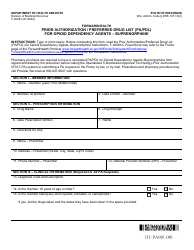

This version of the form is not currently in use and is provided for reference only. Download this version of

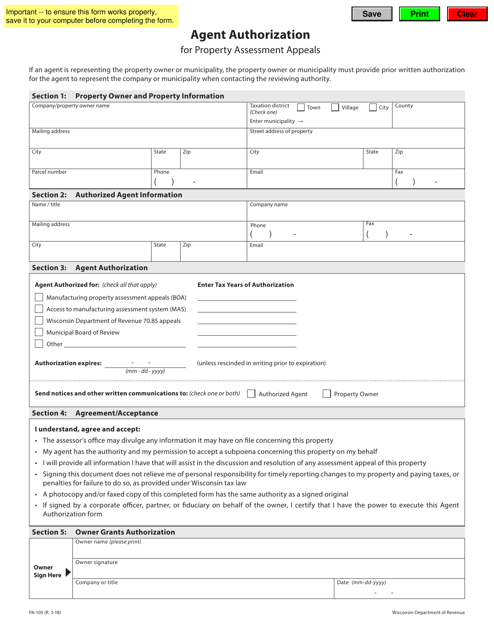

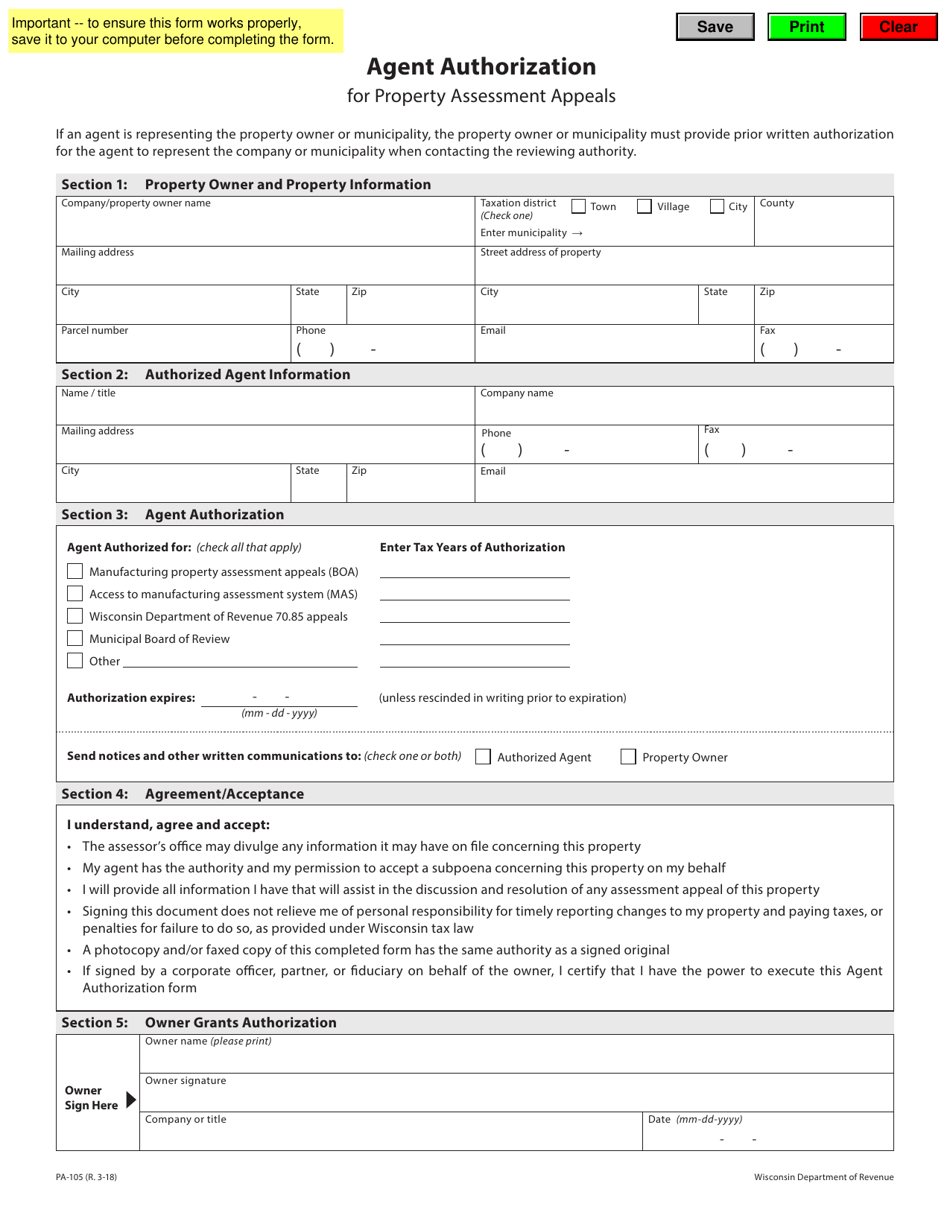

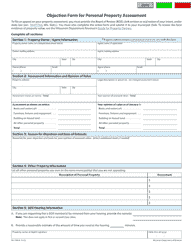

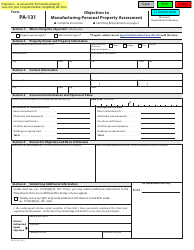

Form PA-105

for the current year.

Form PA-105 Agent Authorization for Property Assessment Appeals - Wisconsin

What Is Form PA-105?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-105?

A: Form PA-105 is the Agent Authorization for Property Assessment Appeals in Wisconsin.

Q: What is the purpose of Form PA-105?

A: The purpose of Form PA-105 is to authorize an agent to represent a property owner in property assessment appeals.

Q: Who needs to fill out Form PA-105?

A: Property owners who want to authorize an agent to represent them in property assessment appeals need to fill out Form PA-105.

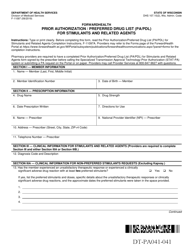

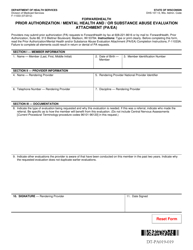

Q: What information is required on Form PA-105?

A: Form PA-105 requires the property owner's information, agent's information, and a description of the property being appealed.

Q: Is there a fee for filing Form PA-105?

A: No, there is no fee for filing Form PA-105.

Q: When should Form PA-105 be filed?

A: Form PA-105 should be filed as soon as possible, but no later than the deadline specified by your local assessment office.

Q: Can I revoke the agent's authorization on Form PA-105?

A: Yes, you can revoke the agent's authorization by submitting a written notice to your local assessment office.

Q: What happens after I file Form PA-105?

A: After you file Form PA-105, your authorized agent can represent you in property assessment appeals.

Q: Who can I contact for assistance with Form PA-105?

A: You can contact your local assessment office or the Wisconsin Department of Revenue for assistance with Form PA-105.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-105 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.