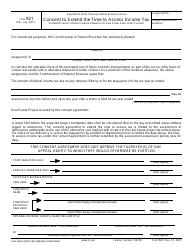

Instructions for IRS Form 965-E Consent Agreement Under Section 965(I)(4)(D)

This document contains official instructions for IRS Form 965-E , Consent Agreement Under Section 965(I)(4)(D) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 965-E is available for download through this link.

FAQ

Q: What is IRS Form 965-E?

A: IRS Form 965-E is a form used to enter into a consent agreement with the IRS under Section 965(I)(4)(D).

Q: What is the purpose of IRS Form 965-E?

A: The purpose of IRS Form 965-E is to provide the IRS with consent to assess and collect amounts due under Section 965.

Q: When should IRS Form 965-E be filed?

A: IRS Form 965-E should be filed with the IRS within 30 days of receiving a Notice of Proposed Adjustment.

Q: Who is required to file IRS Form 965-E?

A: Taxpayers who have received a Notice of Proposed Adjustment related to Section 965 are required to file IRS Form 965-E.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.