This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 965-B

for the current year.

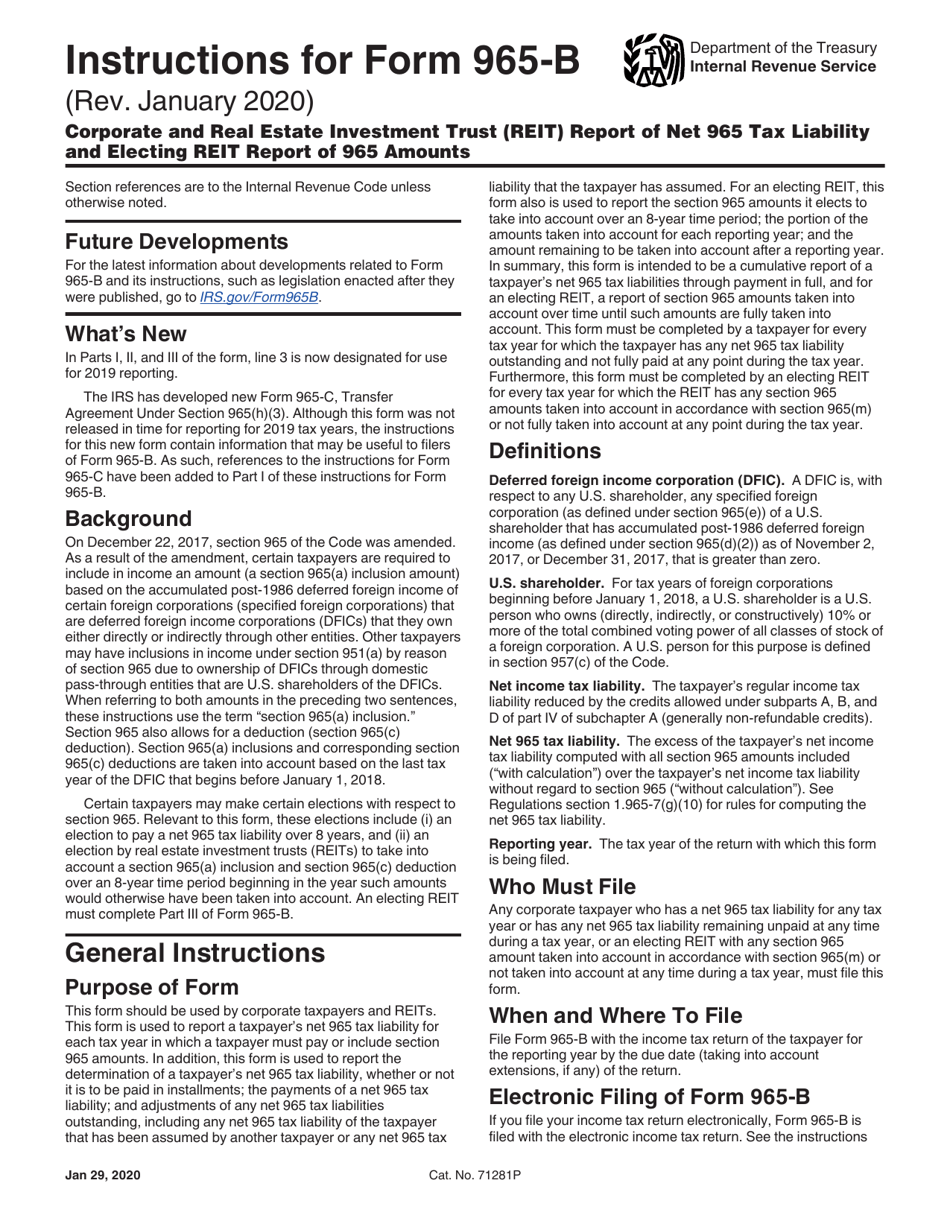

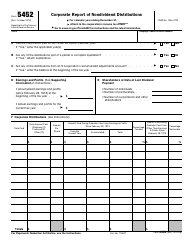

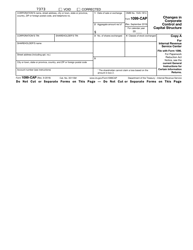

Instructions for IRS Form 965-B Corporate and Real Estate Investment Trust (Reit) Report of Net 965 Tax Liability and Electing Reit Report of 965 Amounts

This document contains official instructions for IRS Form 965-B , Corporate and Real Estate Tax Liability and Electing Reit Report of 965 Amounts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 965-B is available for download through this link.

FAQ

Q: What is Form 965-B?

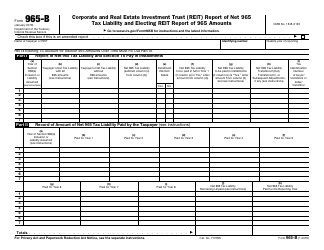

A: Form 965-B is a tax form used to report net 965 tax liability and electing REIT amounts.

Q: Who needs to file Form 965-B?

A: Corporations and Real Estate Investment Trusts (REITs) must file Form 965-B.

Q: What information is reported on Form 965-B?

A: Form 965-B reports the net 965 tax liability and electing REIT amounts.

Q: What is net 965 tax liability?

A: Net 965 tax liability refers to the amount of tax owed under section 965.

Q: What are electing REIT amounts?

A: Electing REIT amounts are the amounts that a REIT elects to pay in installments over a period of time.

Q: Is there a deadline for filing Form 965-B?

A: Yes, the deadline for filing Form 965-B is generally the same as the taxpayer's income tax return filing deadline.

Q: Are there any penalties for not filing Form 965-B?

A: Yes, failure to file Form 965-B may result in penalties and interest charges.

Q: Can I file Form 965-B electronically?

A: Yes, Form 965-B can be filed electronically using the IRS e-file system or through a tax professional.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.