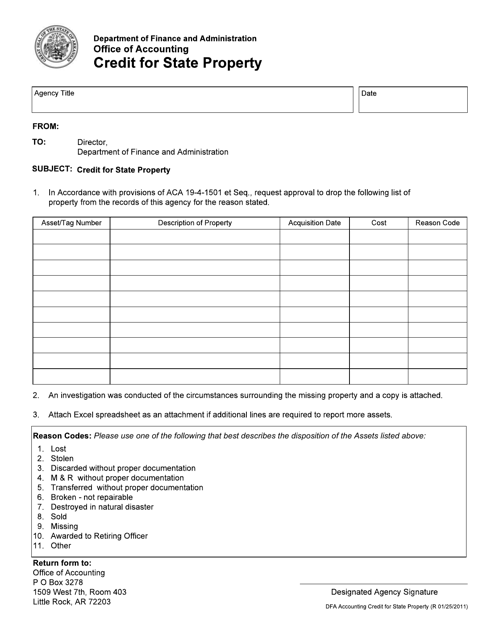

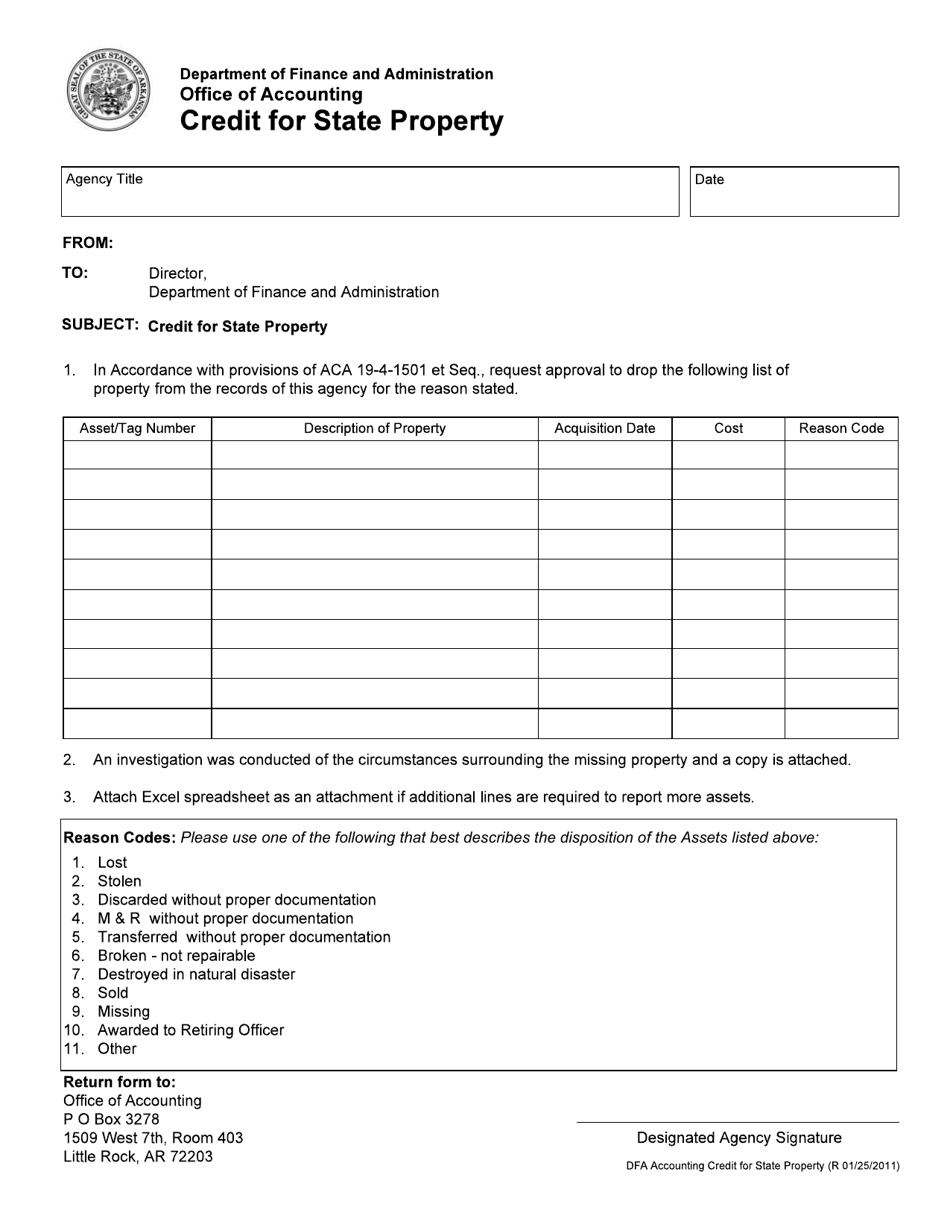

Credit for State Property - Arkansas

Credit for State Property is a legal document that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas.

FAQ

Q: What is credit for state property in Arkansas?

A: Credit for state property in Arkansas is a tax credit available to residents who own property located within the state.

Q: Who is eligible for the credit for state property in Arkansas?

A: Arkansas residents who own property within the state are eligible for the credit for state property.

Q: How much is the credit for state property in Arkansas?

A: The amount of the credit for state property in Arkansas can vary depending on factors such as the assessed value of the property and the tax rate.

Q: How do I claim the credit for state property in Arkansas?

A: To claim the credit for state property in Arkansas, you will need to file the appropriate tax forms with the Arkansas Department of Finance and Administration.

Q: Are there any limitations or conditions for the credit for state property in Arkansas?

A: There may be limitations or conditions for the credit for state property in Arkansas, such as income limits or specific requirements for certain types of property.

Form Details:

- Released on January 25, 2011;

- The latest edition currently provided by the Arkansas Department of Finance & Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.