This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 941-SS

for the current year.

Instructions for IRS Form 941-SS Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands

This document contains official instructions for IRS Form 941-SS , Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 941-SS?

A: IRS Form 941-SS is the Employer's Quarterly Federal Tax Return specifically for employers in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands.

Q: Who needs to file IRS Form 941-SS?

A: Employers in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands need to file IRS Form 941-SS.

Q: How often is IRS Form 941-SS filed?

A: IRS Form 941-SS is filed quarterly.

Q: What information is required on IRS Form 941-SS?

A: IRS Form 941-SS requires employers to report wages paid, tips received, federal income tax withheld, and the employer's share of Medicare and Social Security taxes.

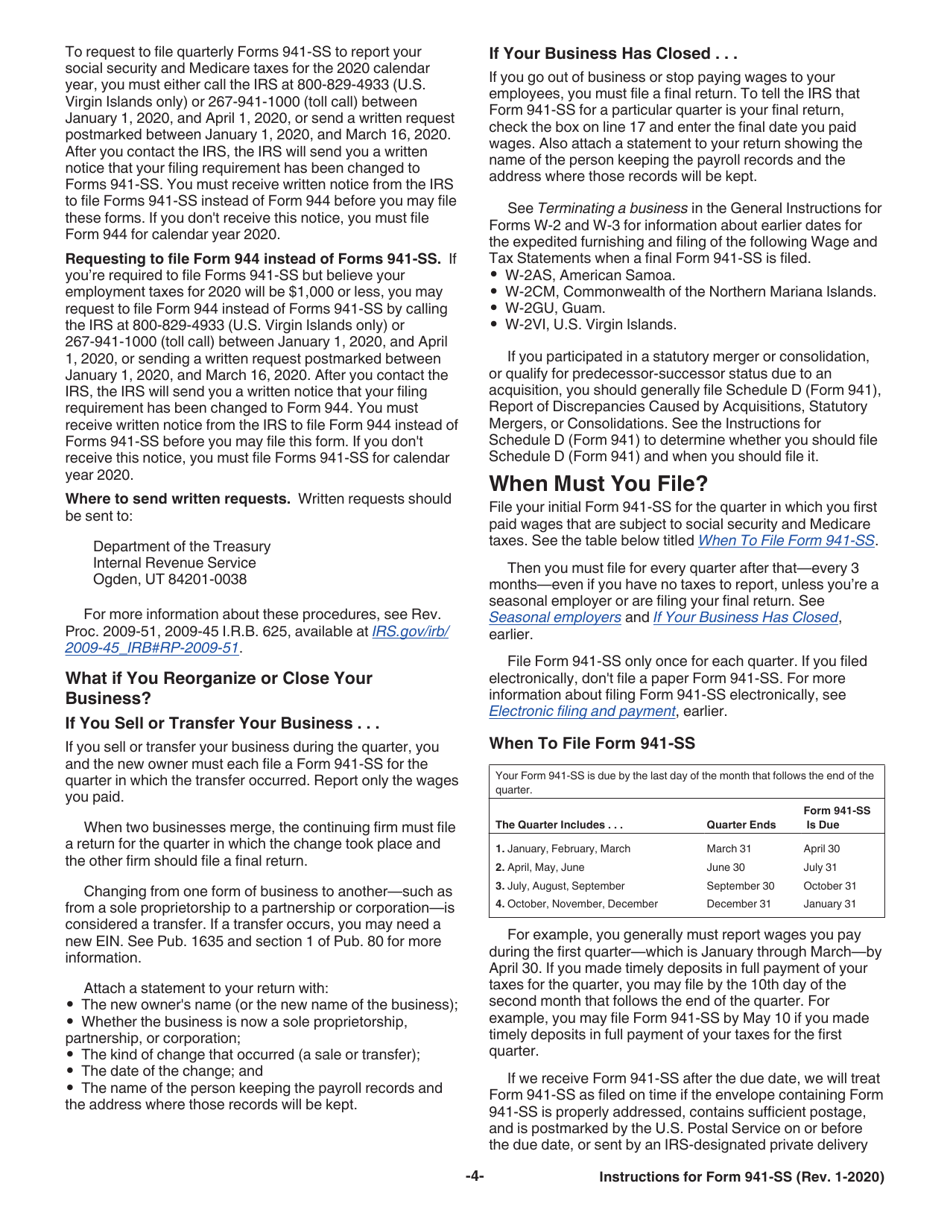

Q: What is the deadline for filing IRS Form 941-SS?

A: The deadline for filing IRS Form 941-SS is the last day of the month following the end of the quarter. For example, the form for the first quarter is due by April 30th.

Q: Are there any penalties for not filing or filing late?

A: Yes, there are penalties for not filing or filing late. It's important to file IRS Form 941-SS on time to avoid penalties.

Instruction Details:

- This 14-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.