This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 843

for the current year.

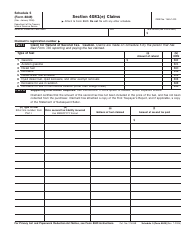

Instructions for IRS Form 843 Claim for Refund and Request for Abatement

This document contains official instructions for IRS Form 843 , Claim for Refund and Request for Abatement - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 843 is available for download through this link.

FAQ

Q: What is IRS Form 843?

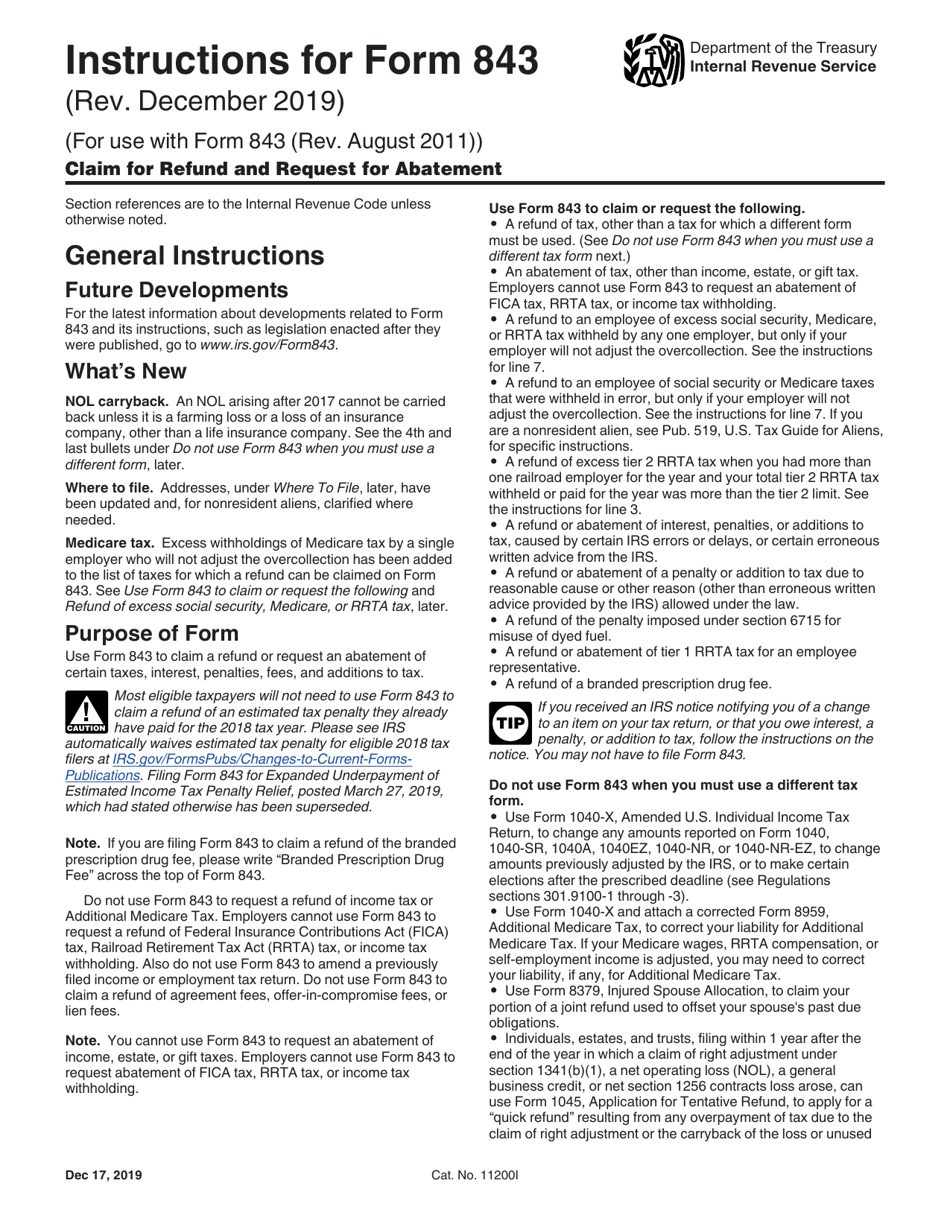

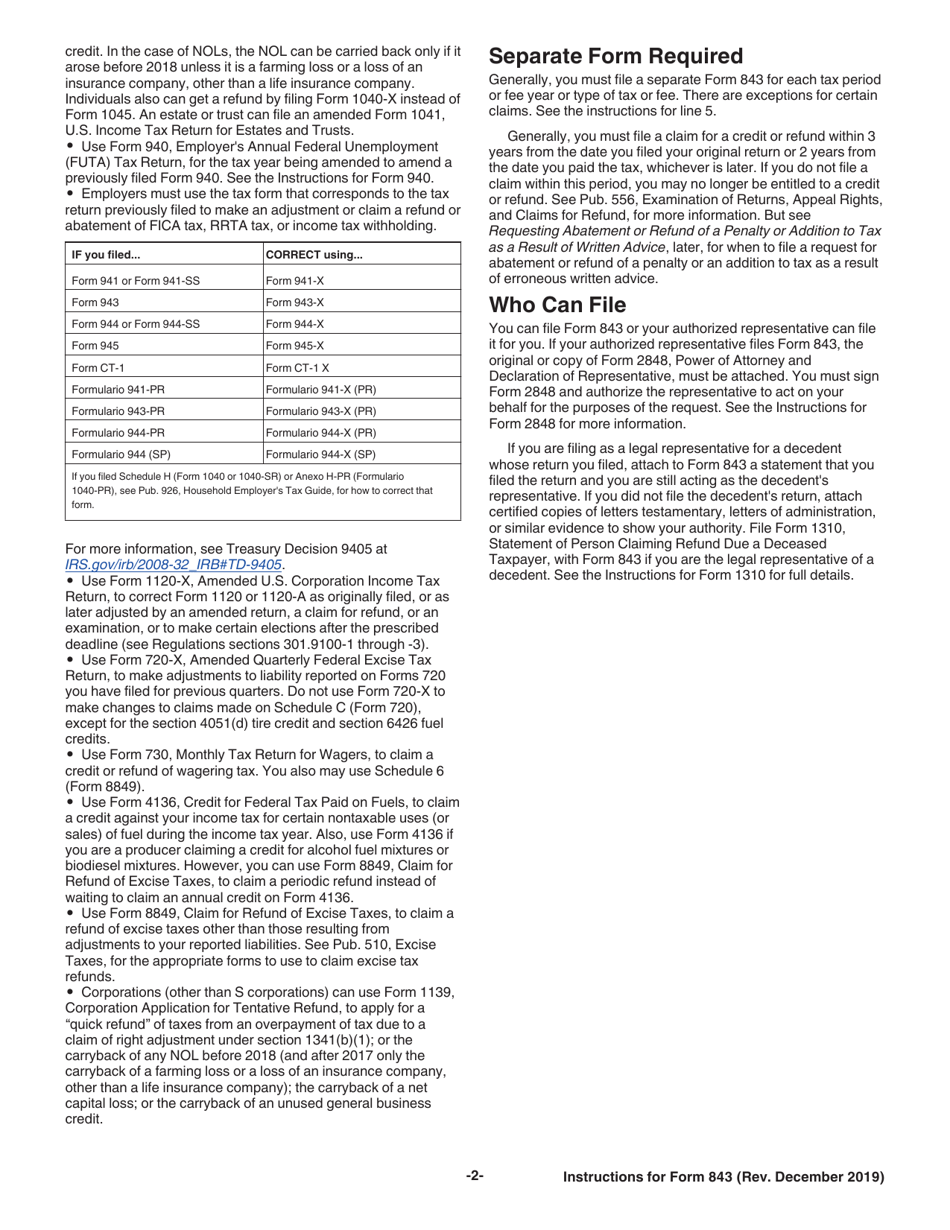

A: IRS Form 843 is a form used to claim a refund or request an abatement of certain taxes or penalties.

Q: Why would I need to use Form 843?

A: You would need to use Form 843 if you believe you have overpaid your taxes or if you are seeking relief from certain penalties.

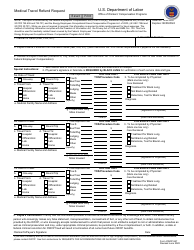

Q: What types of taxes or penalties can I claim a refund or request abatement for?

A: You can claim a refund or request abatement for a variety of taxes or penalties, including income tax, employment tax, estate tax, and certain excise taxes.

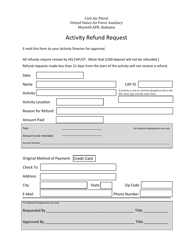

Q: How do I fill out Form 843?

A: To fill out Form 843, you will need to provide your personal information, specify the type of tax or penalty you are claiming a refund or requesting abatement for, and provide supporting documentation.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.