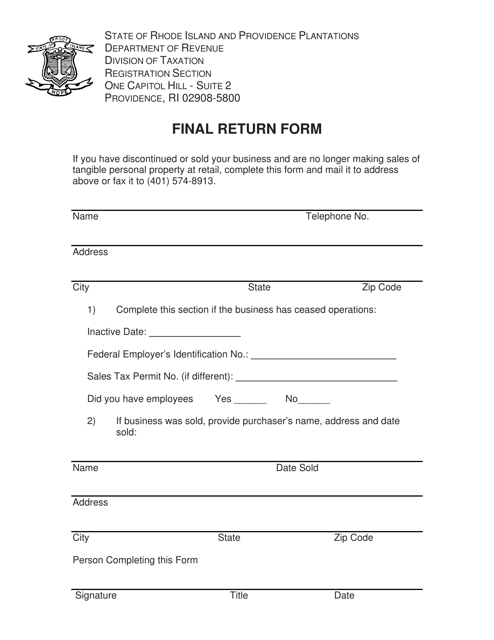

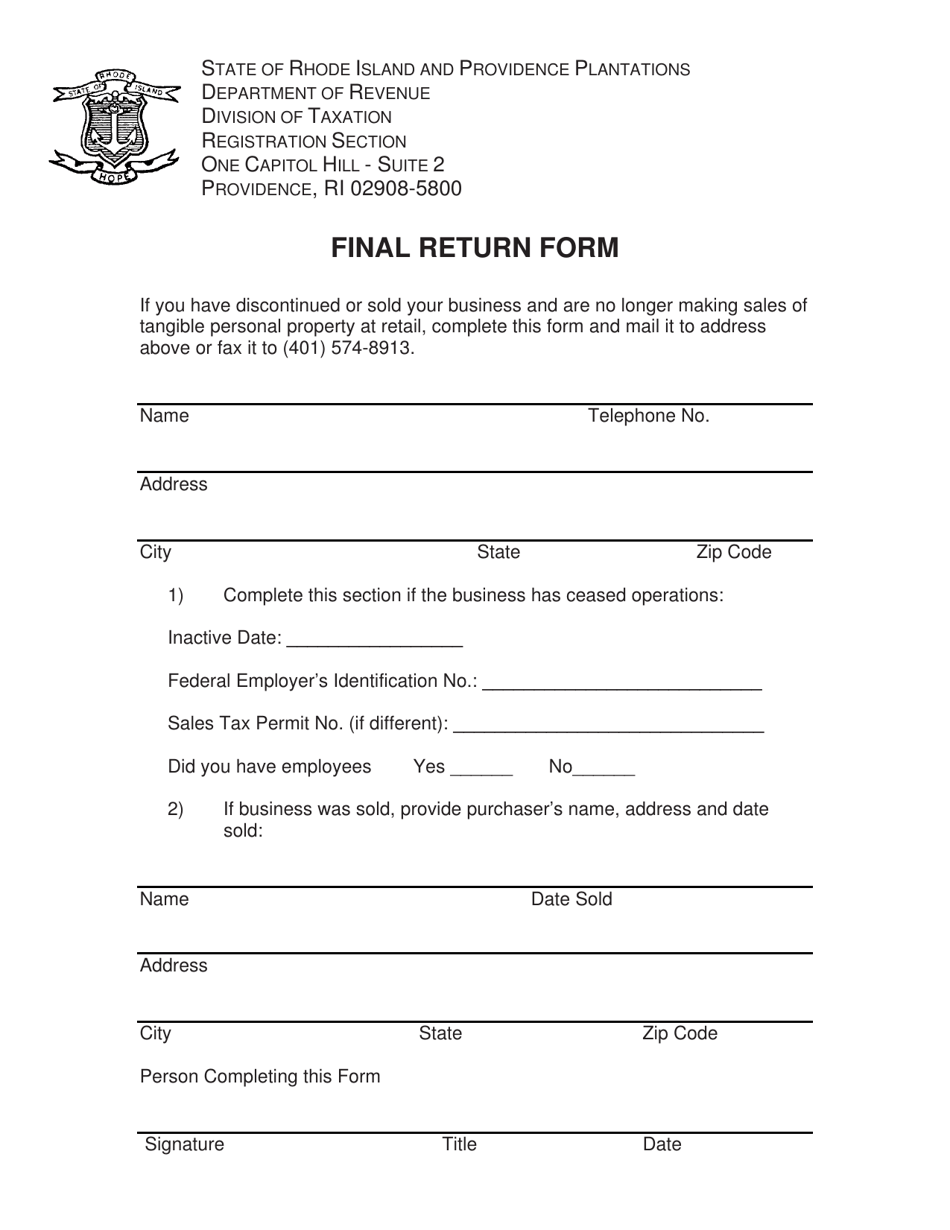

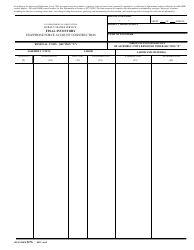

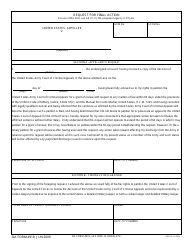

Final Return Form - Rhode Island

Final Return Form is a legal document that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.

FAQ

Q: What is the Final Return Form?

A: The Final Return Form is a tax form used in Rhode Island to report income and expenses for the final tax year of a deceased individual.

Q: Who needs to file a Final Return Form in Rhode Island?

A: The executor or administrator of the deceased individual's estate needs to file the Final Return Form in Rhode Island.

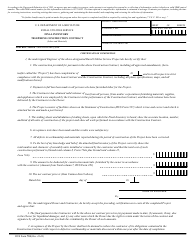

Q: When is the Final Return Form due in Rhode Island?

A: The Final Return Form is due by the 15th day of the 4th month following the close of the tax year.

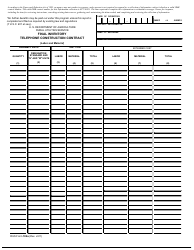

Q: What information do I need to complete the Final Return Form in Rhode Island?

A: You will need to gather information on the deceased individual's income, expenses, deductions, and credits for the final tax year.

Q: Are there any penalties for late filing of the Final Return Form in Rhode Island?

A: Yes, there are penalties for late filing of the Final Return Form in Rhode Island. Penalties may include interest charges and potential legal actions.

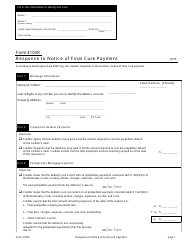

Form Details:

- The latest edition currently provided by the Rhode Island Department of Revenue - Division of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.