 982 Reduction of Tax Attributes Due to Discharge of Indebtedness (And Section 1082 Basis Adjustment)

This document contains official instructions for IRS Form 982 , Reduction of Tax Attributes Due to Discharge of Indebtedness (And Section 1082 Basis Adjustment) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 982 is available for download through this link.

FAQ

Q: What is IRS Form 982?

A: IRS Form 982 is used to report the reduction of tax attributes due to the discharge of indebtedness.

Q: What is the purpose of Form 982?

A: The purpose of Form 982 is to calculate and report the amount of discharged debt that is excluded from taxable income.

Q: What are tax attributes?

A: Tax attributes are various tax benefits, such as credits, deductions, or losses, that a taxpayer may have.

Q: What is a discharge of indebtedness?

A: A discharge of indebtedness occurs when a lender cancels or forgives a debt, and the borrower is relieved from the obligation to repay.

Q: What is a Section 1082 basis adjustment?

A: A Section 1082 basis adjustment is an adjustment made to the basis of certain assets when debt is discharged.

Q: Who needs to file Form 982?

A: Individuals or entities that have had debt discharged during the tax year may need to file Form 982.

Q: Is all discharged debt taxable?

A: No, not all discharged debt is taxable. Certain types of debt, such as qualified principal residence indebtedness, may be excluded from taxable income.

Q: What are some common exclusions for discharged debt?

A: Some common exclusions for discharged debt include bankruptcy, insolvency, and certain student loan forgiveness programs.

Q: Do I need to include Form 982 with my tax return?

A: Yes, if you are required to file Form 982, it should be attached to your tax return.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.